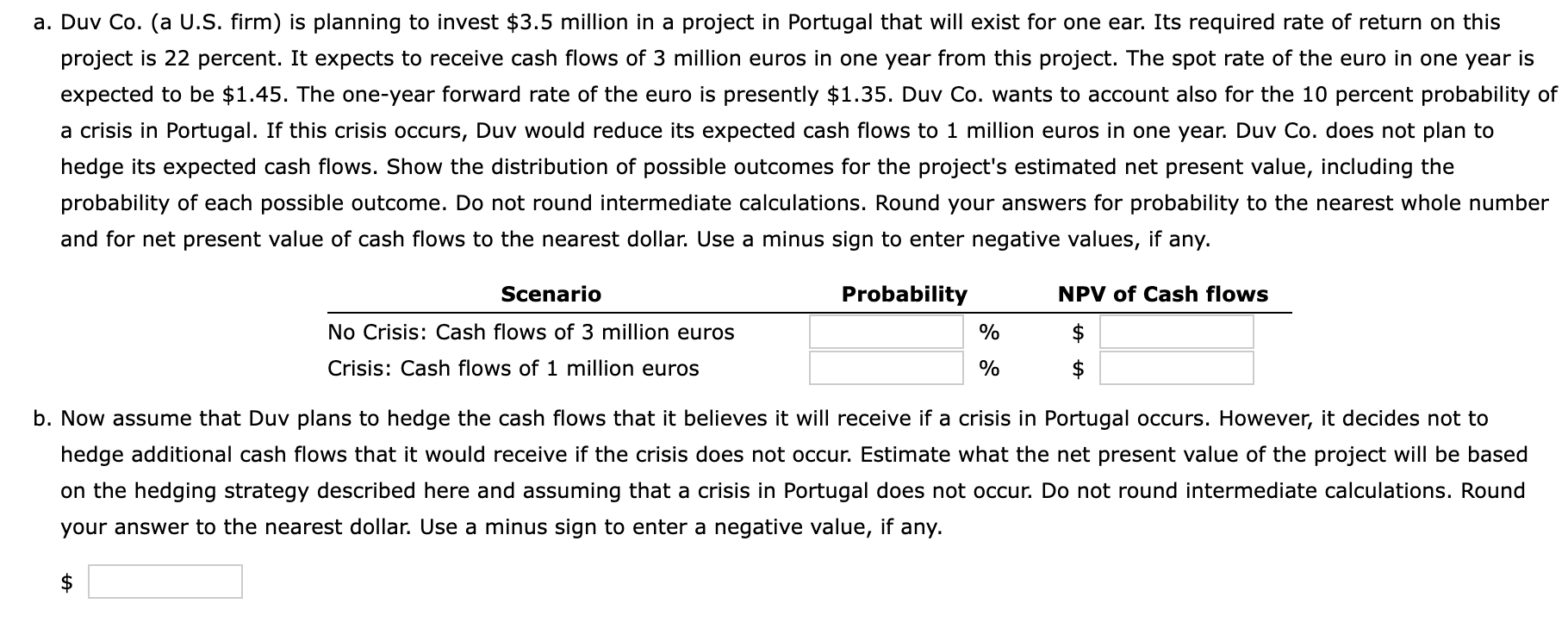

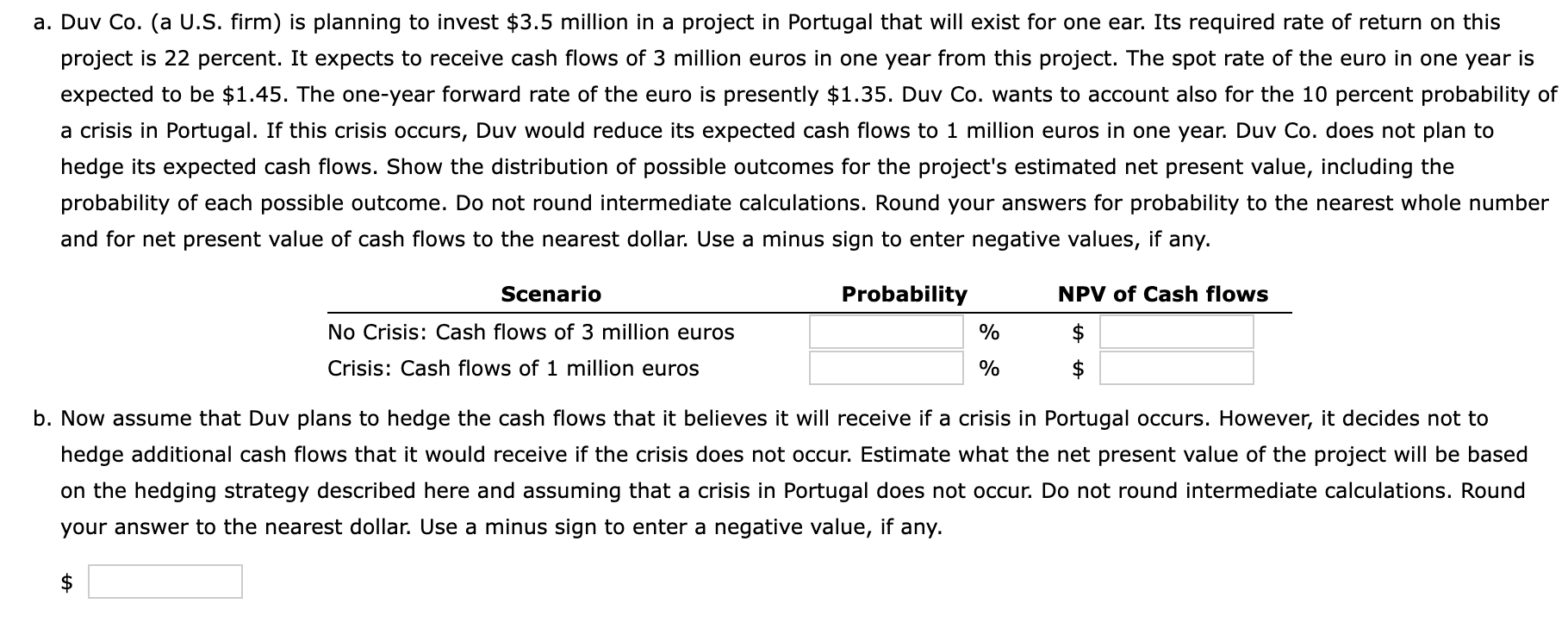

a. Duv Co. (a U.S. firm) is planning to invest $3.5 million in a project in Portugal that will exist for one ear. Its required rate of return on this project is 22 percent. It expects to receive cash flows of 3 million euros in one year from this project. The spot rate of the euro in one year is expected to be $1.45. The one-year forward rate of the euro is presently $1.35. Duv Co. wants to account also for the 10 percent probability of a crisis in Portugal. If this crisis occurs, Duv would reduce its expected cash flows to 1 million euros in one year. Duv Co. does not plan to hedge its expected cash flows. Show the distribution of possible outcomes for the project's estimated net present value, including the probability of each possible outcome. Do not round intermediate calculations. Round your answers for probability to the nearest whole number and for net present value of cash flows to the nearest dollar. Use a minus sign to enter negative values, if any. Scenario Probability NPV of Cash flows % $ No Crisis: Cash flows of 3 million euros Crisis: Cash flows of 1 million euros % $ b. Now assume that Duv plans to hedge the cash flows that it believes it will receive if a crisis in Portugal occurs. However, it decides not to hedge additional cash flows that it would receive if the crisis does not occur. Estimate what the net present value of the project will be based on the hedging strategy described here and assuming that a crisis in Portugal does not occur. Do not round intermediate calculations. Round your answer to the nearest dollar. Use a minus sign to enter a negative value, if any. $ a. Duv Co. (a U.S. firm) is planning to invest $3.5 million in a project in Portugal that will exist for one ear. Its required rate of return on this project is 22 percent. It expects to receive cash flows of 3 million euros in one year from this project. The spot rate of the euro in one year is expected to be $1.45. The one-year forward rate of the euro is presently $1.35. Duv Co. wants to account also for the 10 percent probability of a crisis in Portugal. If this crisis occurs, Duv would reduce its expected cash flows to 1 million euros in one year. Duv Co. does not plan to hedge its expected cash flows. Show the distribution of possible outcomes for the project's estimated net present value, including the probability of each possible outcome. Do not round intermediate calculations. Round your answers for probability to the nearest whole number and for net present value of cash flows to the nearest dollar. Use a minus sign to enter negative values, if any. Scenario Probability NPV of Cash flows % $ No Crisis: Cash flows of 3 million euros Crisis: Cash flows of 1 million euros % $ b. Now assume that Duv plans to hedge the cash flows that it believes it will receive if a crisis in Portugal occurs. However, it decides not to hedge additional cash flows that it would receive if the crisis does not occur. Estimate what the net present value of the project will be based on the hedging strategy described here and assuming that a crisis in Portugal does not occur. Do not round intermediate calculations. Round your answer to the nearest dollar. Use a minus sign to enter a negative value, if any. $