Answered step by step

Verified Expert Solution

Question

1 Approved Answer

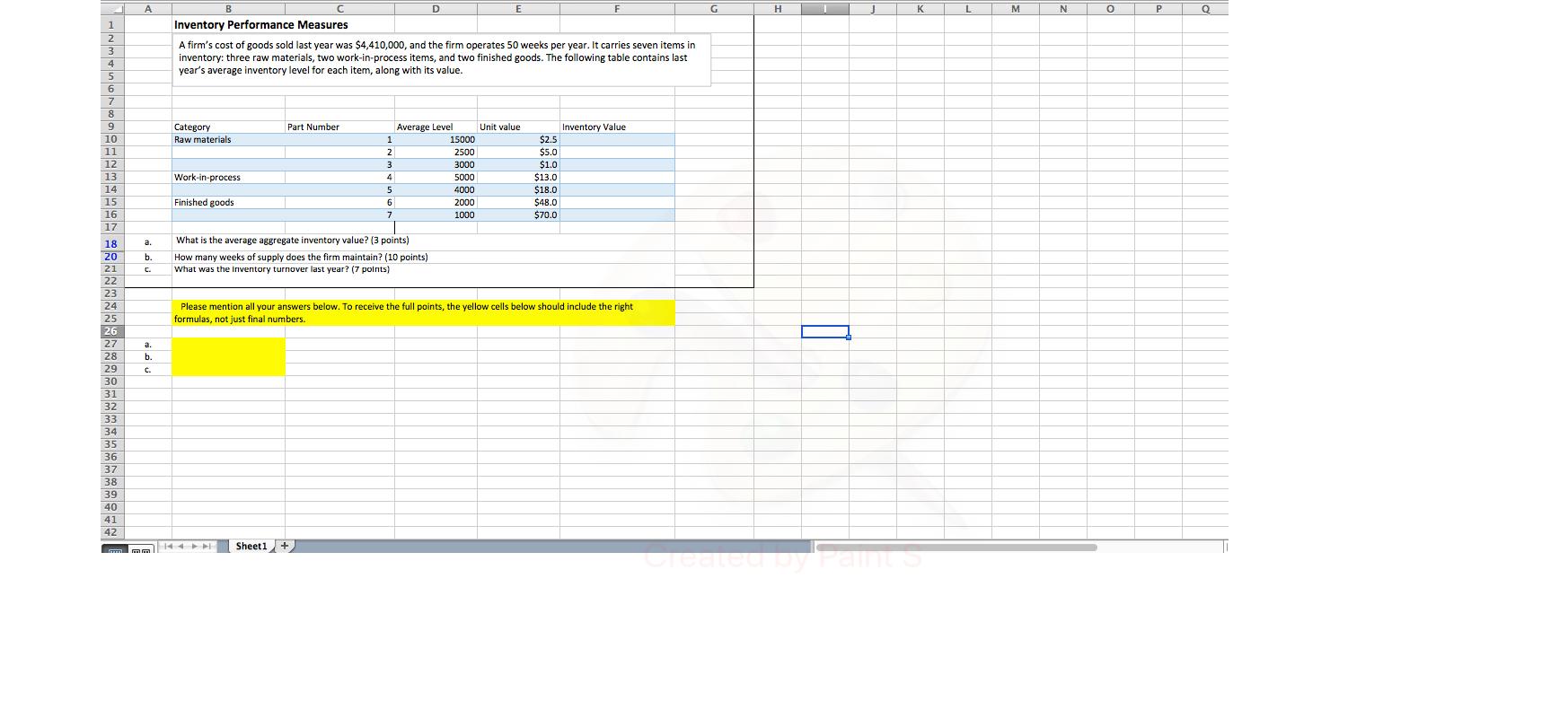

A E F 1 Inventory Performance Measures 2 3 4 A firm's cost of goods sold last year was $4,410,000, and the firm operates

A E F 1 Inventory Performance Measures 2 3 4 A firm's cost of goods sold last year was $4,410,000, and the firm operates 50 weeks per year. It carries seven items in inventory: three raw materials, two work-in-process items, and two finished goods. The following table contains last year's average inventory level for each item, along with its value. 5 6 7 8 9 Category Part Number Average Level Unit value Inventory Value 10 Raw materials 1 15000 $2.5 11 2 2500 $5.0 12 3. 3000 $1.0 13 Work-in-process 4 5000 $13.0 14 5 4000 $18.0 15 Finished goods 6 2000 $48.0 16 7 1000 $70.0 17 18 a. What is the average aggregate inventory value? (3 points) 20 b. How many weeks of supply does the firm maintain? (10 points) 21 What was the Inventory turnover last year? (7 points) 22 23 24 25 Please mention all your answers below. To receive the full points, the yellow cells below should include the right formulas, not just final numbers. 26 27 a. 28 b. 29 30 31 32 33 34 35 36 37 38 39 40 41 42 Sheet1 G H K L M N P Q

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started