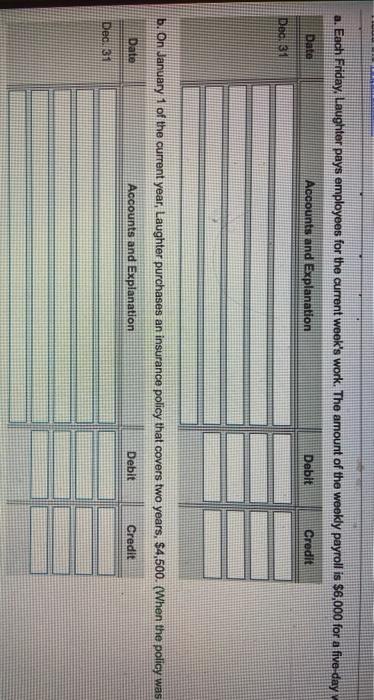

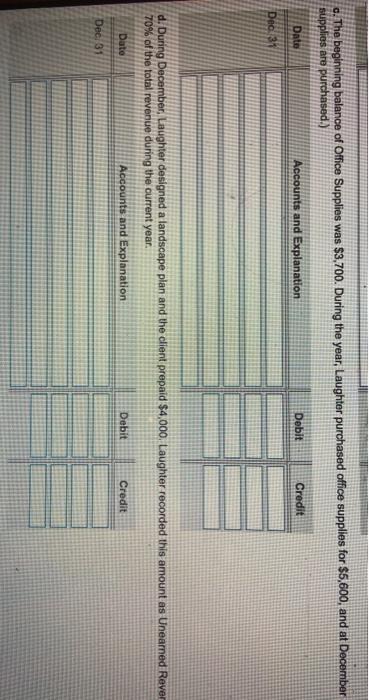

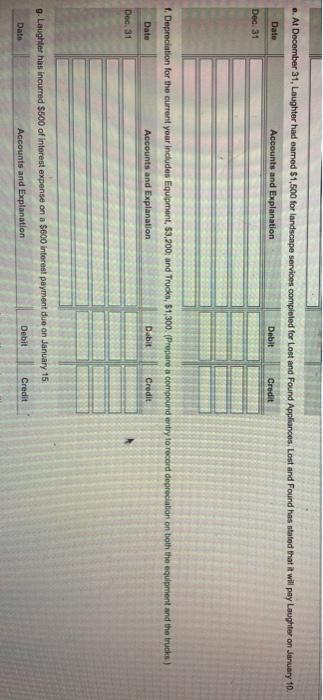

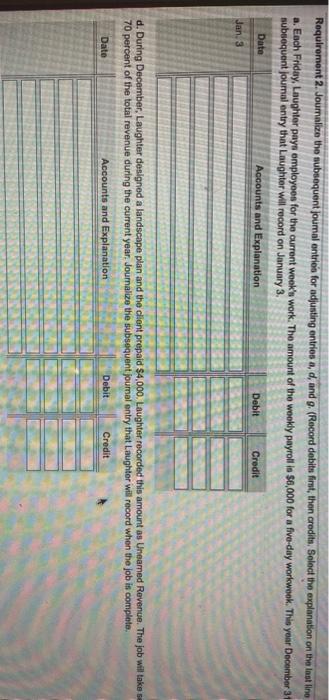

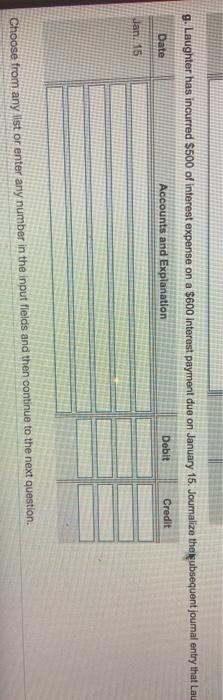

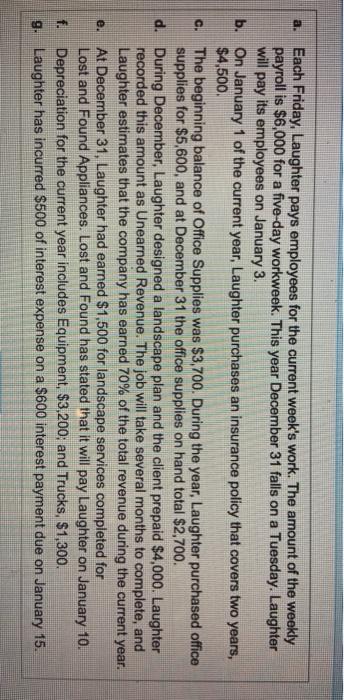

a. Each Friday. Laughter pays employees for the current week's work. The amount of the weekly payroll is $6,000 for a five day Data Accounts and Explanation Debit Credit Dec 31 b. On January 1 of the current year, Laughter purchases an insurance policy that covers two years, $4,500. (When the policy was Date Accounts and Explanation Debit Credit Dedi c. The beginning balance of Office Supplies was $3,700. During the year, Laughter purchased office supplies for $5,600, and at December supplies are purchased.) Date Accounts and Explanation Debit Credit Dec 31 d. During December, Laughter designed a landscape plan and the client prepaid $4,000. Laughter recorded this amount as Uneared Rever 70% of the total revenue during the current year. Dato Accounts and Explanation Debit Credit Dec 31 a. At December 31, Laughter had earned $1,500 for landscape services completed for Lost and Found Appliances, Lost and Found has stated that it will pay Laughter on January 10. Date Accounts and Explanation Debit Credit Dec. 31 1. Depreciation for the current your includes Equipment, $3,200; and Trucks, S1,300 (Prepare a compound entry to record depreciation on both the equipment and the trucks Date Accounts and Explanation Credit Dabit Dec 31 9. Laughter has incurred $500 of interest expense on a $600 Interest payment due on January 15 Date Accounts and Explanation Debit Credit Requirement 2. Joumalize the subsequent joumal entries for adjusting entriosa, d, and 9. (Record debits first, then creditn. Select the explanation on the last line a. Each Friday, Laughter pays employees for the current week's work. The amount of the weekly payroll is 50,000 for a five-day workwork. This year December 31 subsequent journal entry that Laughter will record on January 3. Data Accounts and Explanation Debit Credit Jan 3 d. During December, Laughter designed a landscape plan and the client prepaid $4,000 Laughter recorded this amount as Unearned Revenue. The job will takes 70 percent of the total revenue during the current year. Journalize the subsequent joumal entry that Laughter will record when the job is complete Date Accounts and Explanation Debit Credit g. Laughter has incurred $500 of interest expense on a $600 interest payment due on January 15. Journalize the subsequent journal entry that Lau Date Accounts and Explanation Credit Debit Jan. 15 Choose from any list or enter any number in the input fields and then continue to the next question. a. Each Friday, Laughter pays employees for the current week's work. The amount of the weekly payroll is $6,000 for a five-day workweek. This year December 31 falls on a Tuesday. Laughter will pay its employees on January 3. b. On January 1 of the current year, Laughter purchases an insurance policy that covers two years, $4,500. G. The beginning balance of Office Supplies was $3,700. During the year, Laughter purchased office supplies for $5,600, and at December 31 the office supplies on hand total $2,700. d. During December, Laughter designed a landscape plan and the client prepaid $4,000. Laughter recorded this amount as Unearned Revenue. The job will take several months to complete, and Laughter estimates that the company has earned 70% of the total revenue during the current year. e. At December 31, Laughter had earned $1,500 for landscape services completed for Lost and Found Appliances. Lost and Found has stated that it will pay Laughter on January 10. f. Depreciation for the current year includes Equipment, $3,200; and Trucks, $1,300. 9. Laughter has incurred $500 of interest expense on a $600 interest payment due on January 15