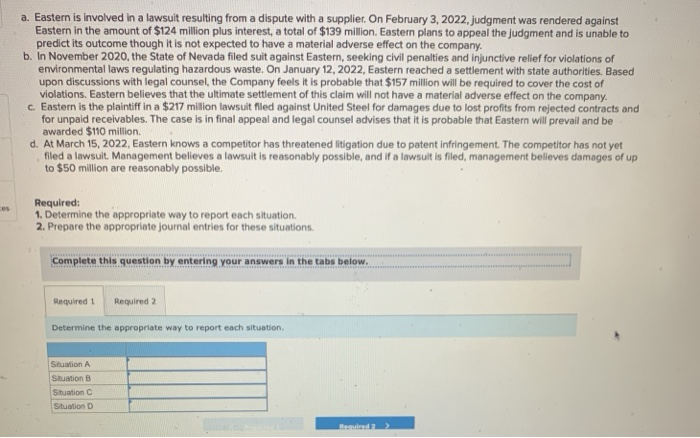

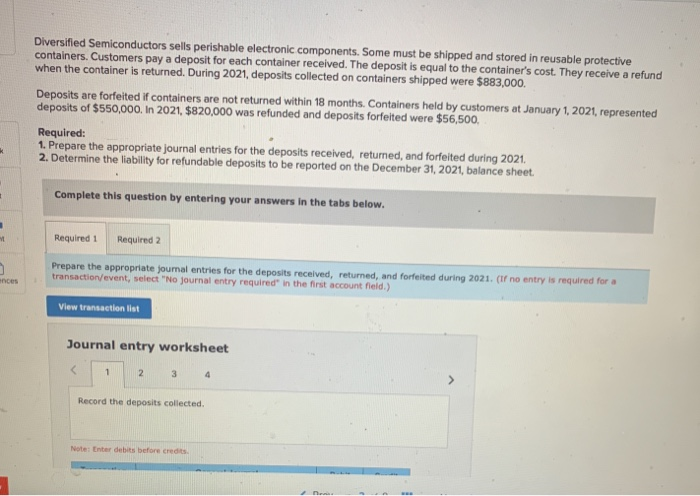

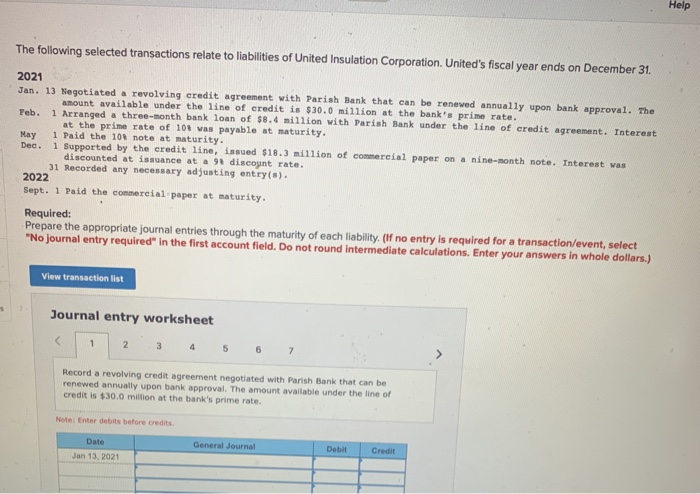

a. Eastern is involved in a lawsuit resulting from a dispute with a supplier. On February 3, 2022, judgment was rendered against Eastern in the amount of $124 million plus interest, a total of $139 million, Eastern plans to appeal the judgment and is unable to predict its outcome though it is not expected to have a material adverse effect on the company. b. In November 2020, the State of Nevada filed suit against Eastern, seeking civil penalties and injunctive relief for violations of environmental laws regulating hazardous waste. On January 12, 2022, Eastern reached a settlement with state authorities. Based upon discussions with legal counsel, the Company feels it is probable that $157 million will be required to cover the cost of violations. Eastern believes that the ultimate settlement of this claim will not have a material adverse effect on the company. c. Eastern is the plaintiff in a $217 million lawsuit filed against United Steel for damages due to lost profits from rejected contracts and for unpaid receivables. The case is in final appeal and legal counsel advises that it is probable that Eastern will prevail and be awarded $110 million. d. At March 15, 2022, Eastern knows a competitor has threatened litigation due to patent infringement. The competitor has not yet filed a lawsuit. Management believes a lawsuit is reasonably possible, and if a lawsuit is filed, management believes damages of up to $50 million are reasonably possible. Required: 1. Determine the appropriate way to report each situation. 2. Prepare the appropriate journal entries for these situations, Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the appropriate way to report each situation Situation A Stuation B Situation C Situation D Diversified Semiconductors sells perishable electronic components. Some must be shipped and stored in reusable protective containers. Customers pay a deposit for each container received. The deposit is equal to the container's cost. They receive a refund when the container is returned. During 2021, deposits collected on containers shipped were $883,000. Deposits are forfeited if containers are not returned within 18 months. Containers held by customers at January 1, 2021, represented deposits of $550,000. In 2021, $820,000 was refunded and deposits forfeited were $56,500. Required: 1. Prepare the appropriate journal entries for the deposits received, returned, and forfeited during 2021. 2. Determine the liability for refundable deposits to be reported on the December 31, 2021, balance sheet. * Complete this question by entering your answers in the tabs below. M Required 1 Required 2 Prepare the appropriate journal entries for the deposits received, returned, and forfeited during 2021. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) inces View transaction list Journal entry worksheet Record the deposits collected Note: Enter debts before credits 2n Help The following selected transactions relate to liabilities of United Insulation Corporation. United's fiscal year ends on December 31. 2021 Jan. 13 Negotiated a revolving credit agreement with Parish Bank that can be renewed annually upon bank approval. The amount available under the line of credit is $30.0 million at the bank's prime rate. Feb. 1 Arranged a three-month bank loan of $8.4 million with Parish Bank under the line of credit agreement. Interest at the prime rate of 108 was payable at maturity. May 1 Paid the 10note at maturity. Dec. 1 Supported by the credit line, issued $18.3 million of commercial paper on a nine-month note. Interest was discounted at issuance at a 98 discount rate. 31 Recorded any necessary adjusting entry(s). 2022 Sept. 1 Paid the commercial paper at maturity. Required: Prepare the appropriate journal entries through the maturity of each liability. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Enter your answers in whole dollars.) View transaction list 5 Journal entry worksheet Record the deposits collected Note: Enter debts before credits 2n Help The following selected transactions relate to liabilities of United Insulation Corporation. United's fiscal year ends on December 31. 2021 Jan. 13 Negotiated a revolving credit agreement with Parish Bank that can be renewed annually upon bank approval. The amount available under the line of credit is $30.0 million at the bank's prime rate. Feb. 1 Arranged a three-month bank loan of $8.4 million with Parish Bank under the line of credit agreement. Interest at the prime rate of 108 was payable at maturity. May 1 Paid the 10note at maturity. Dec. 1 Supported by the credit line, issued $18.3 million of commercial paper on a nine-month note. Interest was discounted at issuance at a 98 discount rate. 31 Recorded any necessary adjusting entry(s). 2022 Sept. 1 Paid the commercial paper at maturity. Required: Prepare the appropriate journal entries through the maturity of each liability. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Enter your answers in whole dollars.) View transaction list 5 Journal entry worksheet