Answered step by step

Verified Expert Solution

Question

1 Approved Answer

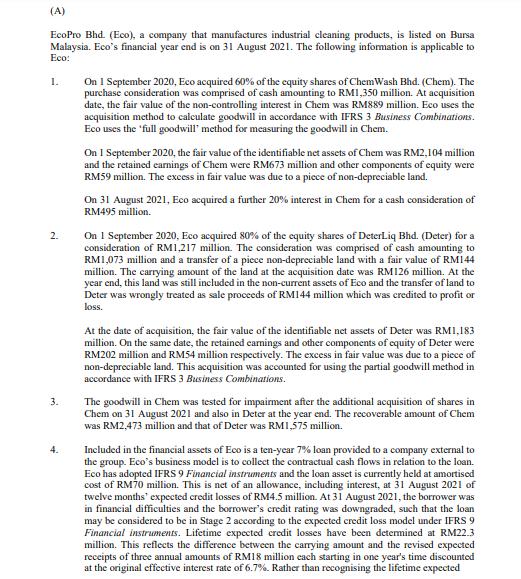

(A) EcoPro Bhd. (Eco), a company that manufactures industrial cleaning products, is listed on Bursa Malaysia. Eco's financial year end is on 31 August

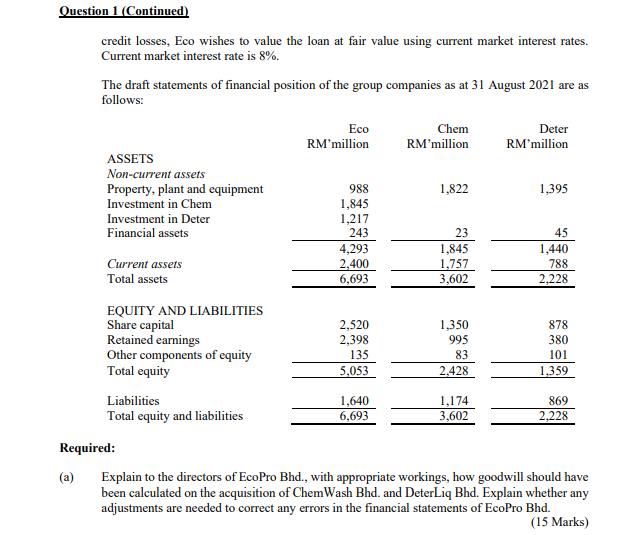

(A) EcoPro Bhd. (Eco), a company that manufactures industrial cleaning products, is listed on Bursa Malaysia. Eco's financial year end is on 31 August 2021. The following information is applicable to Eco: On I September 2020, Eco acquired 60% of the equity shares of ChemWash Bhd. (Chem). The purchase consideration was comprised of cash amounting to RMI,350 million. At acquisition date, the fair value of the non-controlling interest in Chem was RM889 million. Eco uses the acquisition method to calculate goodwill in accordance with IFRS 3 Business Combinations. Eco uses the 'full goodwill' method for measuring the goodwill in Chem. 1. On I September 2020, the fair value of the identifiable net assets of Chem was RM2,104 million and the retained earnings of Chem were RM673 million and other components of equity were RM59 million. The excess in fair value was due to a piece of non-depreciable land. On 31 August 2021, Eco acquired a further 20% interest in Chem for a cash consideration of RM495 million. On 1 September 2020, Eco acquired 80% of the equity shares of DeterLiq Bhd. (Deter) for a consideration of RM1,217 million. The consideration was comprised of cash amounting to RM1,073 million and a transfer of a piece non-depreciable land with a fair value of RM144 million. The carrying amount of the land at the acquisition date was RM126 million. At the year end, this land was still included in the non-current assets of Eco and the transfer of land to Deter was wrongly treated as sale proceeds of RM144 million which was credited to profit or loss. 2. At the date of acquisition, the fair value of the identifiable net assets of Deter was RMI,183 million. On the same date, the retained camings and other components of equity of Deter were RM202 million and RM54 million respectively. The excess in fair value was due to a piece of non-depreciable land. This acquisition was accounted for using the partial goodwill method in accordance with IFRS 3 Business Combinations. 3. The goodwill in Chem was tested for impairment after the additional acquisition of shares in Chem on 31 August 2021 and also in Deter at the year end. The recoverable amount of Chem was RM2,473 million and that of Deter was RMI,575 million. Included in the financial assets of Eco is a ten-year 7% loan provided to a company external to the group. Eco's business model is to collect the contractual cash flows in relation to the loan. Eco has adopted IFRS 9 Financial instruments and the loan asset is currently held at amortised cost of RM70 million. This is net of an allowance, including interest, at 31 August 2021 of twelve months' expected credit losses of RM4.5 million. At 31 August 2021, the borrower was in financial difficulties and the borrower's credit rating was downgraded, such that the loan may be considered to be in Stage 2 according to the expected credit loss model under IFRS 9 Financial instruments. Lifetime expected credit losses have been detemined at RM22.3 million. This reflects the difference between the carying amount and the revised expected receipts of three annual amounts of RM18 million cach starting in one year's time discounted at the original effective interest rate of 6.7%. Rather than recognising the lifetime expected 4. Question 1 (Continued) credit losses, Eco wishes to value the loan at fair value using current market interest rates. Current market interest rate is 8%. The draft statements of financial position of the group companies as at 31 August 2021 are as follows: Eco Chem Deter RM'million RM'million RM'million ASSETS Non-current assets Property, plant and equipment Investment in Chem 988 1,822 1,395 1,845 1,217 243 4,293 2,400 6,693 Investment in Deter Financial assets 23 45 1,845 1,757 3,602 1,440 Current assets 788 Total assets 2,228 EQUITY AND LIABILITIES Share capital Retained earnings Other components of equity Total equity 2,520 2,398 135 1,350 995 83 878 380 101 5,053 2,428 1,359 1,640 6,693 1,174 3,602 Liabilities 869 Total equity and liabilities 2,228 Required: (a) Explain to the directors of EcoPro Bhd., with appropriate workings, how goodwill should have been calculated on the acquisition of ChemWash Bhd. and DeterLiq Bhd. Explain whether any adjustments are needed to correct any errors in the financial statements of EcoPro Bhd. (15 Marks)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To find out the Goodwill of any company we used to find out with the help of general formula PAL Here P is purchased price A is Fair Market value of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started