Question

a. Enter the data into a worksheet and format the table as shown. Format the cells as accounting numbers with no decimal places. b. Create

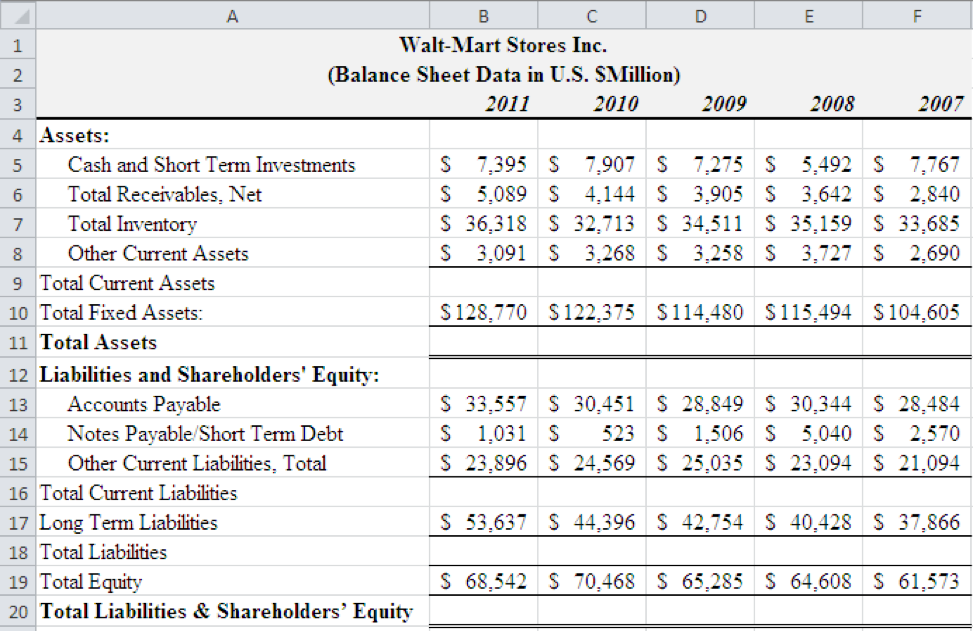

a. Enter the data into a worksheet and format the table as shown. Format the cells as accounting numbers with no decimal places. b. Create a formula to calculate the missing values in the table denoted by a question mark using the SUM function. Also, find capital structure of Walt-Mart Stores Inc. using the following ratios for 2007-2011: total debt to total assets, total debt to total equity, and total assets to total equity. Format the results as percentages with two decimal places the first ratio, and as numbers with two decimal values the other two.

b. Create a formula to calculate the missing values in the table denoted by a question mark using the SUM function. Also, find capital structure of Walt-Mart Stores Inc. using the following ratios for 2007-2011: total debt to total assets, total debt to total equity, and total assets to total equity. Format the results as percentages with two decimal places the first ratio, and as numbers with two decimal values the other two.

Show me the setp. Thanks

Walt-Mart Stores Indc. (Balance Sheet Data in U.S. SMillion) 2011 2 2010 2009 2008 2007 4 Assets: 5 Cash and Short Term Investments 6 Total Receivables, Net 7Total Inventory 8 Other Current Assets 9 Total Current Assets 10 Total Fixed Assets 11 Total Assets 12 Liabilities and Shareholders' Equity: 13 Accounts Payable 14 Notes Payable/Short Term Debt 15 Other Current Liabilities, Total 16 Total Current Liabilities 17 Long Term Liabilities 18 Total Liabilities 19 Total Equity 20 Total Liabilities & Shareholders' Equity S 7,395 S 7,907 S 7,275 S 5,492 S 7,767 S 5,089 S 4,144 S 3,905 S 3.642 2,840 S 36,318 S 32,713 S 34,511 S 35.159S 33,685 S 3.091 S 3.268 S 3.258 S 3.727 S 2.690 S128,770 S122,375S114,480 S 115,494 S104.605 S 33.557 S 30,451 S 28,849 S 30,344 S 28.484 S 1,031 S 523 S 1,506 S 5.040 S 2,570 S 23.896 S 24.569 S 25.035 S 23.094 S 21.094 S 53.637 S 44,396 S 42,754 S 40,428 S 37.866 S 68.542 S 70,468 S 65.285 S 64,608 S 61.,573Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started