Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A European put option written on stock has strike price K = $21 and expires at time t = 1. At the current time

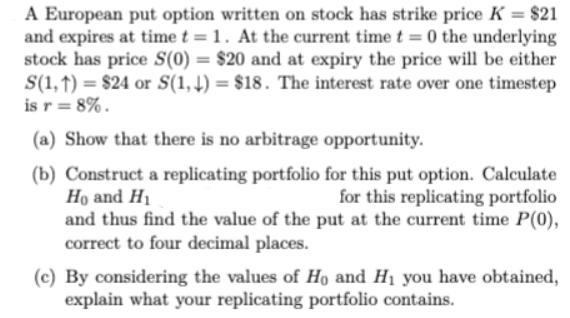

A European put option written on stock has strike price K = $21 and expires at time t = 1. At the current time t=0 the underlying stock has price S(0) = $20 and at expiry the price will be either S(1,1)= $24 or S(1,4)= $18. The interest rate over one timestep is r = 8%. (a) Show that there is no arbitrage opportunity. (b) Construct a replicating portfolio for this put option. Calculate Ho and H for this replicating portfolio and thus find the value of the put at the current time P(0), correct to four decimal places. (c) By considering the values of Ho and H you have obtained, explain what your replicating portfolio contains.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a No Arbitrage Opportunity To show that there is no arbitrage opportunity we need to demonstrate that its not possible to create a portfolio that guar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started