Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A European up-and-in call has strike price K-$21 and barrier B=$25. The values of the call's underlying asset, S(n,j), at different times n and

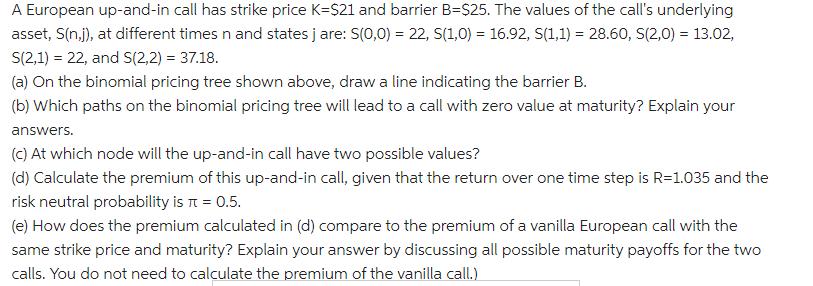

A European up-and-in call has strike price K-$21 and barrier B=$25. The values of the call's underlying asset, S(n,j), at different times n and states j are: S(0,0) = 22, S(1,0) = 16.92, S(1,1)= 28.60, S(2,0) = 13.02, S(2,1)= 22, and S(2,2) = 37.18. (a) On the binomial pricing tree shown above, draw a line indicating the barrier B. (b) Which paths on the binomial pricing tree will lead to a call with zero value at maturity? Explain your answers. (c) At which node will the up-and-in call have two possible values? (d) Calculate the premium of this up-and-in call, given that the return over one time step is R=1.035 and the risk neutral probability is = 0.5. (e) How does the premium calculated in (d) compare to the premium of a vanilla European call with the same strike price and maturity? Explain your answer by discussing all possible maturity payoffs for the two calls. You do not need to calculate the premium of the vanilla call.)

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

a On the binomial pricing tree shown above draw a line indicating the barrier B Answer The line indicating the barrier B is shown in the diagram below b Which paths on the binomial pricing tree will l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started