Question

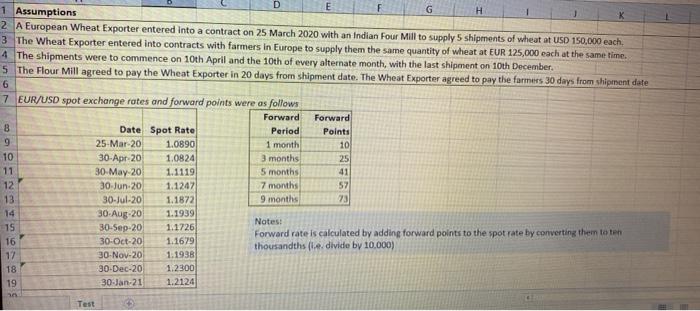

A European Wheat Exporter entered into a contract on 25 March 2020 with an Indian Four Mill to supply 5 shipments of wheat at USD

| A European Wheat Exporter entered into a contract on 25 March 2020 with an Indian Four Mill to supply 5 shipments of wheat at USD 150,000 each. |

| ||||||||||

| The Wheat Exporter entered into contracts with farmers in Europe to supply them the same quantity of wheat at EUR 125,000 each at the same time. | |||||||||||

| The shipments were to commence on 10th April and the 10th of every alternate month, with the last shipment on 10th December. |

| ||||||||||

| The Flour Mill agreed to pay the Wheat Exporter in 20 days from shipment date. The Wheat Exporter agreed to pay the farmers 30 days from shipment date | |||||||||||

|

| |||||||||||

| EUR/USD spot exchange rates and forward points were as follows |

| ||||||||||

| Date | Spot Rate | Forward Period | Forward Points |

| |||||||

| 25-Mar-20 | 1.0890 | 1 month | 10 |

| |||||||

| 30-Apr-20 | 1.0824 | 3 months | 25 |

| |||||||

| 30-May-20 | 1.1119 | 5 months | 41 |

| |||||||

| 30-Jun-20 | 1.1247 | 7 months | 57 |

| |||||||

| 30-Jul-20 | 1.1872 | 9 months | 73 |

| |||||||

| 30-Aug-20 | 1.1939 |

| |||||||||

| 30-Sep-20 | 1.1726 | ||||||||||

| 30-Oct-20 | 1.1679 | ||||||||||

| 30-Nov-20 | 1.1938 | ||||||||||

| 30-Dec-20 | 1.2300 |

| |||||||||

| 30-Jan-21 | 1.2124 |

| |||||||||

|

| |||||||||||

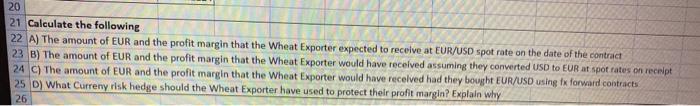

| Calculate the following |

|

|

|

|

|

|

|

| |||

| A) The amount of EUR and the profit margin that the Wheat Exporter expected to receive at EUR/USD spot rate on the date of the contract |

| ||||||||||

| B) The amount of EUR and the profit margin that the Wheat Exporter would have received assuming they converted USD to EUR at spot rates on receipt | |||||||||||

| C) The amount of EUR and the profit margin that the Wheat Exporter would have received had they bought EUR/USD using fx forward contracts |

| ||||||||||

| D) What Curreny risk hedge should the Wheat Exporter have used to protect their profit margin? Explain why show calcultion in excel please with formula s

s |

| ||||||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started