Question

(a) Examine the Cash Flow from Assets (CFFA) for the Year 2021? (10 marks) (b) Examine the Cash Flow to Creditors (CFTC) for the Year

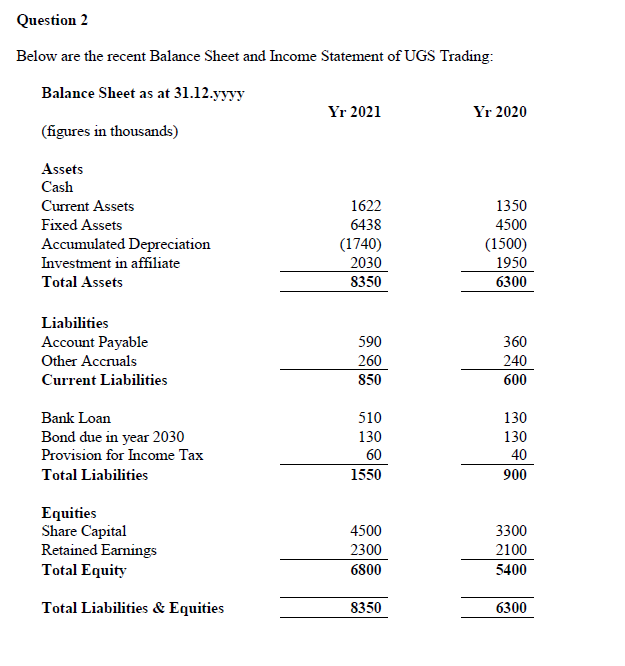

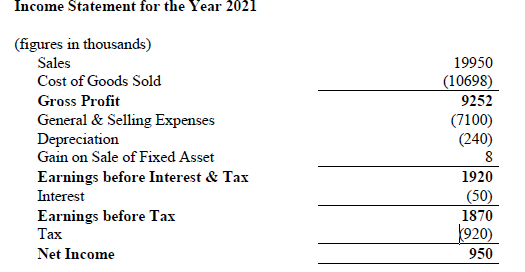

(a) Examine the Cash Flow from Assets (CFFA) for the Year 2021? (10 marks) (b) Examine the Cash Flow to Creditors (CFTC) for the Year 2021? (5 marks) (c) Examine the Cash Flow to Shareholders (CFTS) for the Year 2021? (5 marks) (d) Appraise three (3) key points that you could draw from these three sets of cash flows? (15 marks) (e) Discuss how the firm was financed in Year 2021 by commenting on the level of gearing in Year 2021. (10 marks) (f) Henceforth, infer the likely level of the Return of Equity in the previous Year 2020. Justify your response. (5 marks)

(a) Examine the Cash Flow from Assets (CFFA) for the Year 2021? (10 marks) (b) Examine the Cash Flow to Creditors (CFTC) for the Year 2021? (5 marks) (c) Examine the Cash Flow to Shareholders (CFTS) for the Year 2021? (5 marks) (d) Appraise three (3) key points that you could draw from these three sets of cash flows? (15 marks) (e) Discuss how the firm was financed in Year 2021 by commenting on the level of gearing in Year 2021. (10 marks) (f) Henceforth, infer the likely level of the Return of Equity in the previous Year 2020. Justify your response. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started