Question

a) Exercise 1: Using Warehouse Space as the cost driver, how much (dollars) would be allocated to the Retail Department? See circle on the printed

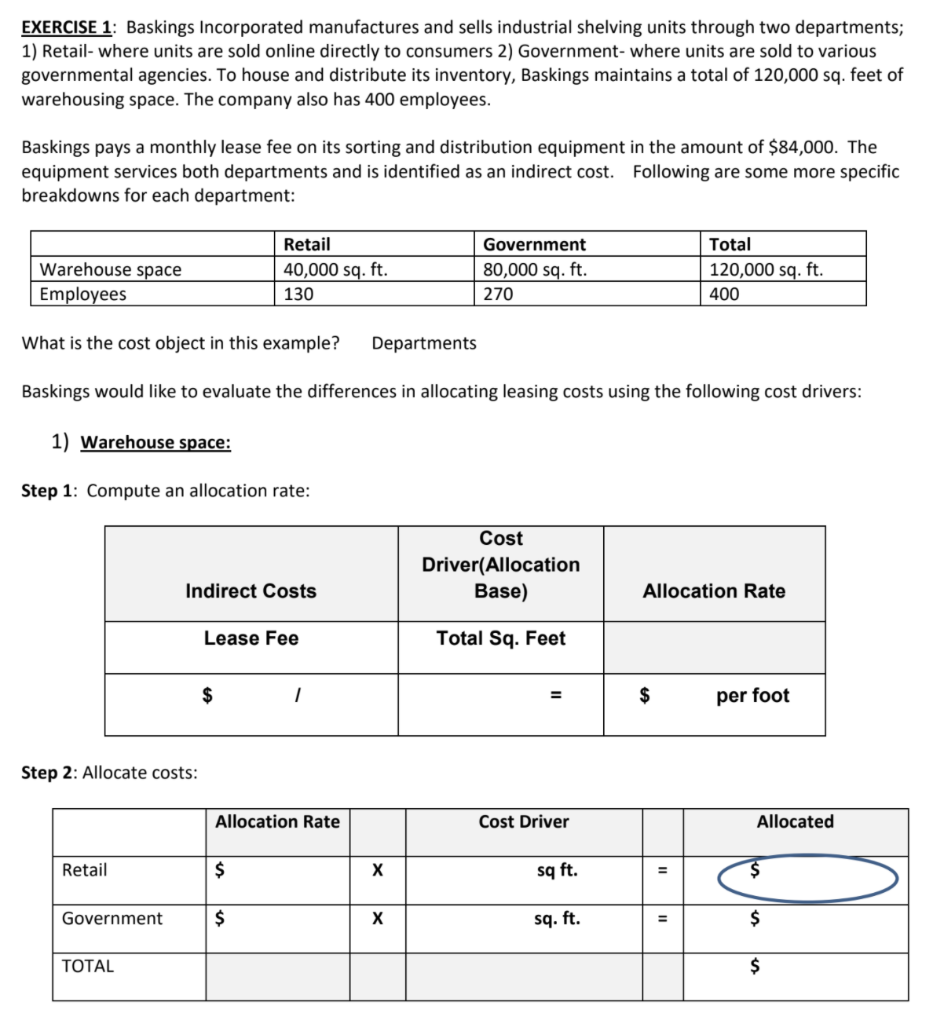

a) Exercise 1: Using Warehouse Space as the cost driver, how much (dollars) would be allocated to the Retail Department? See circle on the printed exercise.

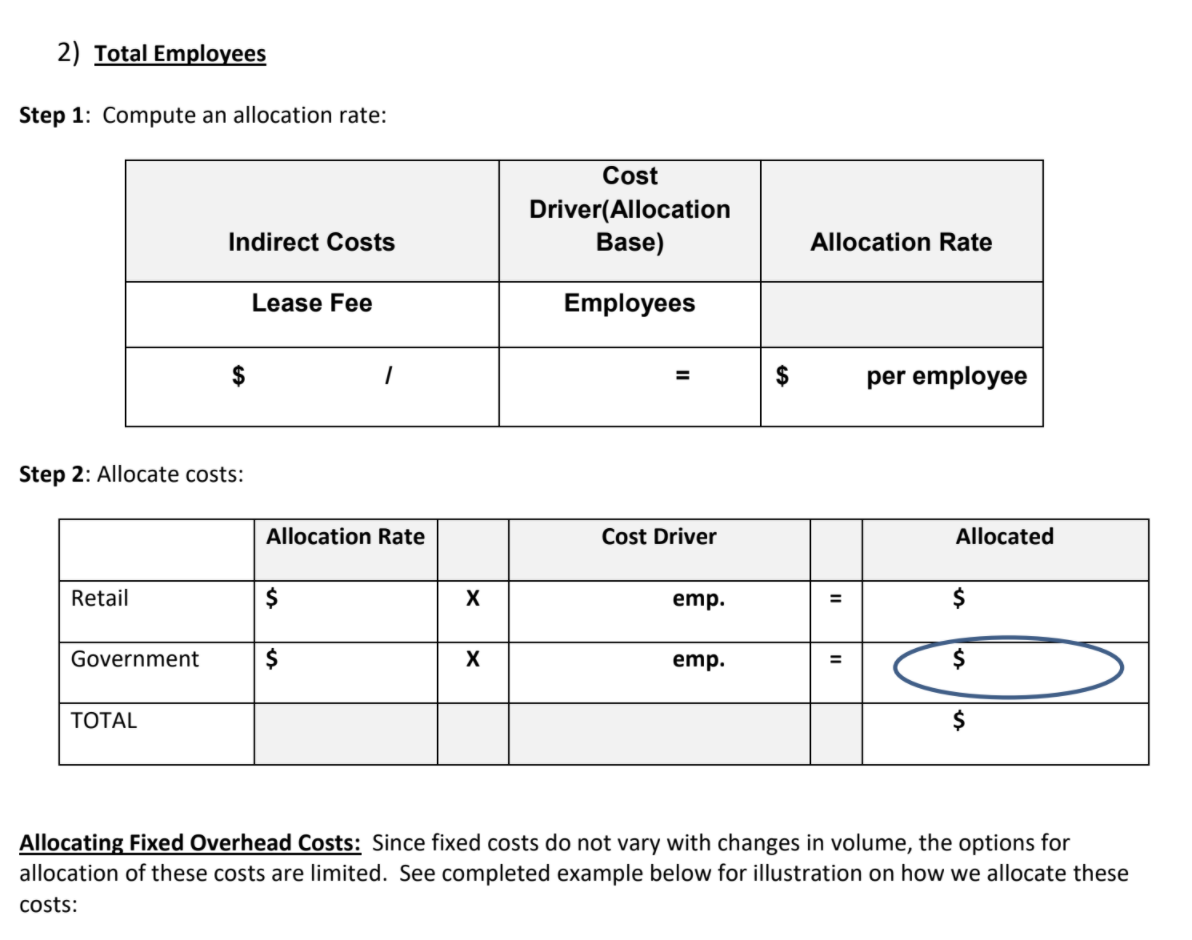

b) Exercise 1: Using Total Employees as the cost driver, how much (dollars) would be allocated to the Government Department? See circle on the printed exercise.

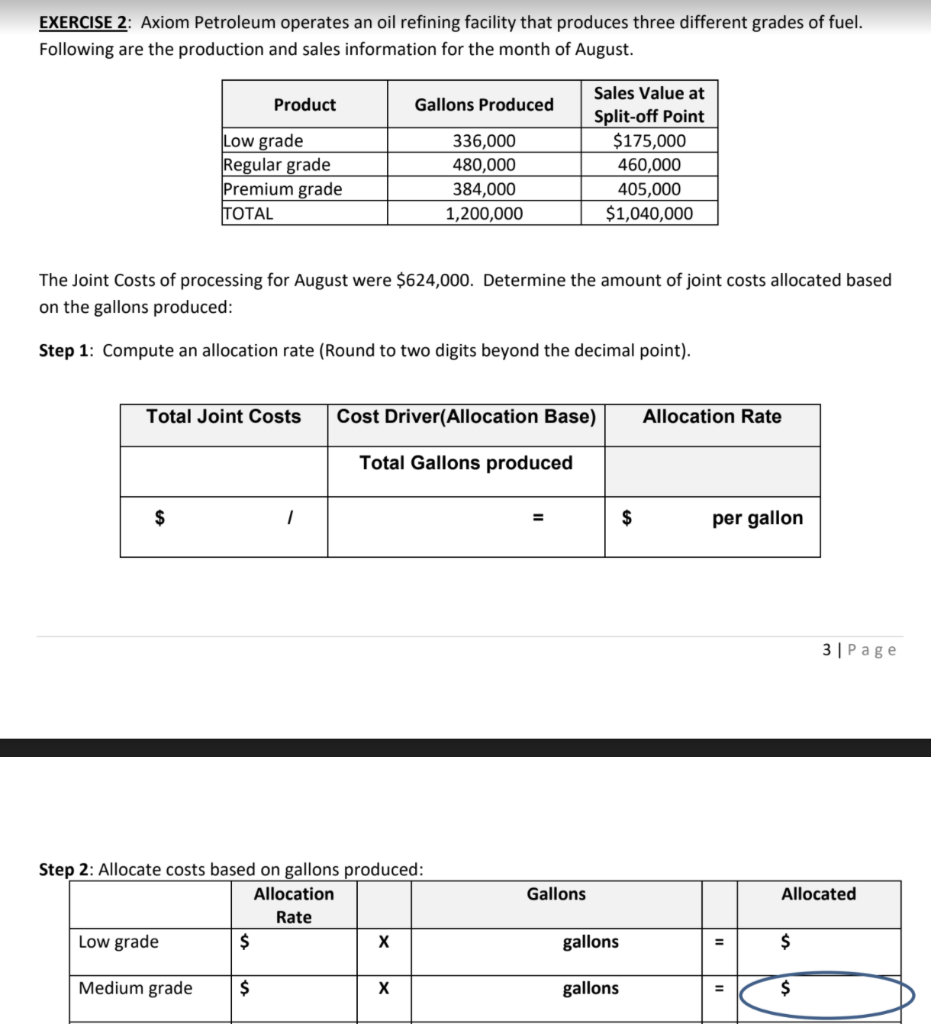

c) Exercise 2: Using Total Gallons as the cost driver, how much (dollars) would be allocated to the Medium Grade joint product? See circle on the printed exercise. d) Exercise 2: What is the allocation rate per $ of Sales Value? See circle on the printed exercise.

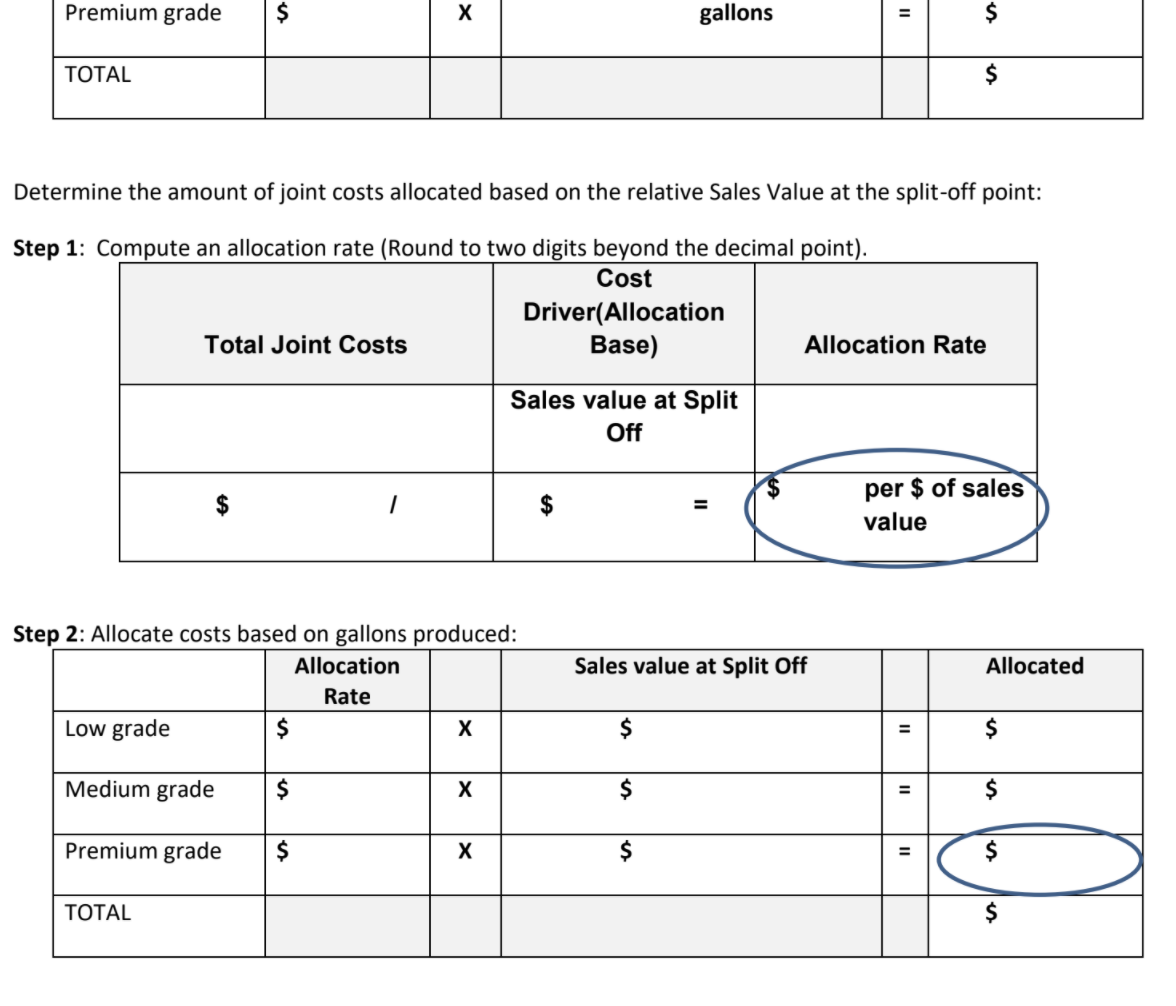

e) Exercise 2: Using Sales Value at Split-Off as the cost driver, how much (dollars) would be allocated to the Premium Grade joint product? See circle on the printed exercise.

EXERCISE 1: Baskings Incorporated manufactures and sells industrial shelving units through two departments; 1) Retail- where units are sold online directly to consumers 2) Government- where units are sold to various governmental agencies. To house and distribute its inventory, Baskings maintains a total of 120,000 sq. feet of warehousing space. The company also has 400 employees. Baskings pays a monthly lease fee on its sorting and distribution equipment in the amount of $84,000. The equipment services both departments and is identified as an indirect cost. Following are some more specific breakdowns for each department: Warehouse space Employees Retail 40,000 sq. ft. 130 Government 80,000 sq. ft. 270 Total 120,000 sq. ft. 400 What is the cost object in this example? Departments Baskings would like to evaluate the differences in allocating leasing costs using the following cost drivers: 1) Warehouse space: Step 1: Compute an allocation rate: Cost Driver(Allocation Base) Indirect Costs Allocation Rate Lease Fee Total Sq. Feet $ 1 $ per foot Step 2: Allocate costs: Allocation Rate Cost Driver Allocated Retail $ sq ft. Government $ sq. ft. $ TOTAL $ 2) Total Employees Step 1: Compute an allocation rate: Cost Driver(Allocation Base) Indirect Costs Allocation Rate Lease Fee Employees $ 1 = $ per employee Step 2: Allocate costs: Allocation Rate Cost Driver Allocated Retail emp. $ Government $ emp. $ TOTAL Allocating Fixed Overhead Costs: Since fixed costs do not vary with changes in volume, the options for allocation of these costs are limited. See completed example below for illustration on how we allocate these costs: EXERCISE 2: Axiom Petroleum operates an oil refining facility that produces three different grades of fuel. Following are the production and sales information for the month of August. Product Gallons Produced Low grade Regular grade Premium grade TOTAL 336,000 480,000 384,000 1,200,000 Sales Value at Split-off Point $175,000 460,000 405,000 $1,040,000 The Joint Costs of processing for August were $624,000. Determine the amount of joint costs allocated based on the gallons produced: Step 1: Compute an allocation rate (Round to two digits beyond the decimal point). Total Joint Costs Cost Driver(Allocation Base) Allocation Rate Gallons produced $ 1 $ per gallon 3 Page Gallons Allocated Step 2: Allocate costs based on gallons produced: Allocation Rate Low grade $ gallons = $ Medium grade $ X gallons = $ Premium grade $ gallons = $ TOTAL Determine the amount of joint costs allocated based on the relative Sales Value at the split-off point: Step 1: Compute an allocation rate (Round to two digits beyond the decimal point). Cost Driver(Allocation Total Joint Costs Base) Allocation Rate Sales value at Split Off $ per $ of sales value Sales value at Split Off Allocated Step 2: Allocate costs based on gallons produced: Allocation Rate Low grade $ X $ = $ Medium grade $ 11 $ Premium grade $ $ TOTALStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started