Question

a) Exercise 1: What is the Direct Materials Used in Production (dollars)? See circle on the printed exercise. (4 points for correct answer. No partial

a) Exercise 1: What is the Direct Materials Used in Production (dollars)? See circle on the printed exercise. (4 points for correct answer. No partial credit).

b) Exercise 1: Is the amount of overhead Under or Over Applied? UNDER or OVER? See circle on the printed exercise. (3 points for correct answer. No partial credit).

c) Exercise 1: What is the Cost of Goods Manufactured (dollars)? See circle on the printed exercise. (5 points for correct answer. No partial credit).

d) Exercise 1: What is the ending balance in Work in Process Inventory? See circle on printed exercise. (5 points for correct answer. No partial credit).

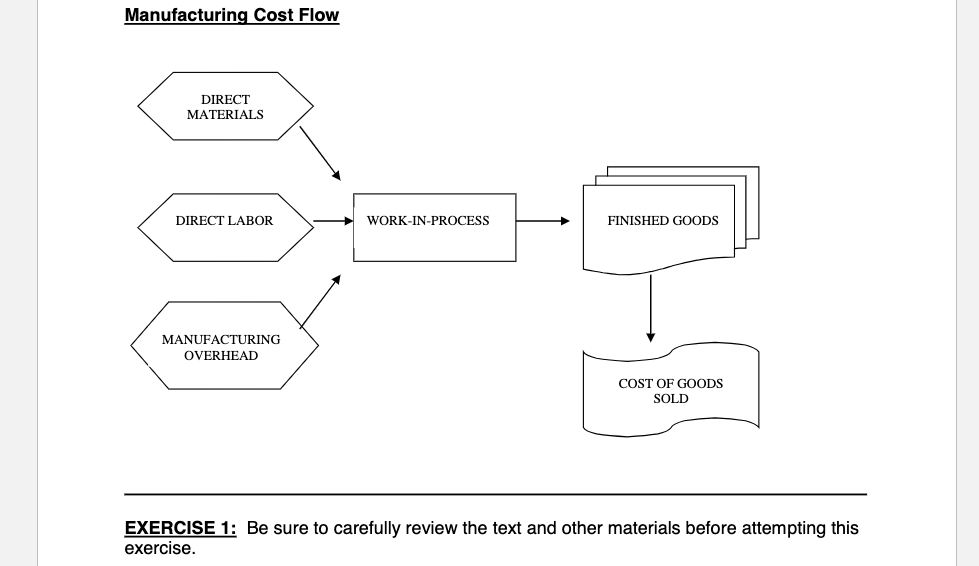

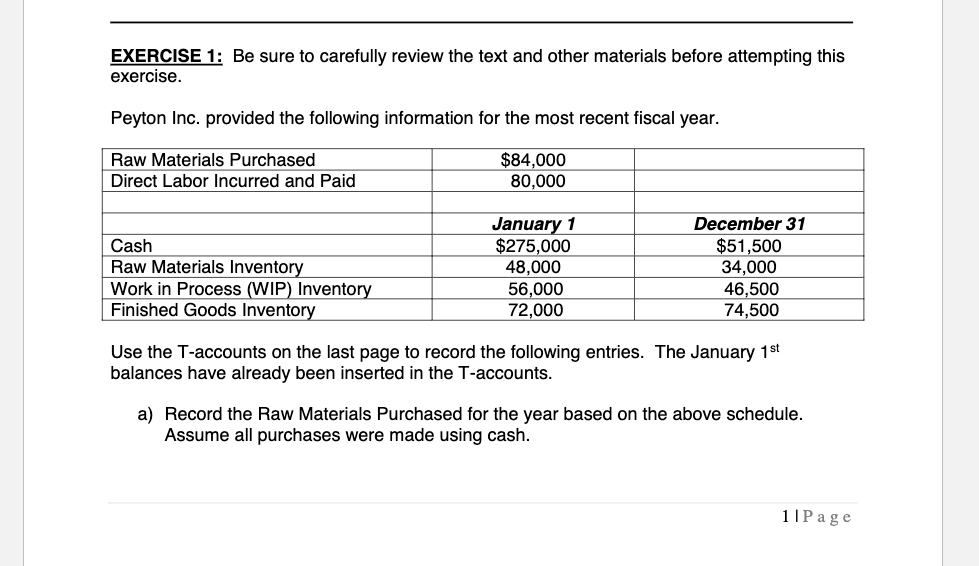

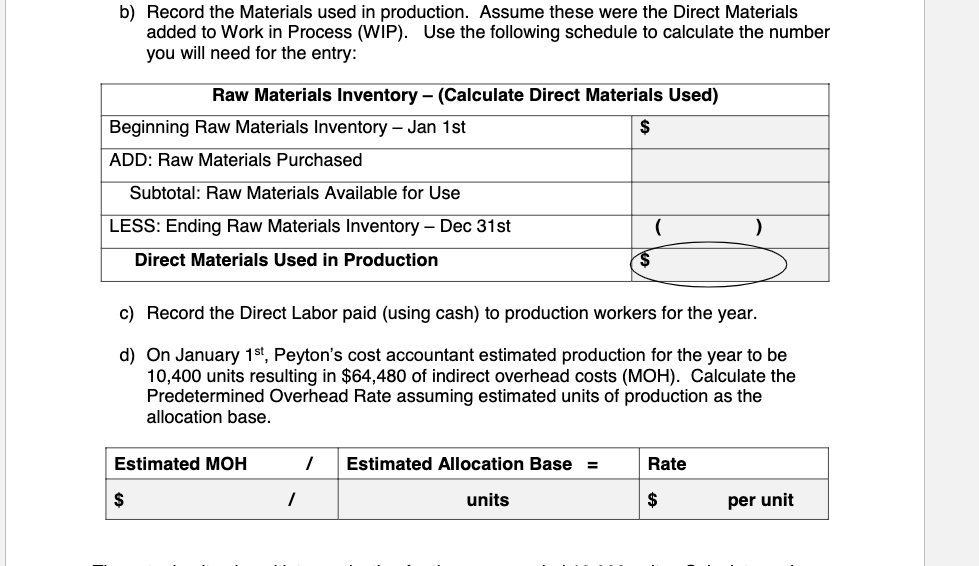

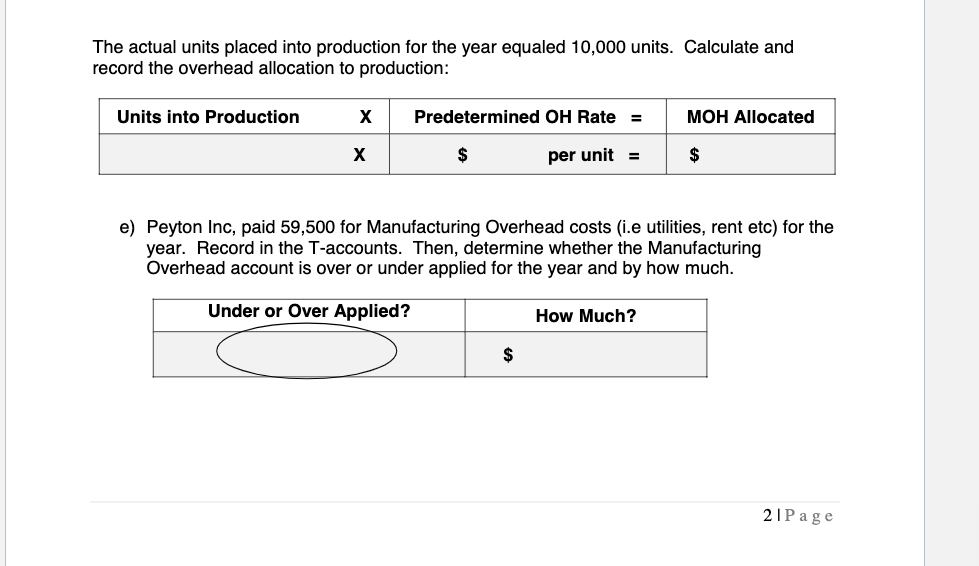

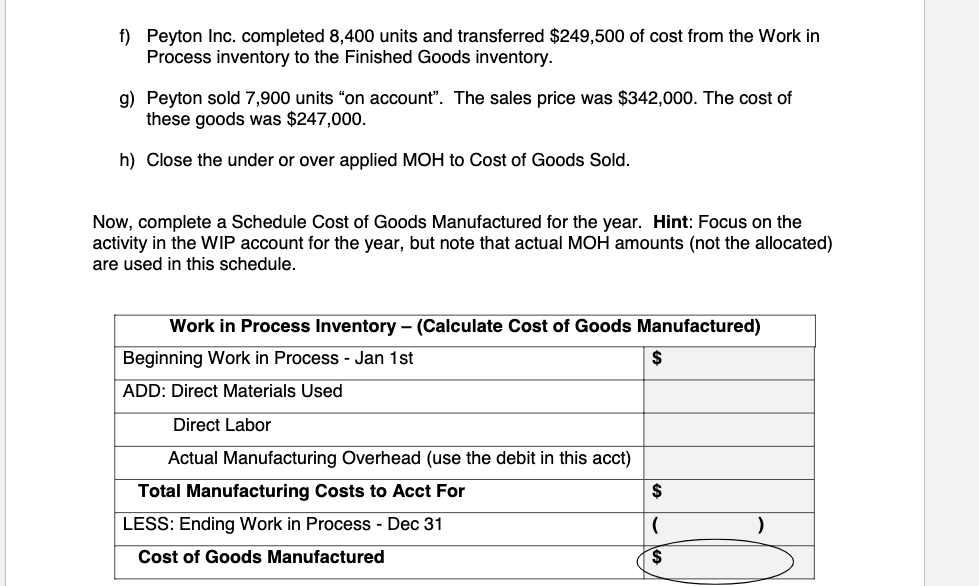

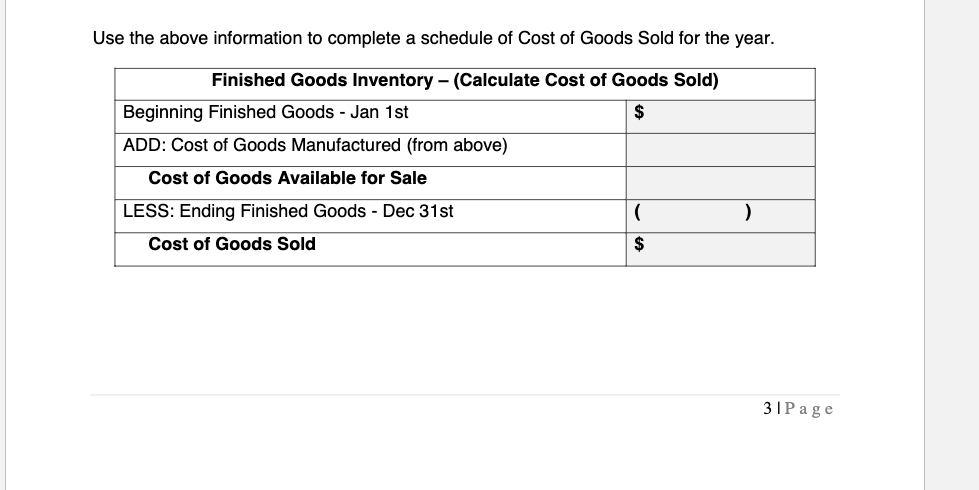

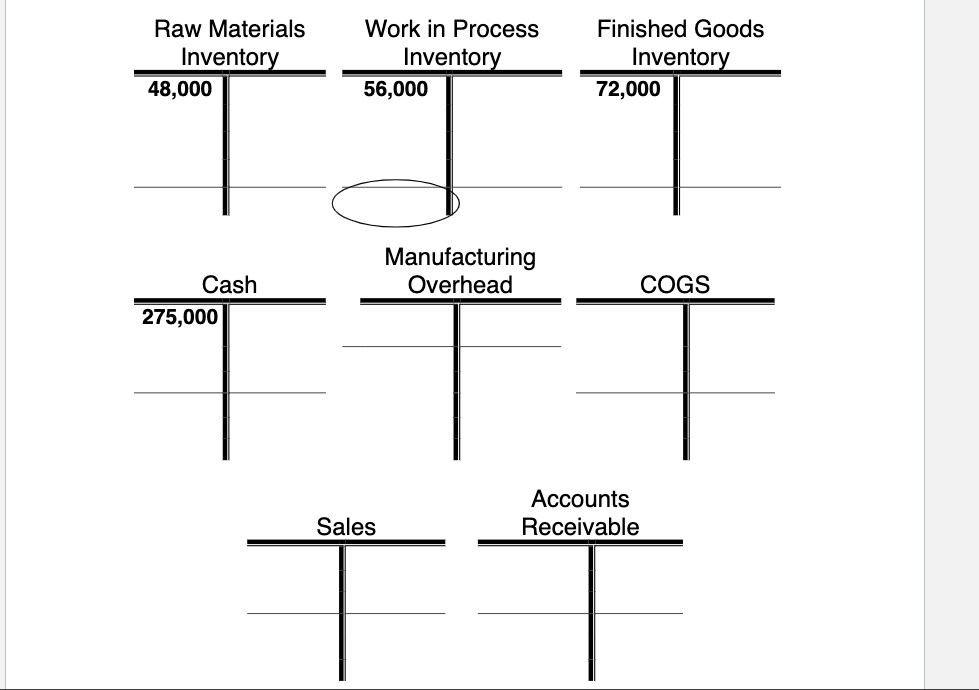

Manufacturina Cost Flow EXERCISE 1: Be sure to carefully review the text and other materials before attempting this exercise. EXERCISE 1: Be sure to carefully review the text and other materials before attempting this exercise. Peyton Inc. provided the following information for the most recent fiscal year. Use the T-accounts on the last page to record the following entries. The January 1st balances have already been inserted in the T-accounts. a) Record the Raw Materials Purchased for the year based on the above schedule. Assume all purchases were made using cash. b) Record the Materials used in production. Assume these were the Direct Materials added to Work in Process (WIP). Use the following schedule to calculate the number you will need for the entry: c) Record the Direct Labor paid (using cash) to production workers for the year. d) On January 1st, Peyton's cost accountant estimated production for the year to be 10,400 units resulting in $64,480 of indirect overhead costs (MOH). Calculate the Predetermined Overhead Rate assuming estimated units of production as the allocation base. The actual units placed into production for the year equaled 10,000 units. Calculate and record the overhead allocation to production: e) Peyton Inc, paid 59,500 for Manufacturing Overhead costs (i.e utilities, rent etc) for the year. Record in the T-accounts. Then, determine whether the Manufacturing Overhead account is over or under applied for the year and by how much. f) Peyton Inc. completed 8,400 units and transferred $249,500 of cost from the Work in Process inventory to the Finished Goods inventory. g) Peyton sold 7,900 units "on account". The sales price was $342,000. The cost of these goods was $247,000. h) Close the under or over applied MOH to Cost of Goods Sold. Now, complete a Schedule Cost of Goods Manufactured for the year. Hint: Focus on the activity in the WIP account for the year, but note that actual MOH amounts (not the allocated) are used in this schedule. Use the above information to complete a schedule of Cost of Goods Sold for the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started