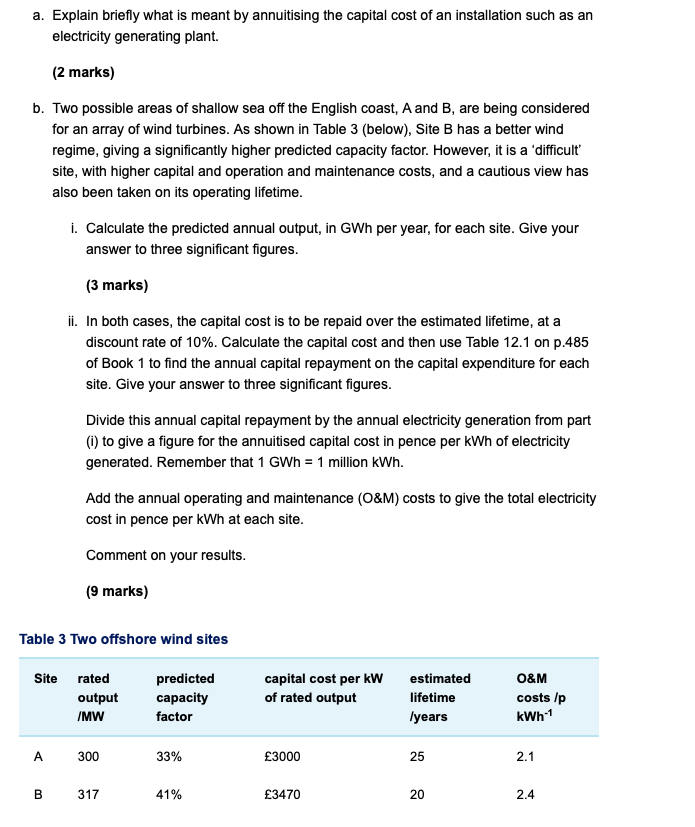

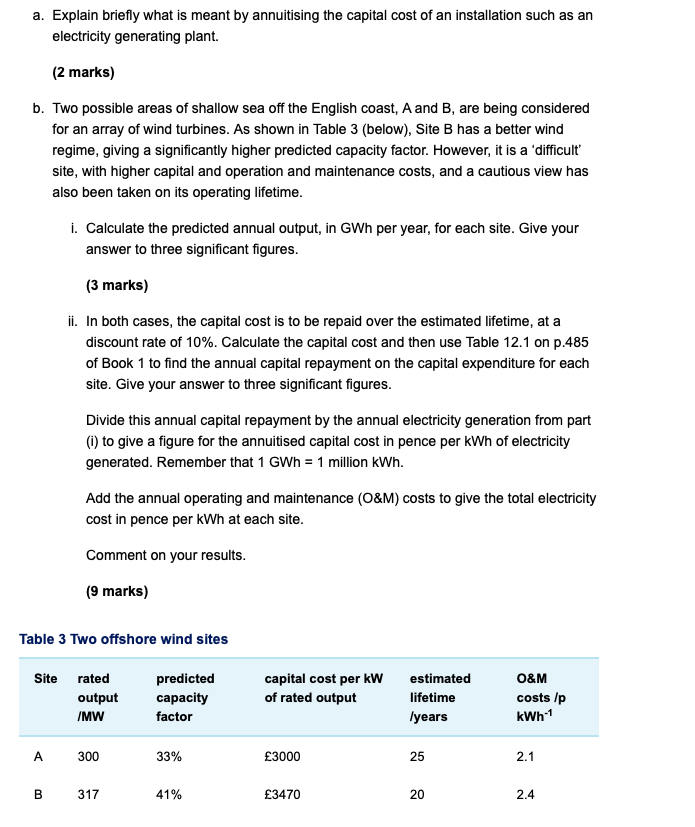

a. Explain briefly what is meant by annuitising the capital cost of an installation such as an electricity generating plant. (2 marks) b. Two possible areas of shallow sea off the English coast, A and B, are being considered for an array of wind turbines. As shown in Table 3 (below), Site B has a better wind regime, giving a significantly higher predicted capacity factor. However, it is a 'difficult site, with higher capital and operation and maintenance costs, and a cautious view has also been taken on its operating lifetime. i. Calculate the predicted annual output, in GWh per year, for each site. Give your answer to three significant figures. (3 marks) ii. In both cases, the capital cost is to be repaid over the estimated lifetime, at a discount rate of 10%. Calculate the capital cost and then use Table 12.1 on p.485 of Book 1 to find the annual capital repayment on the capital expenditure for each site. Give your answer to three significant figures. Divide this annual capital repayment by the annual electricity generation from part (1) to give a figure for the annuitised capital cost in pence per kWh of electricity generated. Remember that 1 GWh = 1 million kWh. Add the annual operating and maintenance (O&M) costs to give the total electricity cost in pence per kWh at each site. Comment on your results. (9 marks) Table 3 Two offshore wind sites Site rated output /MW predicted capacity factor capital cost per kW of rated output estimated lifetime /years O&M costs /p kWh-1 A 300 33% 3000 B 317 41% 3470 a. Explain briefly what is meant by annuitising the capital cost of an installation such as an electricity generating plant. (2 marks) b. Two possible areas of shallow sea off the English coast, A and B, are being considered for an array of wind turbines. As shown in Table 3 (below), Site B has a better wind regime, giving a significantly higher predicted capacity factor. However, it is a 'difficult site, with higher capital and operation and maintenance costs, and a cautious view has also been taken on its operating lifetime. i. Calculate the predicted annual output, in GWh per year, for each site. Give your answer to three significant figures. (3 marks) ii. In both cases, the capital cost is to be repaid over the estimated lifetime, at a discount rate of 10%. Calculate the capital cost and then use Table 12.1 on p.485 of Book 1 to find the annual capital repayment on the capital expenditure for each site. Give your answer to three significant figures. Divide this annual capital repayment by the annual electricity generation from part (1) to give a figure for the annuitised capital cost in pence per kWh of electricity generated. Remember that 1 GWh = 1 million kWh. Add the annual operating and maintenance (O&M) costs to give the total electricity cost in pence per kWh at each site. Comment on your results. (9 marks) Table 3 Two offshore wind sites Site rated output /MW predicted capacity factor capital cost per kW of rated output estimated lifetime /years O&M costs /p kWh-1 A 300 33% 3000 B 317 41% 3470