Answered step by step

Verified Expert Solution

Question

1 Approved Answer

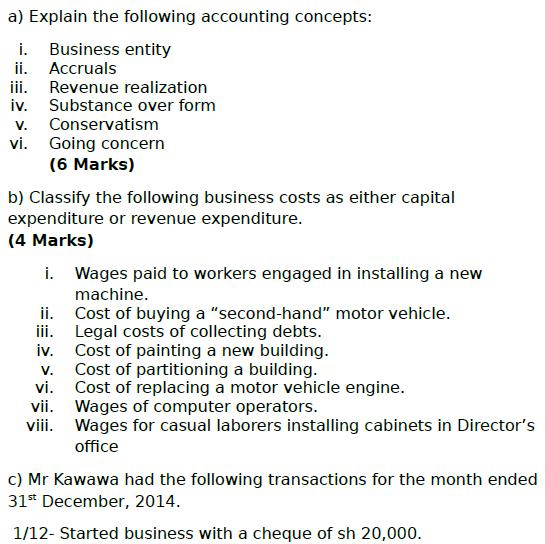

a) Explain the following accounting concepts: i. Business entity Revenue realization ii. Accruals iii. iv. V. Substance over form Conservatism vi. Going concern (6

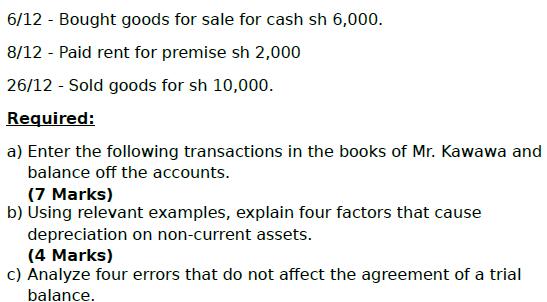

a) Explain the following accounting concepts: i. Business entity Revenue realization ii. Accruals iii. iv. V. Substance over form Conservatism vi. Going concern (6 Marks) b) Classify the following business costs as either capital expenditure or revenue expenditure. (4 Marks) i. Wages paid to workers engaged in installing a new machine. ii. Cost of buying a "second-hand" motor vehicle. iii. Legal costs of collecting debts. iv. V. vi. vii. Cost of painting a new building. Cost of partitioning a building. Cost of replacing a motor vehicle engine. Wages of computer operators. viii. Wages for casual laborers installing cabinets in Director's office c) Mr Kawawa had the following transactions for the month ended 31st December, 2014. 1/12- Started business with a cheque of sh 20,000. 6/12 - Bought goods for sale for cash sh 6,000. 8/12 - Paid rent for premise sh 2,000 26/12 - Sold goods for sh 10,000. Required: a) Enter the following transactions in the books of Mr. Kawawa and balance off the accounts. (7 Marks) b) Using relevant examples, explain four factors that cause depreciation on non-current assets. (4 Marks) c) Analyze four errors that do not affect the agreement of a trial balance.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

i Business Entity Concept This concept refers to the idea that the business is considered as a separate entity from its owners It means that the transactions of the business should be accounted for se...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started