Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Explain the propositions by Modigliani and Miller (MM) with respect to the effect of leverage on the overall cost of capital and value

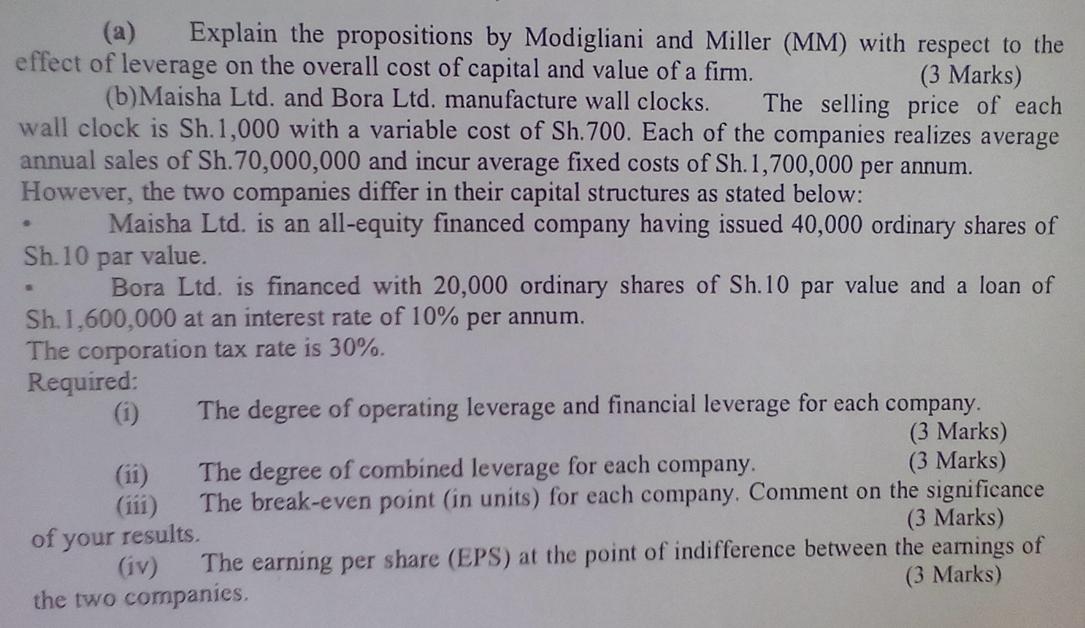

(a) Explain the propositions by Modigliani and Miller (MM) with respect to the effect of leverage on the overall cost of capital and value of a firm. (3 Marks) (b)Maisha Ltd. and Bora Ltd. manufacture wall clocks. The selling price of each wall clock is Sh. 1,000 with a variable cost of Sh.700. Each of the companies realizes average annual sales of Sh.70,000,000 and incur average fixed costs of Sh. 1,700,000 per annum. However, the two companies differ in their capital structures as stated below: Maisha Ltd. is an all-equity financed company having issued 40,000 ordinary shares of Sh.10 par value. Bora Ltd. is financed with 20,000 ordinary shares of Sh.10 par value and a loan of Sh. 1,600,000 at an interest rate of 10% per annum. The corporation tax rate is 30%. Required: (1) . The degree of operating leverage and financial leverage for each company. (3 Marks) (3 Marks) The degree of combined leverage for each company. The break-even point (in units) for each company. Comment on the significance (3 Marks) the earnings of (3 Marks) of your results. (iv) The earning per share (EPS) at the point of indifference between the two companies.

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a The Modigliani and Miller MM propositions state that in a perfect market with no taxes transaction costs or bankruptcy costs the cost of capital and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started