Question

(a) Explain why bond prices fluctuate in response to interest rate changes by the central bank (e.g. the Bank of England or the Federal

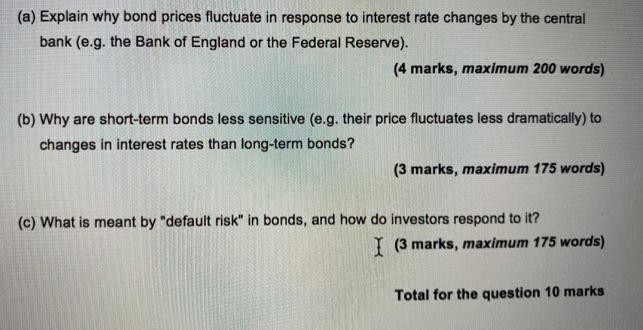

(a) Explain why bond prices fluctuate in response to interest rate changes by the central bank (e.g. the Bank of England or the Federal Reserve). (4 marks, maximum 200 words) (b) Why are short-term bonds less sensitive (e.g. their price fluctuates less dramatically) to changes in interest rates than long-term bonds? (3 marks, maximum 175 words) (c) What is meant by "default risk" in bonds, and how do investors respond to it? (3 marks, maximum 175 words) Total for the question 10 marks

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a As interest rates change loan prices also change The main reason for this is the relationship between competitive prices and returns When central ba...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of corporate finance

Authors: Robert Parrino, David S. Kidwell, Thomas W. Bates

2nd Edition

978-0470933268, 470933267, 470876441, 978-0470876442

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App