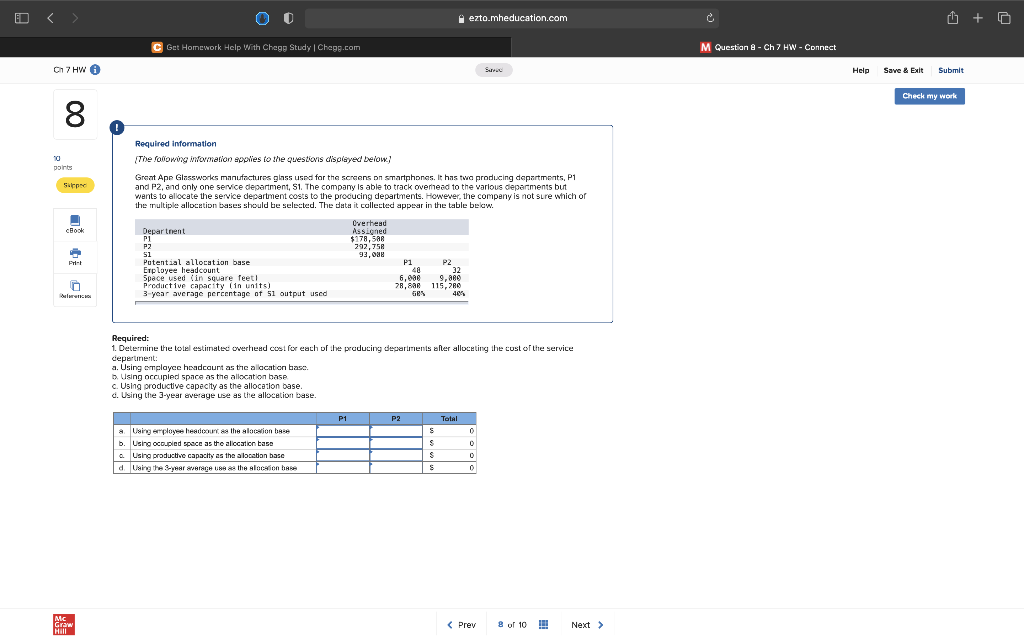

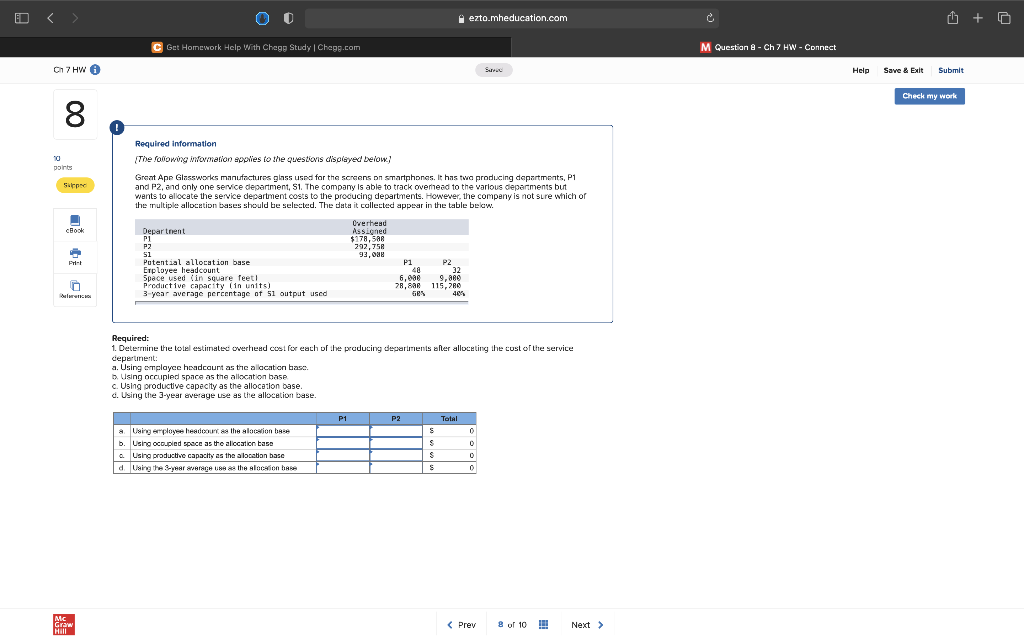

A ezto.mheducation.com U + D Get Homework Help With Chege Study | Chegg.com M Question - Ch 7 HW - Connect 7 Ch 7 HW O Surro Help Save Exit Submit Check my work 00 0 points Required information The following iwormation applies to the questions displayed below) Great Ape Glassworks manufactures glass used for the screens on smartphones. It has twa producing departments, P1 and P2, and only one service department, S1. The company is able to track overhead to the various departments but wants to allocate the service department costs to the procucing departments. However, the company is not sure which of the multiple allocation bases should be selected. The data it collected appear in the table below. Supe cBook Overhead Assigned $178,588 292,758 93,038 Department P1 51 Potential allocation base Erployee headcount Space used in square feet! Productive capacity (in units) 3 year average percentage of 51 output used P1 P2 32 6,9ae 9.88 78, sa 115,280 Ges 405 Required: 1. Determine the total estimated overhead cost for each of the producing departments after allocating the cost of the service departinent: a. Using employee headcount as the allocation base. b. Using occupied space as the allocation base c. Using productive capacity as the allocation base d. Using the 3-year everage Lise as the allocation base. P1 P2 Total S 0 S D a Using employee headcourse the location base b. Using coupled space as the allocation taso a Using productive capacity as the allocation base d Laing the 3year sarace U as the location here S 0 0 S S MC Graw Hill A ezto.mheducation.com U + D Get Homework Help With Chege Study | Chegg.com M Question - Ch 7 HW - Connect 7 Ch 7 HW O Surro Help Save Exit Submit Check my work 00 0 points Required information The following iwormation applies to the questions displayed below) Great Ape Glassworks manufactures glass used for the screens on smartphones. It has twa producing departments, P1 and P2, and only one service department, S1. The company is able to track overhead to the various departments but wants to allocate the service department costs to the procucing departments. However, the company is not sure which of the multiple allocation bases should be selected. The data it collected appear in the table below. Supe cBook Overhead Assigned $178,588 292,758 93,038 Department P1 51 Potential allocation base Erployee headcount Space used in square feet! Productive capacity (in units) 3 year average percentage of 51 output used P1 P2 32 6,9ae 9.88 78, sa 115,280 Ges 405 Required: 1. Determine the total estimated overhead cost for each of the producing departments after allocating the cost of the service departinent: a. Using employee headcount as the allocation base. b. Using occupied space as the allocation base c. Using productive capacity as the allocation base d. Using the 3-year everage Lise as the allocation base. P1 P2 Total S 0 S D a Using employee headcourse the location base b. Using coupled space as the allocation taso a Using productive capacity as the allocation base d Laing the 3year sarace U as the location here S 0 0 S S MC Graw Hill