Answered step by step

Verified Expert Solution

Question

1 Approved Answer

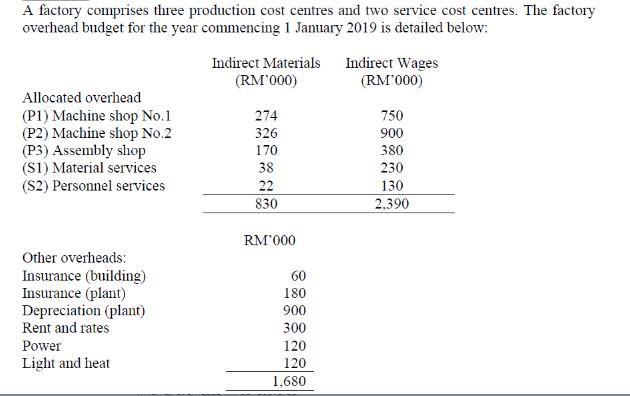

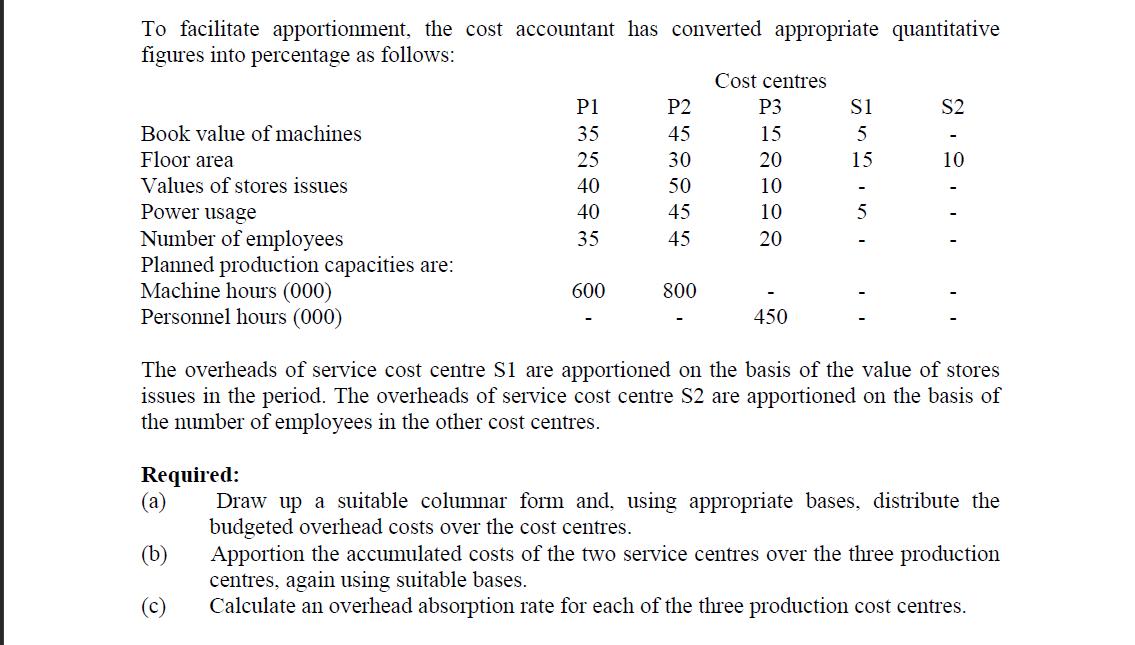

A factory comprises three production cost centres and two service cost centres. The factory overhead budget for the year commencing 1 January 2019 is

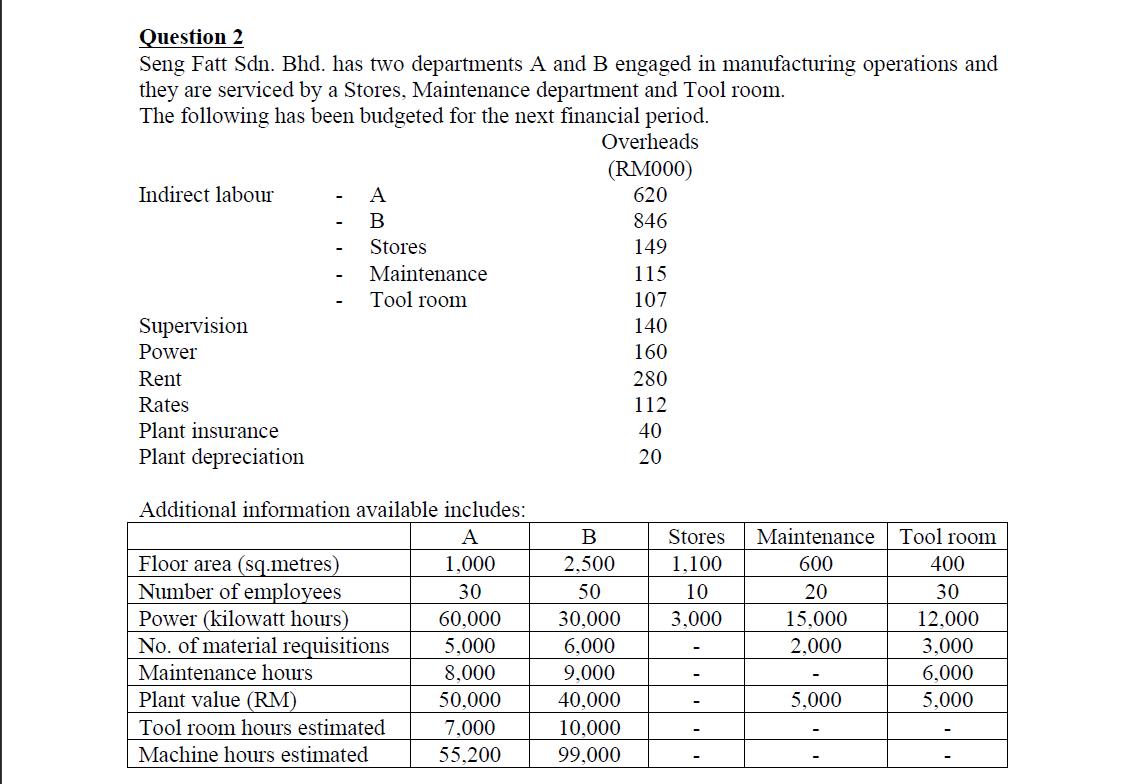

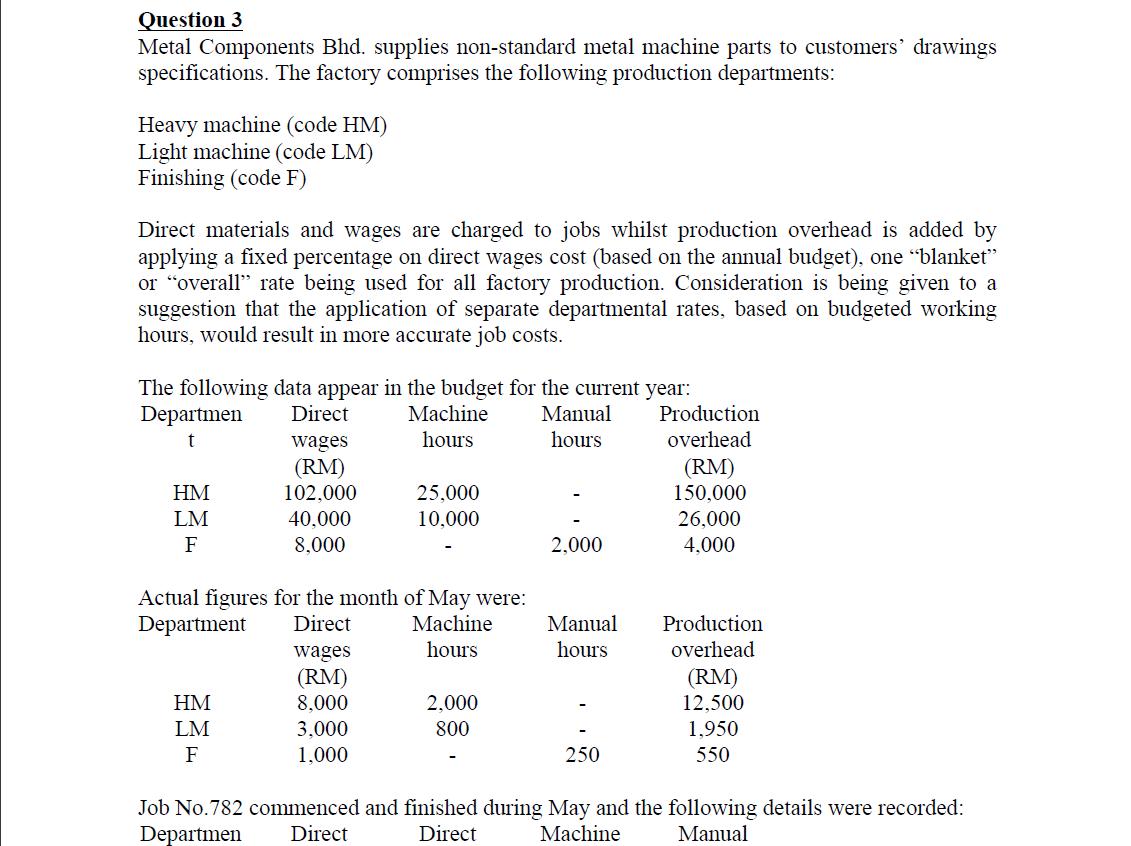

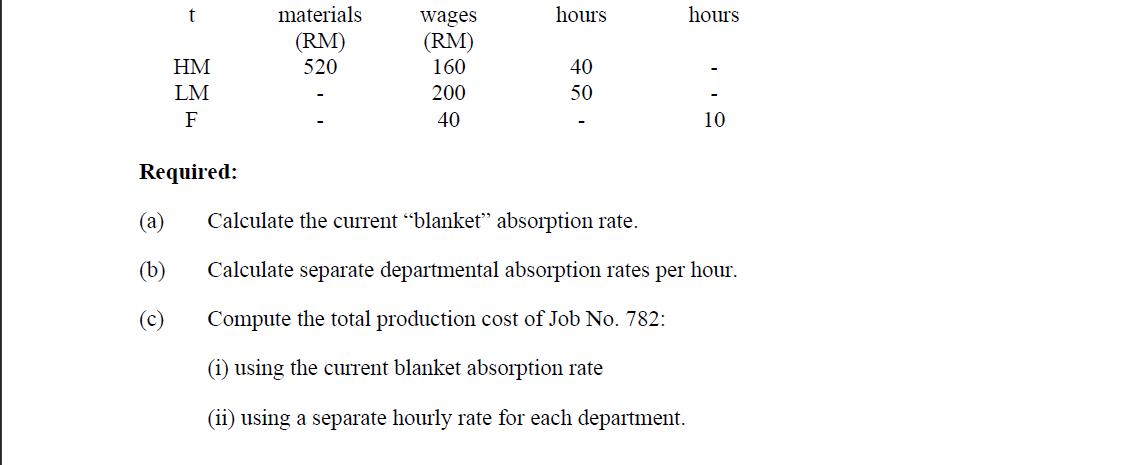

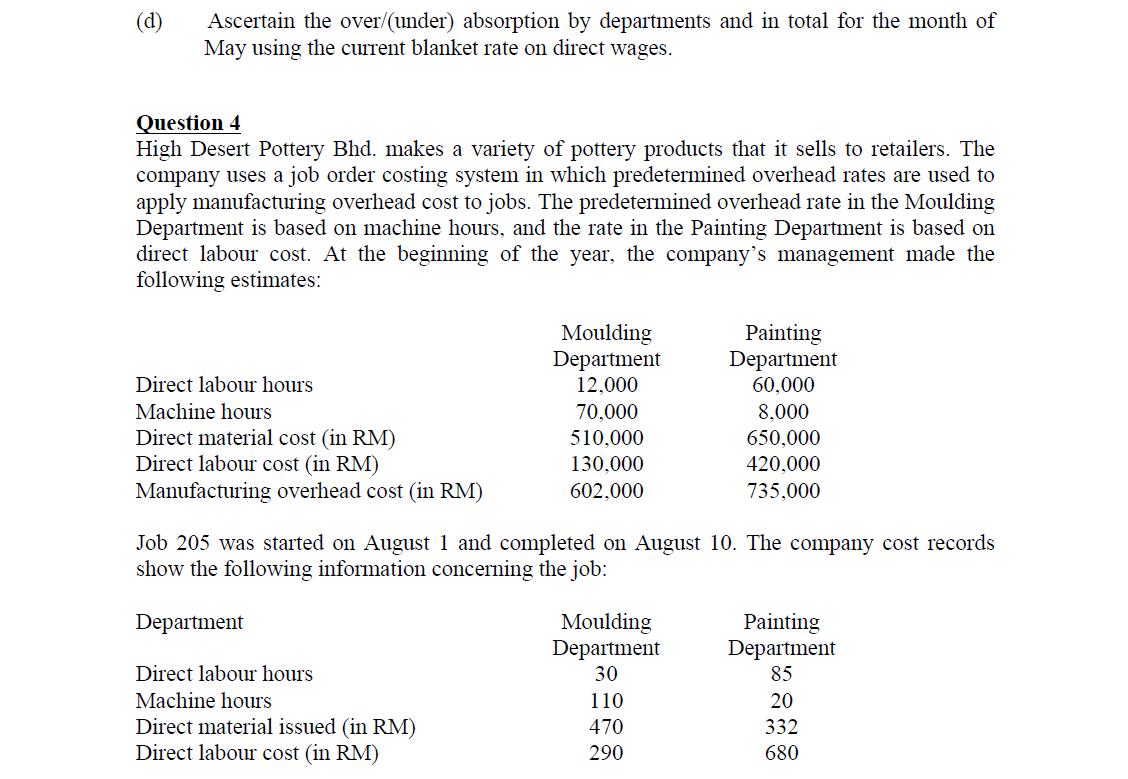

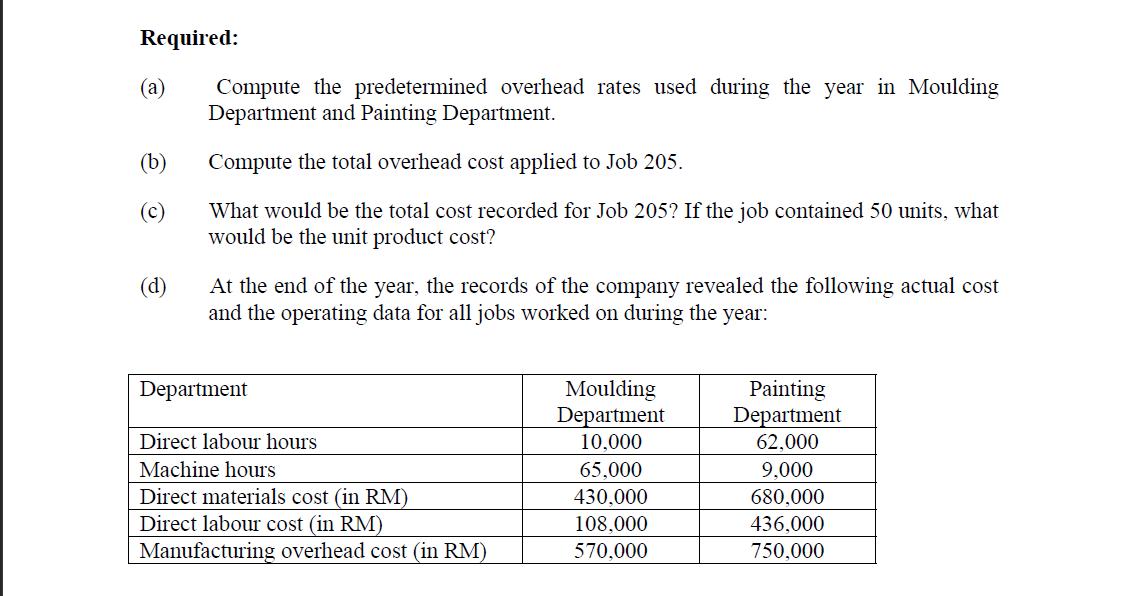

A factory comprises three production cost centres and two service cost centres. The factory overhead budget for the year commencing 1 January 2019 is detailed below: Indirect Materials (RM'000) Allocated overhead (P1) Machine shop No.1 (P2) Machine shop No.2 (P3) Assembly shop (S1) Material services (S2) Personnel services Other overheads: Insurance (building) Insurance (plant) Depreciation (plant) Rent and rates Power Light and heat 274 326 170 38 22 830 RM'000 60 180 900 300 120 120 1.680 Indirect Wages (RM'000) 750 900 380 230 130 2,390 To facilitate apportionment, the cost accountant has converted appropriate quantitative figures into percentage as follows: Book value of machines Floor area Values of stores issues Power usage Number of employees Planned production capacities are: Machine hours (000) Personnel hours (000) Required: (a) (b) P1 35 25 40 40 35 (c) 600 P2 45 30 50 45 45 800 Cost centres P3 15 20 10 10 20 450 $1 5 15 - 5 S2 The overheads of service cost centre S1 are apportioned on the basis of the value of stores issues in the period. The overheads of service cost centre S2 are apportioned on the basis of the number of employees in the other cost centres. 10 Draw up a suitable columnar form and, using appropriate bases, distribute the budgeted overhead costs over the cost centres. Apportion the accumulated costs of the two service centres over the three production centres, again using suitable bases. Calculate an overhead absorption rate for each of the three production cost centres. Question 2 Seng Fatt Sdn. Bhd. has two departments A and B engaged in manufacturing operations and they are serviced by a Stores, Maintenance department and Tool room. The following has been budgeted for the next financial period. Indirect labour Supervision Power Rent Rates Plant insurance Plant depreciation A B Stores Maintenance Tool room Additional information available includes: A 1,000 30 60,000 5,000 8,000 50,000 7,000 55,200 Floor area (sq.metres) Number of employees Power (kilowatt hours) No. of material requisitions Maintenance hours Plant value (RM) Tool room hours estimated Machine hours estimated Overheads (RM000) 620 846 149 115 107 140 160 280 112 40 20 B 2.500 50 30,000 6,000 9,000 40,000 10,000 99,000 Stores 1,100 10 3,000 Maintenance Tool room 600 20 W 15,000 2,000 5,000 400 30 12,000 3,000 6.000 5,000 Required: Calculate appropriate machine hour overhead absorption rates for both manufacturing departments in which all overheads will be recovered. Question 3 Metal Components Bhd. supplies non-standard metal machine parts to customers' drawings specifications. The factory comprises the following production departments: Heavy machine (code HM) Light machine (code LM) Finishing (code F) Direct materials and wages are charged to jobs whilst production overhead is added by applying a fixed percentage on direct wages cost (based on the annual budget), one "blanket" or "overall" rate being used for all factory production. Consideration is being given to a suggestion that the application of separate departmental rates, based on budgeted working hours, would result in more accurate job costs. The following data appear in the budget for the current year: Departmen Manual hours HM LM F Direct wages (RM) 102,000 40,000 8,000 HM LM F Machine hours Actual figures for the month of May were: Department Direct Machine hours wages (RM) 8,000 3,000 1,000 25,000 10,000 2,000 800 2,000 Manual hours 250 Production overhead (RM) 150,000 26,000 4,000 Production overhead (RM) 12,500 1,950 550 Job No.782 commenced and finished during May and the following details were recorded: Departmen Direct Direct Machine Manual t (a) (b) (c) HM LM F Required: materials (RM) 520 wages (RM) 160 200 40 hours 40 50 hours 10 Calculate the current "blanket" absorption rate. Calculate separate departmental absorption rates per hour. Compute the total production cost of Job No. 782: (i) using the current blanket absorption rate (ii) using a separate hourly rate for each department. (d) Ascertain the over/(under) absorption by departments and in total for the month of May using the current blanket rate on direct wages. Question 4 High Desert Pottery Bhd. makes a variety of pottery products that it sells to retailers. The company uses a job order costing system in which predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Moulding Department is based on machine hours, and the rate in the Painting Department is based on direct labour cost. At the beginning of the year, the company's management made the following estimates: Direct labour hours Machine hours Direct material cost (in RM) Direct labour cost (in RM) Manufacturing overhead cost (in RM) Moulding Department 12,000 70,000 510,000 130,000 602,000 Direct labour hours Machine hours Direct material issued (in RM) Direct labour cost (in RM) Job 205 was started on August 1 and completed on August 10. The company cost records show the following information concerning the job: Department Moulding Department 30 Painting Department 60,000 8,000 650,000 420,000 735,000 110 470 290 Painting Department 85 20 332 680 Required: (a) (b) (c) (d) Compute the predetermined overhead rates used during the year in Moulding Department and Painting Department. Compute the total overhead cost applied to Job 205. What would be the total cost recorded for Job 205? If the job contained 50 units, what would be the unit product cost? At the end of the year, the records of the company revealed the following actual cost and the operating data for all jobs worked on during the year: Department Direct labour hours Machine hours Direct materials cost (in RM) Direct labour cost (in RM) Manufacturing overhead cost (in RM) Moulding Department 10,000 65,000 430,000 108,000 570,000 Painting Department 62,000 9,000 680,000 436,000 750,000 Required: What was the amount of over/(under) absorbed overhead in each department at the end of the year?

Step by Step Solution

★★★★★

3.38 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Answer Lets go through each part of the required tasks a Distribution of Budgeted Overhead Costs over Cost Centers Well distribute the allocated overhead and other overhead costs over the cost centers ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started