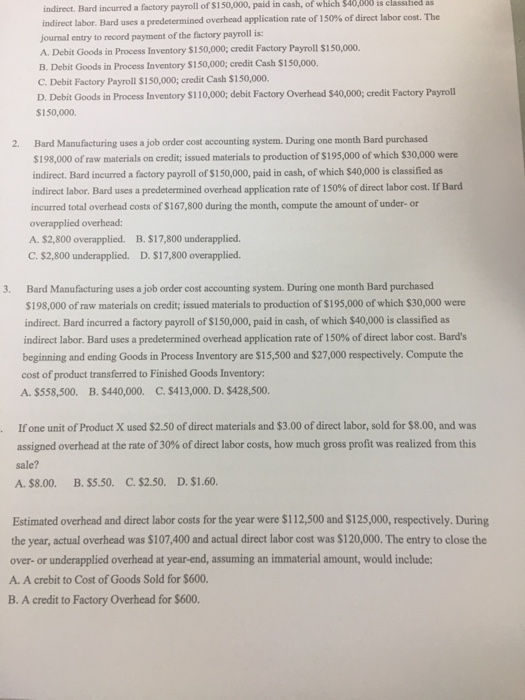

a factory payroll of $1 50,000, paid in cash, of which $40,005 elassihed as indirect. Bard incurred indirect labor. Bard uses a predetermined overhead application rate of 150% of direct labor cost. The journal entry to record payment of the factory payroll is: A. Debit Goods in Process Inventory $150,000, credit Factory Payroll $150,000. B. Debit Goods in Process Inventory $150,000; credit Cash $1s0,000. C. Debit Factory Payroll $150,000; credit Cash $150,000. D. Debit Goods in Process Inventory $110,000; debit Factory Overhead $40,000; credit Factory Payroll $150,000. 2 Bard Manufacturing uses a job order cost accounting system. During one month Bard purchased S198,000 of raw materials on credit; issued materials to production of $195,000 of which $30,000 were indirect. Bard incurred a factory payroll of S150,000, paid in cash, of which $40,000 is classified as indirect labor. Bard uses a predetermined overhead application rate of 150% of direct labor cost. If Bard incurred total overhead costs of $167,800 during the month, compute the amount of under-or overapplied overhead: A. $2,800 overapplied. B.$17,800 underapplied. C. $2,800 underapplied. D. $17,800 overapplied Bard Manufacturing uses a job order cost accounting system. During one month Bard purchased $198,000 of raw materials on credit; issued materials to production of $195,000 of which $30,000 were indirect. Bard incurred a factory payroll of $150,000, paid in cash, of which $40,000 is classified as indirect labor. Bard uses a predetermined overhead application rate of 150% of direct labor cost. Bard's beginning and ending Goods in Process Inventory are $15,500 and $27,000 respectively. Compute the cost of product transferred to Finished Goods Inventory 3. A. $558,500. B.$440,000. C.$413,000. D. $428,500. If one unit of Product X used $2.50 of direct materials and $3.00 of direct labor, sold for $8.00, and was assigned overhead at the rate of 30% ofdirect labor costs, how much gross profit was realized from this sale? A. $8.00. B. S5.50. C. $2.50. D. $1.60. Estimated overhead and direct labor costs for the year were $112,500 and $125,000, respectively. During the year, actual overhead was $107,400 and actual direct labor cost was $120,000. The entry to close the over-or underapplied overhead at year-end, assuming an immaterial amount, would include: A. A crebit to Cost of Goods Sold for $600 B. A credit to Factory Overhead for $600