Fairco, a family business is considering making an investment in its manufacturing operation. Three decisions are under consideration: (1) a large investment; (2) a

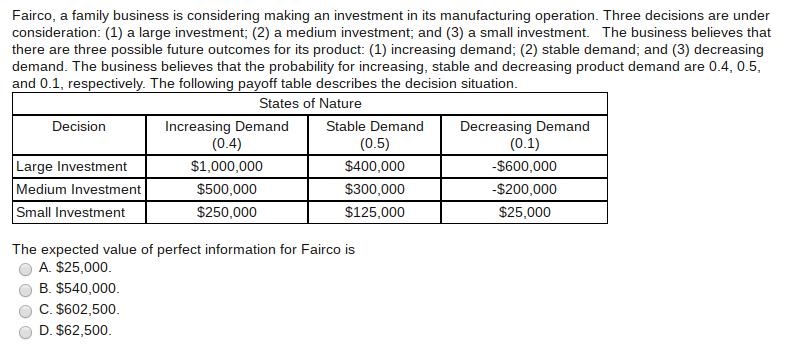

Fairco, a family business is considering making an investment in its manufacturing operation. Three decisions are under consideration: (1) a large investment; (2) a medium investment; and (3) a small investment. The business believes that there are three possible future outcomes for its product: (1) increasing demand; (2) stable demand; and (3) decreasing demand. The business believes that the probability for increasing, stable and decreasing product demand are 0.4, 0.5, and 0.1, respectively. The following payoff table describes the decision situation. States of Nature Increasing Demand (0.4) Decreasing Demand (0.1) Decision Stable Demand (0.5) Large Investment Medium Investment Small Investment $1,000,000 $400,000 -$600,000 $500,000 $300,000 -$200,000 $250,000 $125,000 $25,000 The expected value of perfect information for Fairco is A. $25,000. B. $540,000. C. $602,500. D. $62,500.

Step by Step Solution

3.28 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Answer Option D 62500 Explanation Expected payoff Large investment 04 1000000 05400...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started