Question

9. A farmer is buying a new tractor valued at $60,000. The deal will be financed by one of the following two methods. Compute

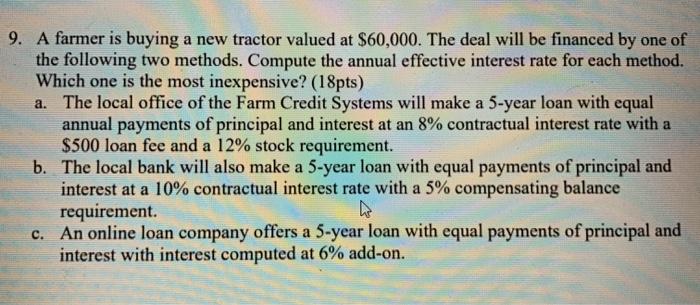

9. A farmer is buying a new tractor valued at $60,000. The deal will be financed by one of the following two methods. Compute the annual effective interest rate for each method. Which one is the most inexpensive? (18pts) a. The local office of the Farm Credit Systems will make a 5-year loan with equal annual payments of principal and interest at an 8% contractual interest rate with a $500 loan fee and a 12% stock requirement. b. The local bank will also make a 5-year loan with equal payments of principal and interest at a 10% contractual interest rate with a 5% compensating balance requirement. c. An online loan company offers a 5-year loan with equal payments of principal and interest with interest computed at 6% add-on. .

Step by Step Solution

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Organic Chemistry

Authors: Francis A. Carey

4th edition

0072905018, 978-0072905014

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App