Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A farmer produces 1 0 , 0 0 0 bushels of corn per season, which he sells in September. A good friend of his suggested

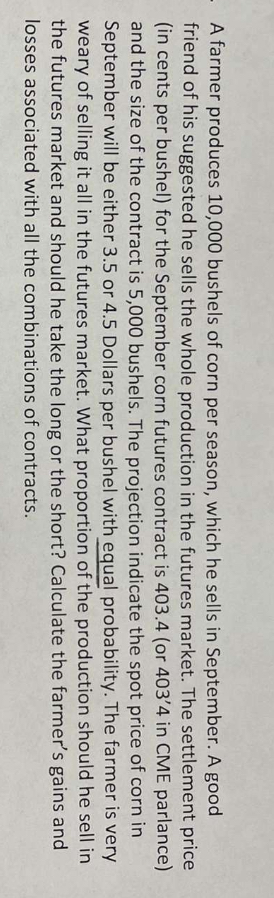

A farmer produces bushels of corn per season, which he sells in September. A good friend of his suggested he sells the whole production in the futures market. The settlement price in cents per bushel for the September corn futures contract is or in CME parlance and the size of the contract is bushels. The projection indicate the spot price of corn in September will be either or Dollars per bushel with equal probability. The farmer is very weary of selling it all in the futures market. What proportion of the production should he sell in the futures market and should he take the long or the short? Calculate the farmer's gains and losses associated with all the combinations of contracts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started