Answered step by step

Verified Expert Solution

Question

1 Approved Answer

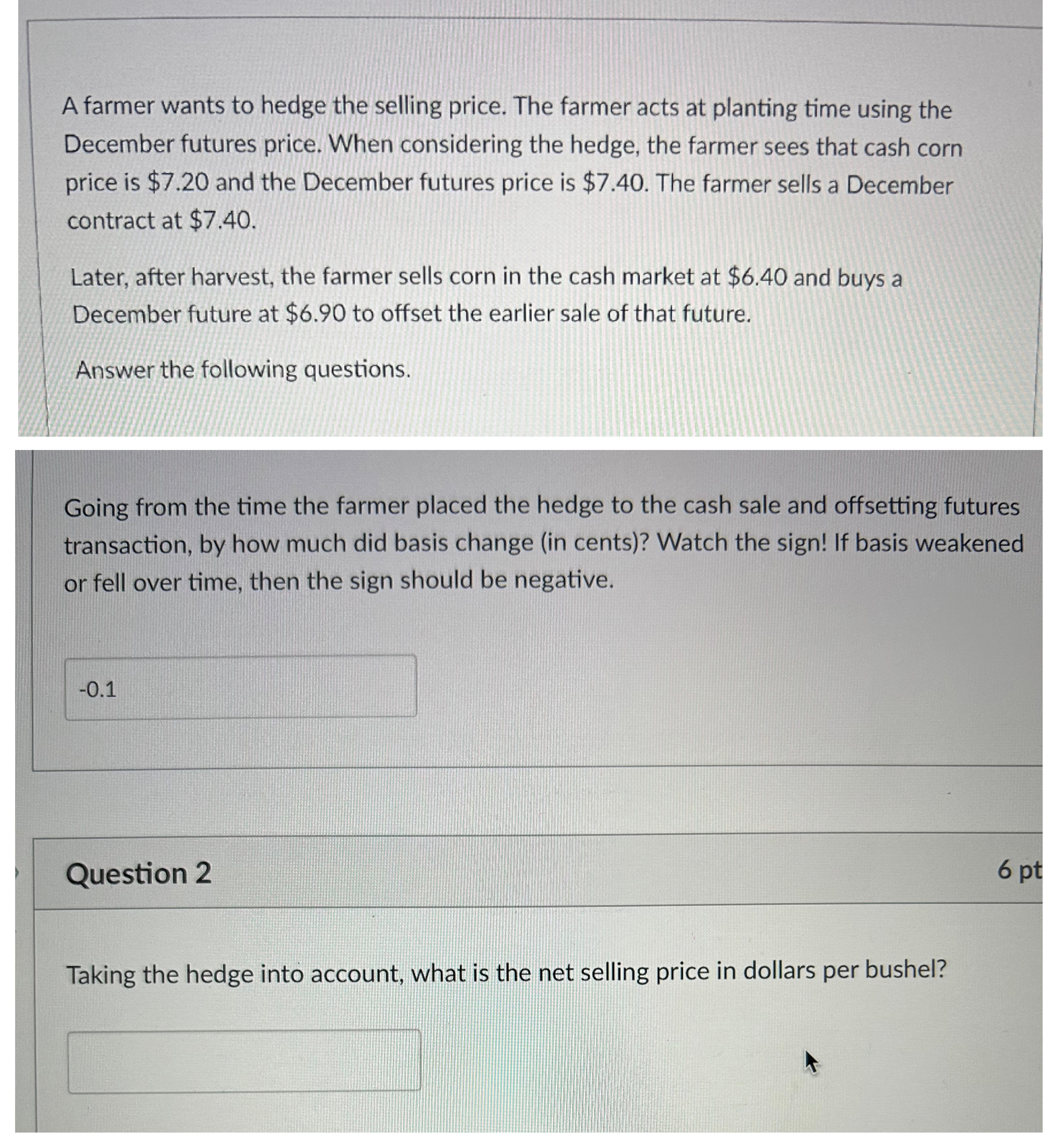

A farmer wants to hedge the selling price. The farmer acts at planting time using the December futures price. When considering the hedge, the farmer

A farmer wants to hedge the selling price. The farmer acts at planting time using the December futures price. When considering the hedge, the farmer sees that cash corn price is $ and the December futures price is $ The farmer sells a December contract at $

Later, after harvest, the farmer sells corn in the cash market at $ and buys a December future at $ to offset the earlier sale of that future.

Answer the following questions.

Going from the time the farmer placed the hedge to the cash sale and offsetting futures transaction, by how much did basis change in cents Watch the sign! If basis weakened or fell over time, then the sign should be negative.

Question

Taking the hedge into account, what is the net selling price in dollars per bushel?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started