a) Felix has a gross income of $18,000. What is his total tax due? b) Sarina made $42,000 in the calendar year. How much

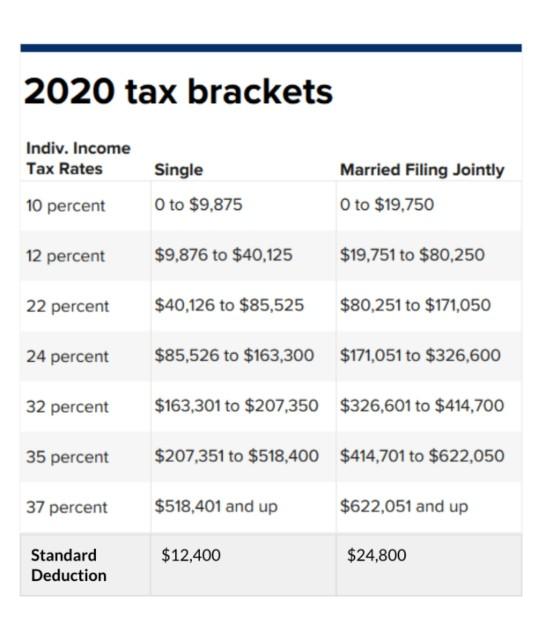

a) Felix has a gross income of $18,000. What is his total tax due? b) Sarina made $42,000 in the calendar year. How much does she owe in federal taxes? c) Kennedy has a gross income of $95,000. What is her total tax due? d) Alex and Tory are married and filing jointly. Their gross income is $150,000. How much do they owe in federal taxes? 2020 tax brackets Indiv. Income Tax Rates Single Married Filing Jointly 10 percent 0 to $9,875 0 to $19,750 12 percent $9,876 to $40,125 $19,751 to $80,250 22 percent $40,126 to $85,525 $80,251 to $171,050 24 percent $85,526 to $163,300 $171,051 to $326,600 32 percent $163,301 to $207,350 $326,601 to $414,700 35 percent $207,351 to $518,400 $414,701 to $622,050 37 percent $518,401 and up $622,051 and up Standard Deduction $12,400 $24,800

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Felix has a gross income of 18000 What is his total tax due To calculate Felixs total tax due we need to subtract his standard deduction from his gross income and then apply the appropriate ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started