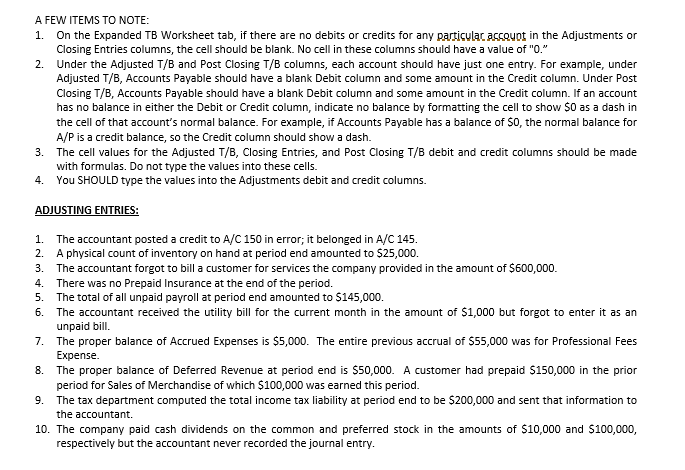

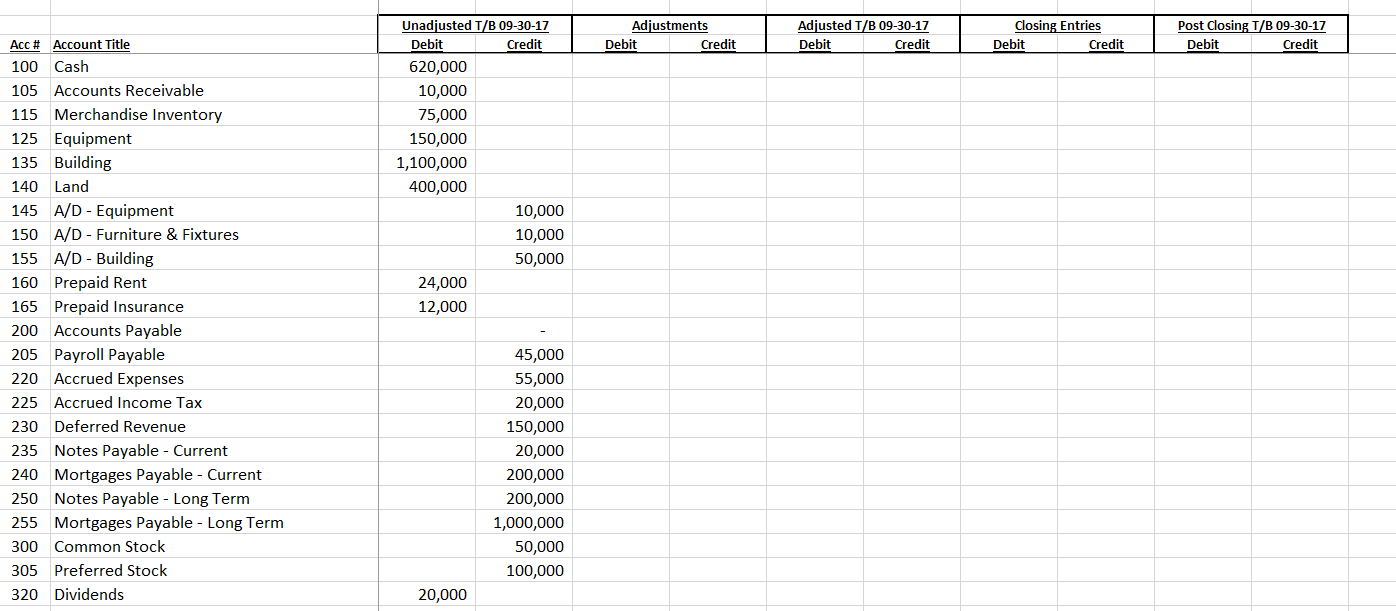

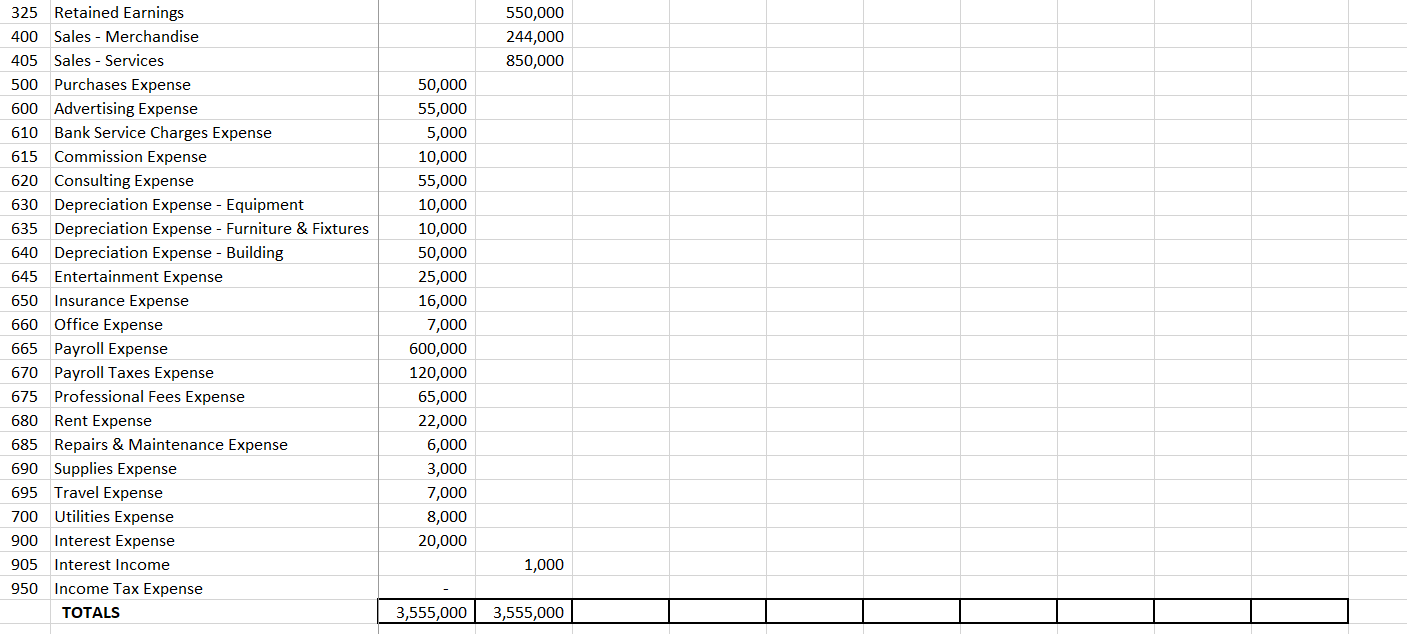

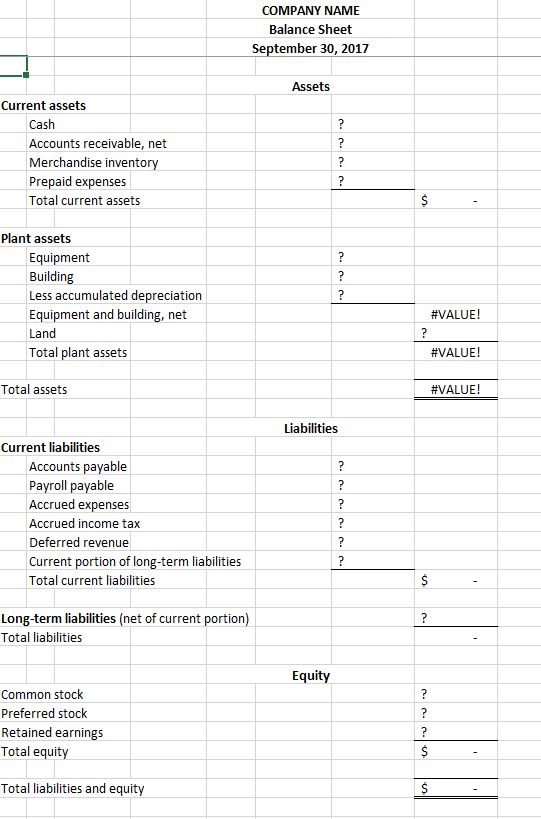

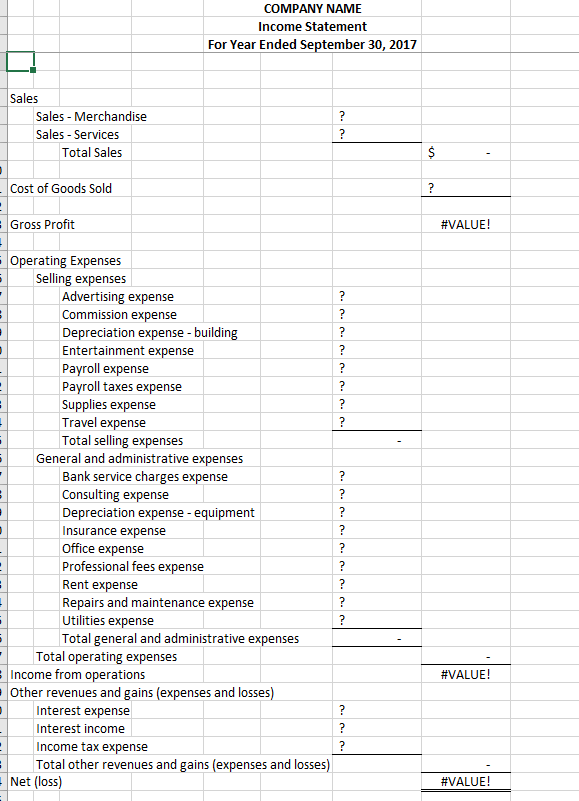

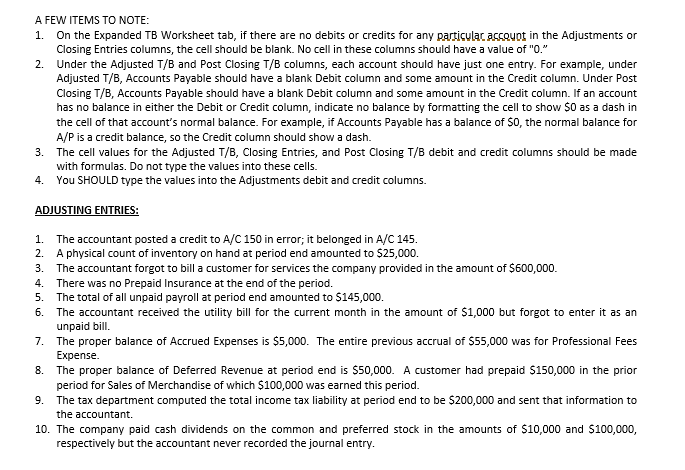

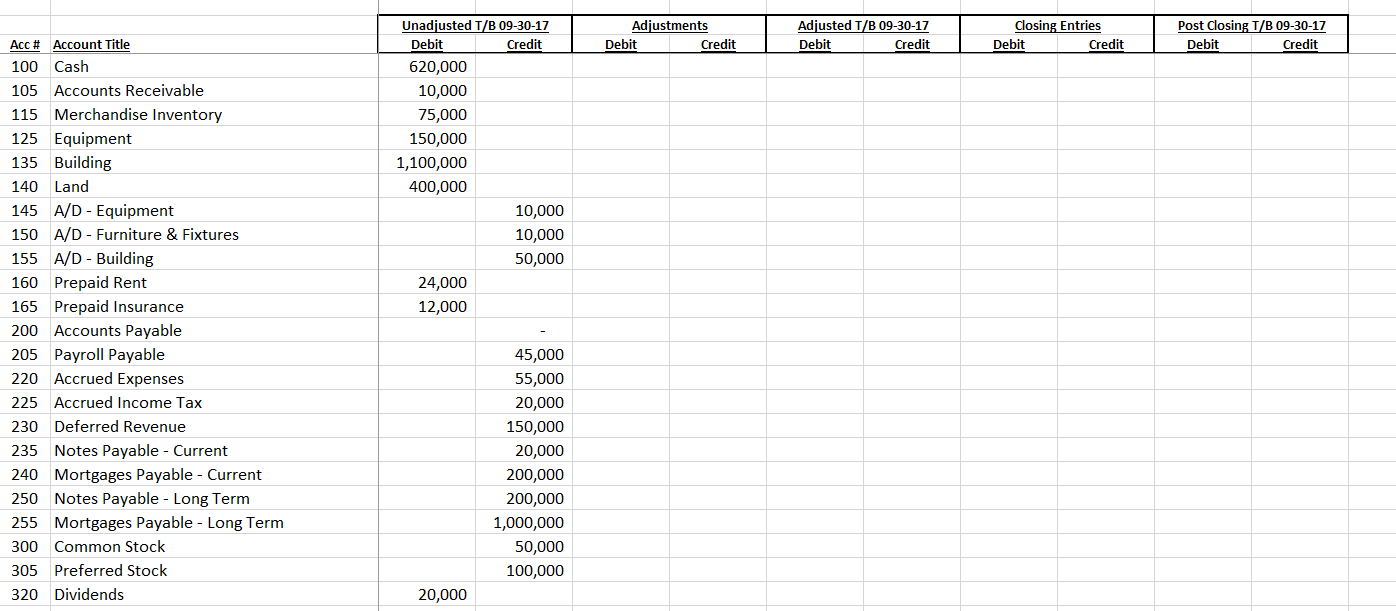

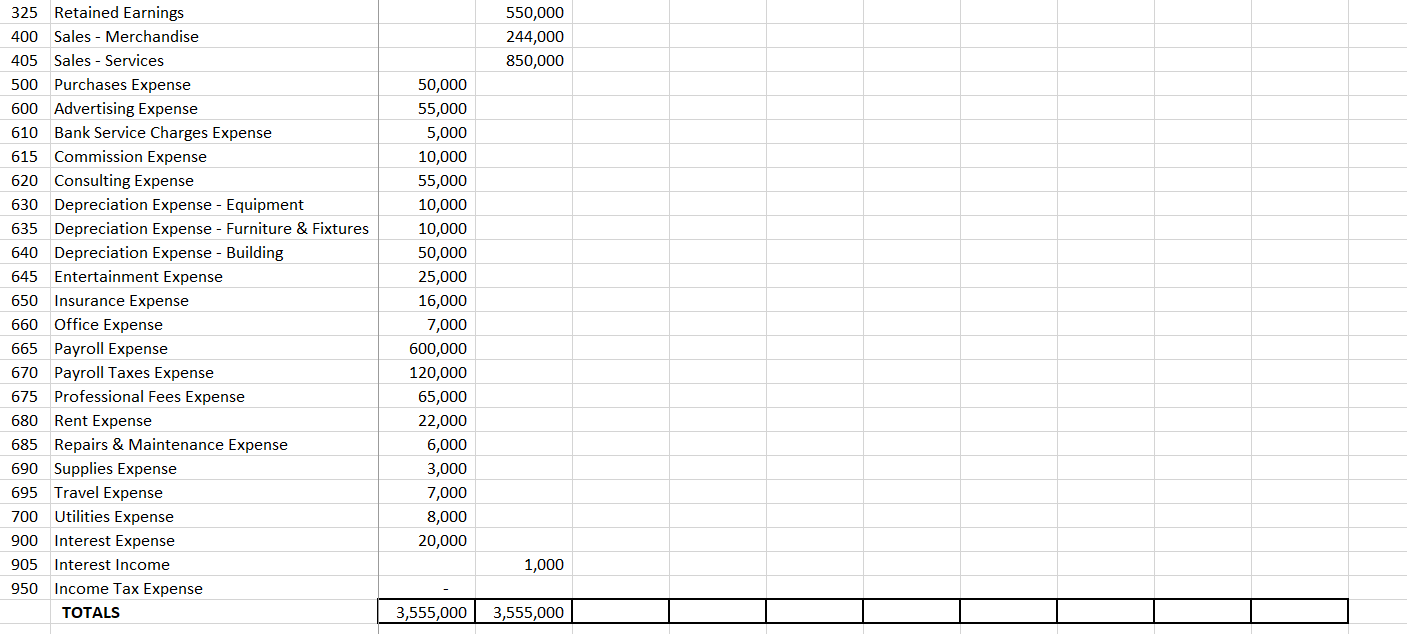

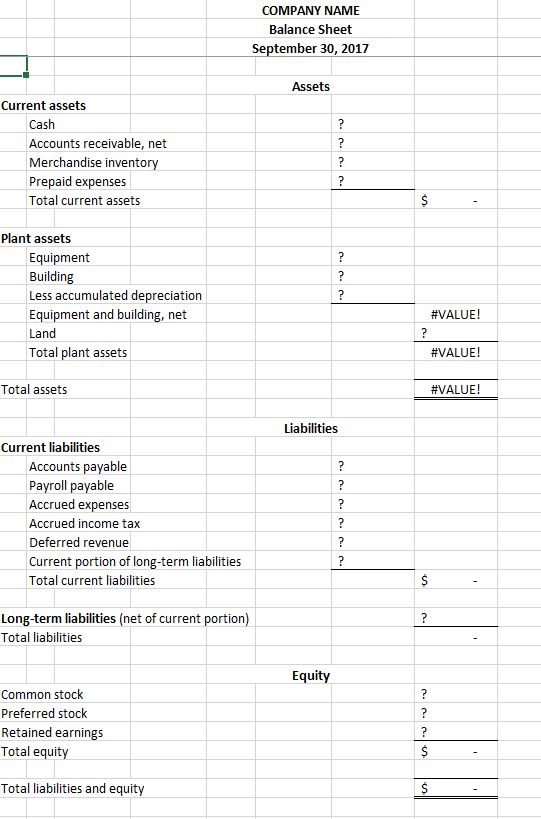

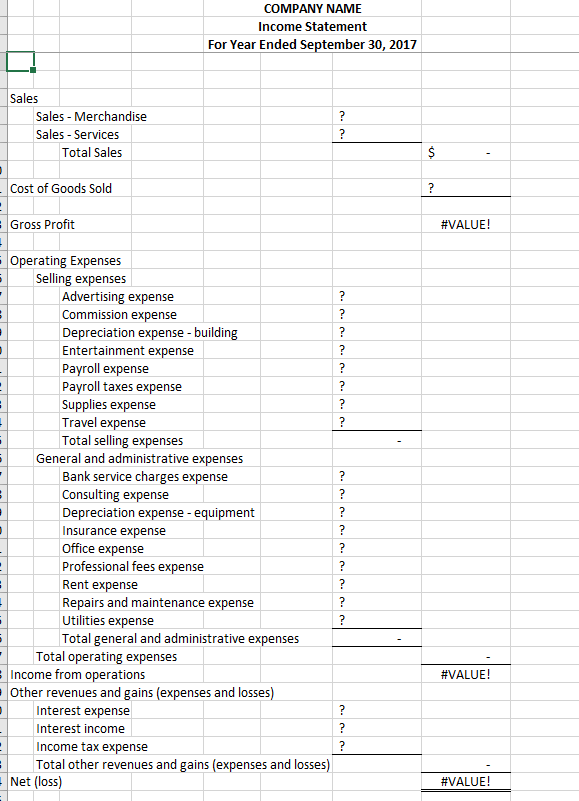

A FEW ITEMS TO NOTE: 1. On the Expanded TB Worksheet tab, if there are no debits or credits for any particulac accouot in the Adjustments or Closing Entries columns, the cell should be blank. No cell in these columns should have a value of "0." 2. Under the Adjusted T/B and Post Closing T/B columns, each account should have just one entry. For example, under Adjusted T/B, Accounts Payable should have a blank Debit column and some amount in the Credit column. Under Post Closing T/B, Accounts Payable should have a blank Debit column and some amount in the Credit column. If an account has no balance in either the Debit or Credit column, indicate no balance by formatting the cell to show $0 as a dash in the cell of that account's normal balance. For example, if Accounts Payable has a balance of $0, the normal balance for A/P is a credit balance, so the Credit column should show a dash. 3. The cell values for the Adjusted T/B, Closing Entries, and Post Closing T/B debit and credit columns should be made with formulas. Do not type the values into these cells. 4. You SHOULD type the values into the Adjustments debit and credit columns. ADJUSTING ENTRIES: 1. The accountant posted a credit to A/C 150 in error; it belonged in A/C 145. 2. A physical count of inventory on hand at period end amounted to $25,000. 3. The accountant forgot to bill a customer for services the company provided in the amount of $600,000 4. There was no Prepaid Insurance at the end of the period. 5. The total of all unpaid payroll at period end amounted to $145,000. 6. The accountant received the utility bill for the current month in the amount of $1,000 but forgot to enter it as an unpaid bill. 7. The proper balance of Accrued Expenses is $5,000. The entire previous accrual of $55,000 was for Professional Fees Expense. 8. The proper balance of Deferred Revenue at period end is $50,000. A customer had prepaid $150,000 in the prior period for Sales of Merchandise of which $100,000 was earned this period. 9. The tax department computed the total income tax liability at period end to be $200,000 and sent that information to the accountant. 10. The company paid cash dividends on the common and preferred stock in the amounts of $10,000 and $100,000, respectively but the accountant never recorded the journal entry. Adjustments Debit Credit Adjusted T/B 09-30-17 Debit Credit Closing Entries Debit Credit Post Closing T/B 09-30-17 Debit Credit | Unadjusted T/B 09-30-17 Debit Credit 620,000 10,000 75,000 150,000 1,100,000 400,000 10,000 10,000 50,000 24,000 12,000 Acc # Account Title 100 Cash 105 Accounts Receivable 115 Merchandise Inventory 125 Equipment 135 Building 140 Land 145 A/D - Equipment 150 A/D - Furniture & Fixtures 155 A/D - Building 160 Prepaid Rent 165 Prepaid Insurance 200 Accounts Payable 205 Payroll Payable 220 Accrued Expenses 225 Accrued Income Tax 230 Deferred Revenue 235 Notes Payable - Current 240 Mortgages Payable - Current 250 Notes Payable - Long Term 255 Mortgages Payable - Long Term 300 Common Stock 305 Preferred Stock 320 Dividends 45,000 55,000 20,000 150,000 20,000 200,000 200,000 1,000,000 50,000 100,000 20,000 550,000 244,000 850,000 325 Retained Earnings 400 Sales - Merchandise 405 Sales - Services 500 Purchases Expense 600 Advertising Expense 610 Bank Service Charges Expense 615 Commission Expense 620 Consulting Expense 630 Depreciation Expense - Equipment 635 Depreciation Expense - Furniture & Fixtures 640 Depreciation Expense - Building 645 Entertainment Expense 650 Insurance Expense 660 Office Expense 665 Payroll Expense 670 Payroll Taxes Expense 675 Professional Fees Expense 680 Rent Expense 685 Repairs & Maintenance Expense 690 Supplies Expense 695 Travel Expense 700 Utilities Expense 900 Interest Expense 905 Interest Income 950 Income Tax Expense TOTALS 50,000 55,000 5,000 10,000 55,000 10,000 10,000 50,000 25,000 16,000 7,000 600,000 120,000 65,000 22,000 6,000 3,000 7,000 8,000 20,000 1,000 3,555,00 | 3,555,000|III 3,555,000 3,555,000 I COMPANY NAME Balance Sheet September 30, 2017 Assets Current assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Total current assets $ . Plant assets Equipment Building Less accumulated depreciation Equipment and building, net Land Total plant assets #VALUE! #VALUE! Total assets #VALUE! Liabilities Current liabilities Accounts payable Payroll payable Accrued expenses Accrued income tax Deferred revenue Current portion of long-term liabilities Total current liabilities S - Long-term liabilities (net of current portion) Total liabilities Equity Common stock Preferred stock Retained earnings Total equity Total liabilities and equity COMPANY NAME Income Statement For Year Ended September 30, 2017 Sales Sales - Merchandise Sales - Services Total Sales - Cost of Goods Sold Gross Profit #VALUE! Operating Expenses Selling expenses Advertising expense Commission expense Depreciation expense - building Entertainment expense Payroll expense Payroll taxes expense Supplies expense Travel expense Total selling expenses General and administrative expenses Bank service charges expense Consulting expense Depreciation expense - equipment Insurance expense Office expense Professional fees expense Rent expense Repairs and maintenance expense Utilities expense Total general and administrative expenses Total operating expenses Income from operations Other revenues and gains (expenses and losses) Interest expense Interest income Income tax expense Total other revenues and gains (expenses and losses) - Net (loss) #VALUE! #VALUE