Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A few years ago, Tesla was petitioning the German government for permission to build a Giga factory near Berlin. Depending on the outcome, the company

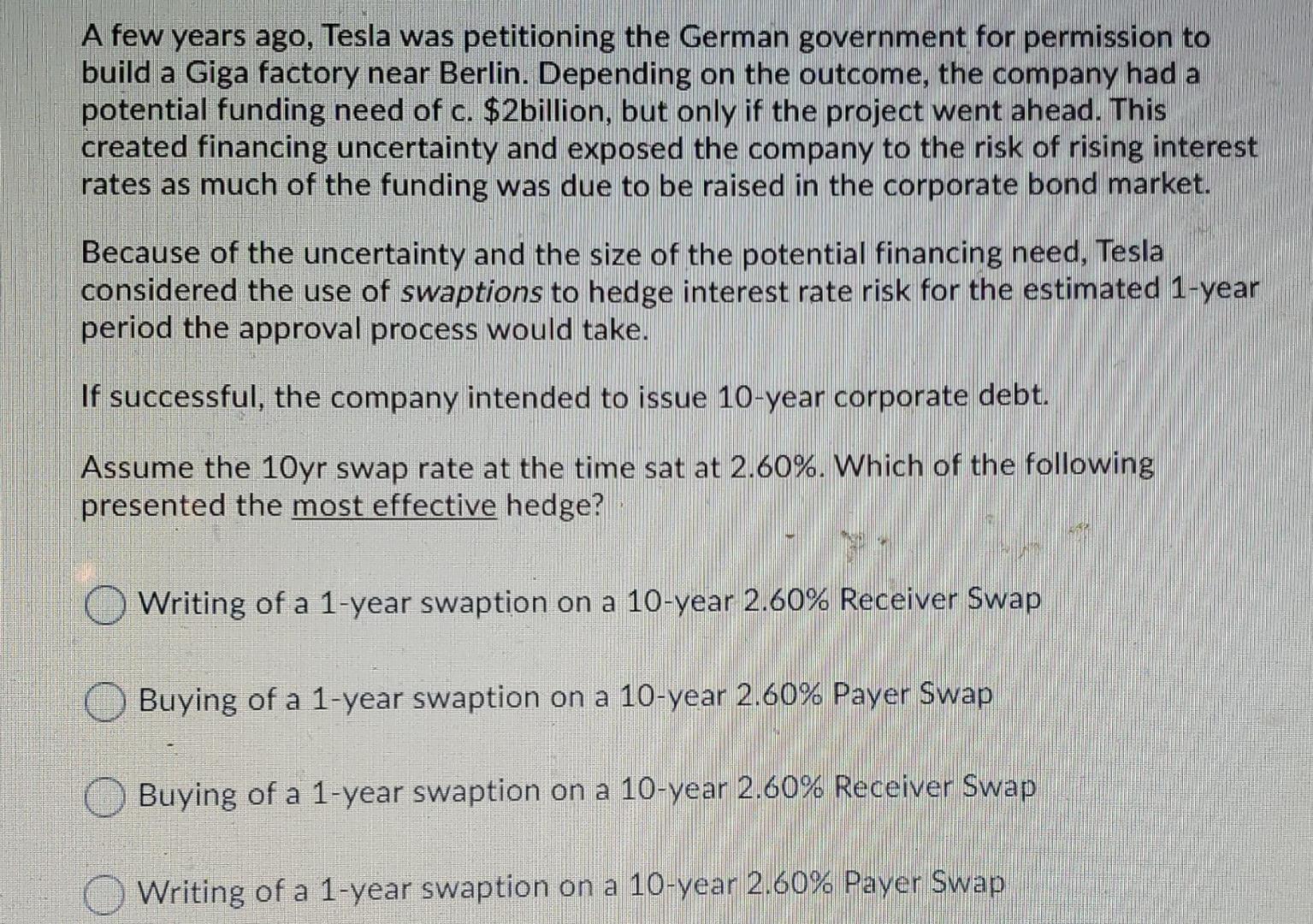

A few years ago, Tesla was petitioning the German government for permission to build a Giga factory near Berlin. Depending on the outcome, the company had a potential funding need of c. $2billion, but only if the project went ahead. This created financing uncertainty and exposed the company to the risk of rising interest rates as much of the funding was due to be raised in the corporate bond market. Because of the uncertainty and the size of the potential financing need, Tesla considered the use of swaptions to hedge interest rate risk for the estimated 1-year period the approval process would take. If successful, the company intended to issue 10-year corporate debt. Assume the 10yr swap rate at the time sat at 2.60%. Which of the following presented the most effective hedge? Writing of a 1-year swaption on a 10-year 2.60% Receiver Swap Buying of a 1-year swaption on a 10-year 2.60% Payer Swap Buying of a 1-year swaption on a 10-year 2.60% Receiver Swap Writing of a 1-year swaption on a 10-year 2.60% Payer Swap

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started