Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. Fexmon Corporation is a public limited firm. The firm decides to acquire a mining excavator which costs $20 million. Straight-line depreciation is applied over

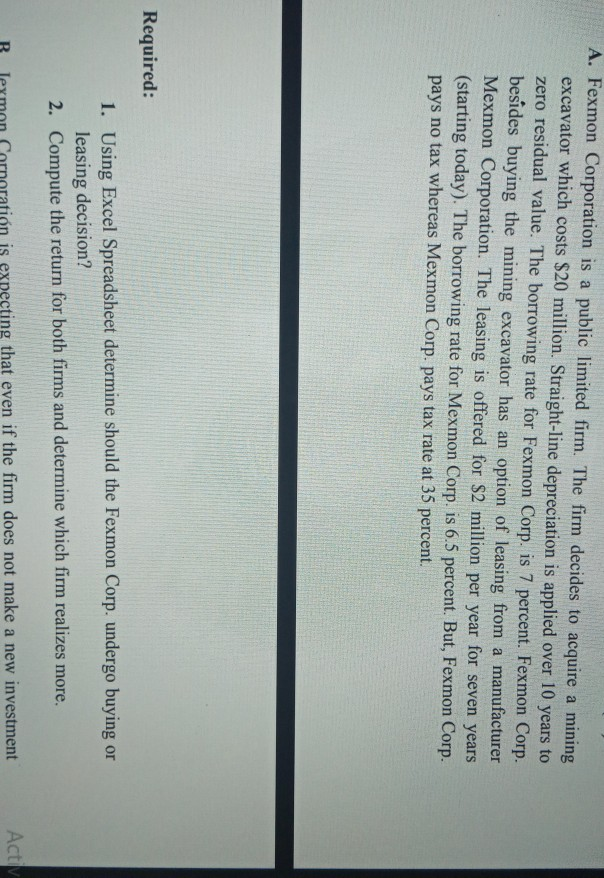

A. Fexmon Corporation is a public limited firm. The firm decides to acquire a mining excavator which costs $20 million. Straight-line depreciation is applied over 10 years to zero residual value. The borrowing rate for Fexmon Corp. is 7 percent. Fexmon Corp. besides buying the mining excavator has an option of leasing from a manufacturer Mexmon Corporation. The leasing is offered for $2 million per year for seven years (starting today). The borrowing rate for Mexmon Corp. is 6.5 percent. But, Fexmon Corp. pays no tax whereas Mexmon Corp. pays tax rate at 35 percent. Required: 1. Using Excel Spreadsheet determine should the Fexmon Corp. undergo buying or leasing decision? 2. Compute the return for both firms and determine which firm realizes more. is expecting that even if the firm does not make a new investment Act A. Fexmon Corporation is a public limited firm. The firm decides to acquire a mining excavator which costs $20 million. Straight-line depreciation is applied over 10 years to zero residual value. The borrowing rate for Fexmon Corp. is 7 percent. Fexmon Corp. besides buying the mining excavator has an option of leasing from a manufacturer Mexmon Corporation. The leasing is offered for $2 million per year for seven years (starting today). The borrowing rate for Mexmon Corp. is 6.5 percent. But, Fexmon Corp. pays no tax whereas Mexmon Corp. pays tax rate at 35 percent. Required: 1. Using Excel Spreadsheet determine should the Fexmon Corp. undergo buying or leasing decision? 2. Compute the return for both firms and determine which firm realizes more. is expecting that even if the firm does not make a new investment Act

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started