Question

A financial analyst draws a cash flow diagram to model the following scenario. A 180-day commercial bill will mature for $200000. The price paid for

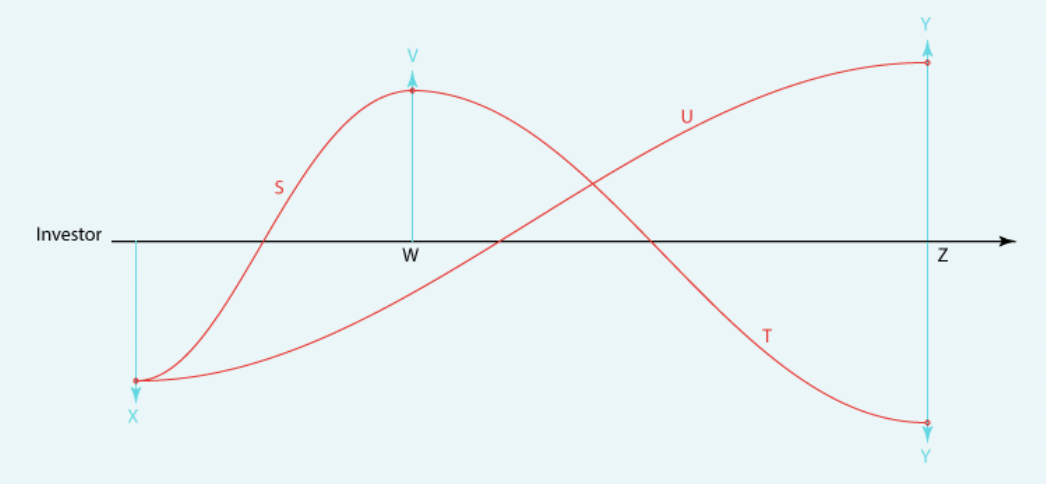

A financial analyst draws a cash flow diagram to model the following scenario. A 180-day commercial bill will mature for $200000. The price paid for the bill at issue was $191935.55. The bill was sold 84 days after issue for $198500.82. Calculate the annual rate of simple interest (as a percentage, to two decimal places) earned by the buyer who paid $191935.55 and sold for $198500.82. What was the annual rate of simple discount (as a percentage, to two decimal places) that the buyer sold at (earning a price of $198500.82)? Here is the cash flow diagram the analyst drew.

Which response best reflects the values of Z, Y, X, W, V, U, T and S?

Question 11Answer

a.

Z is 180.00, Y is $200000.00, X is $191935.55, W is 84, V is $198500.82, U is not required, T is 2.71% p.a. (simple discount) and S is 15.80% p.a. (simple interest).

b.

Z is 180.00, Y is $200000.00, X is $191935.55, W is 84, V is $198500.82, U is not required, T is 2.85% p.a. (simple discount) and S is 14.86% p.a. (simple interest).

c.

Z is 180.00, Y is $200000.00, X is $191935.55, W is 96.00, V is $198500.82, U is not required, T is 3.26% p.a. (simple discount) and S is 13.01% p.a. (simple interest).

d.

Z is 180.00, Y is $200000.00, X is $191935.55, W is 84, V is $198500.82, U is not required, T is 2.75% p.a. (simple discount) and S is 14.96% p.a. (simple interest).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started