Question

A financial analyst draws a cash flow diagram to model the following scenario. A 270-day commercial bill will mature for $200000. The price paid for

A financial analyst draws a cash flow diagram to model the following scenario.

A financial analyst draws a cash flow diagram to model the following scenario.

A 270-day commercial bill will mature for $200000. The price paid for the bill at issue was $192550.66. The bill was sold 224 days after issue for $199475.73. Calculate the annual rate of simple interest (as a percentage, to two decimal places) earned by the buyer who paid $192550.66 and sold for $199475.73. What was the annual rate of simple discount (as a percentage, to two decimal places) that the buyer sold at (earning a price of $199475.73)?

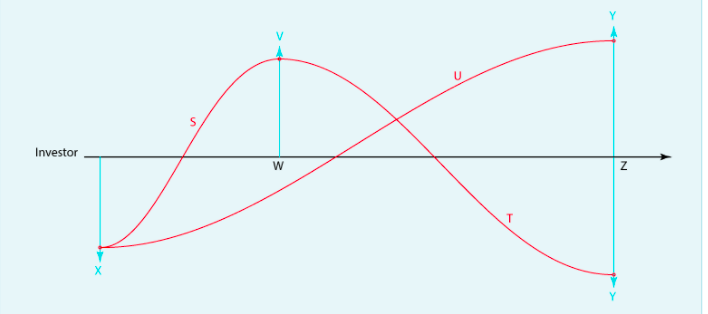

Here is the cash flow diagram the analyst drew.

Here is the cash flow diagram the analyst drew.

Which response best reflects the values of Z, Y, X, W, V, U, T and S?

a.

Z is 270.00, Y is $200000.00, X is $192550.66, W is 224, V is $199475.73, U is not required, T is 1.88% p.a. (simple discount) and S is 5.99% p.a. (simple interest).

b.

Z is 270.00, Y is $200000.00, X is $192550.66, W is 46.00, V is $199475.73, U is not required, T is 0.43% p.a. (simple discount) and S is 28.54% p.a. (simple interest).

c.

Z is 270.00, Y is $200000.00, X is $192550.66, W is 224, V is $199475.73, U is not required, T is 1.98% p.a. (simple discount) and S is 5.96% p.a. (simple interest).

d.

Z is 270.00, Y is $200000.00, X is $192550.66, W is 224, V is $199475.73, U is not required, T is 2.08% p.a. (simple discount) and S is 5.86% p.a. (simple interest).

U 5 Investor w z T U 5 Investor w z TStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started