Question

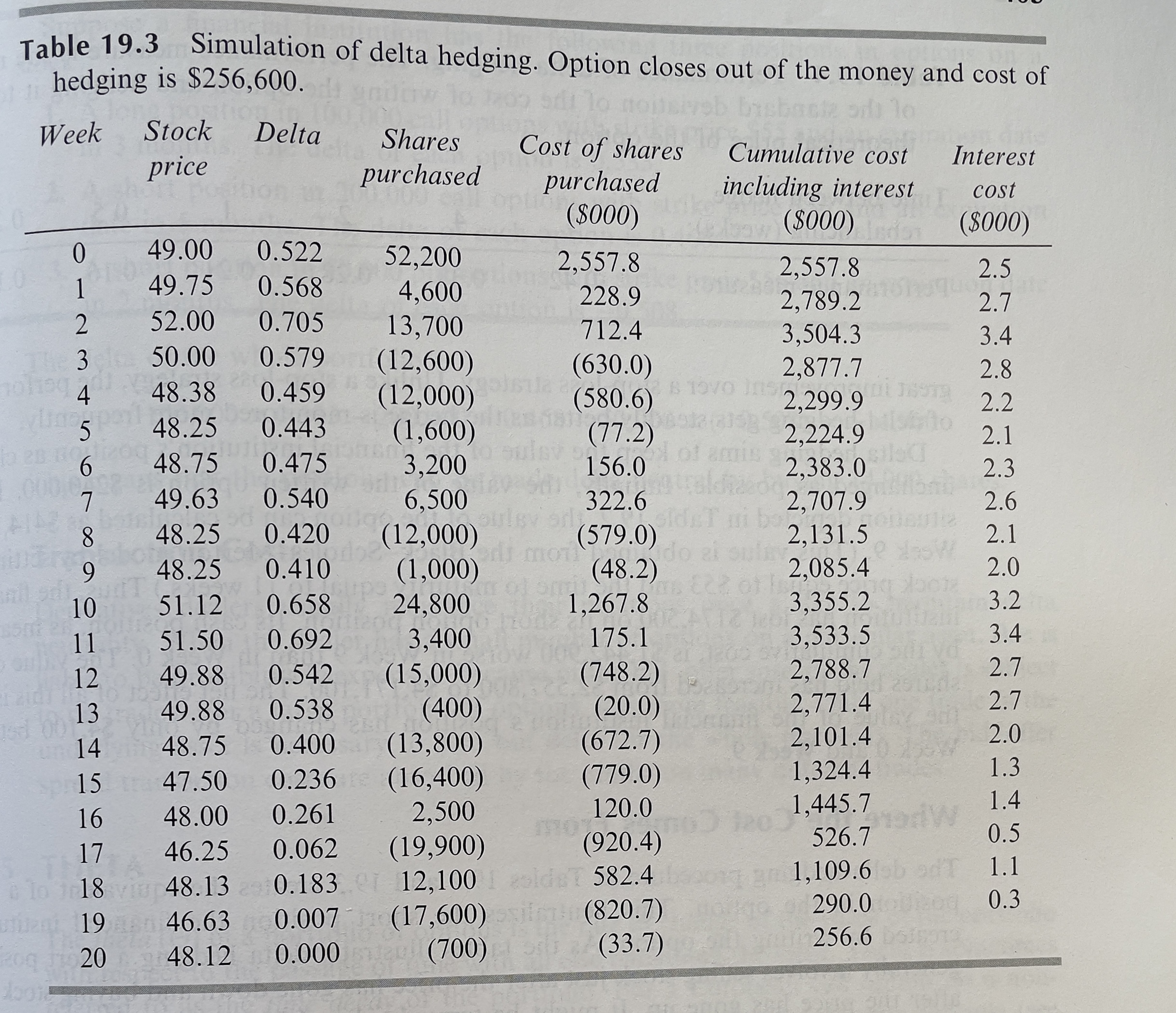

A financial institution has sold a European put option on 100,000 shares of a non-dividend- paying stock. We assume that the stock price is $49,

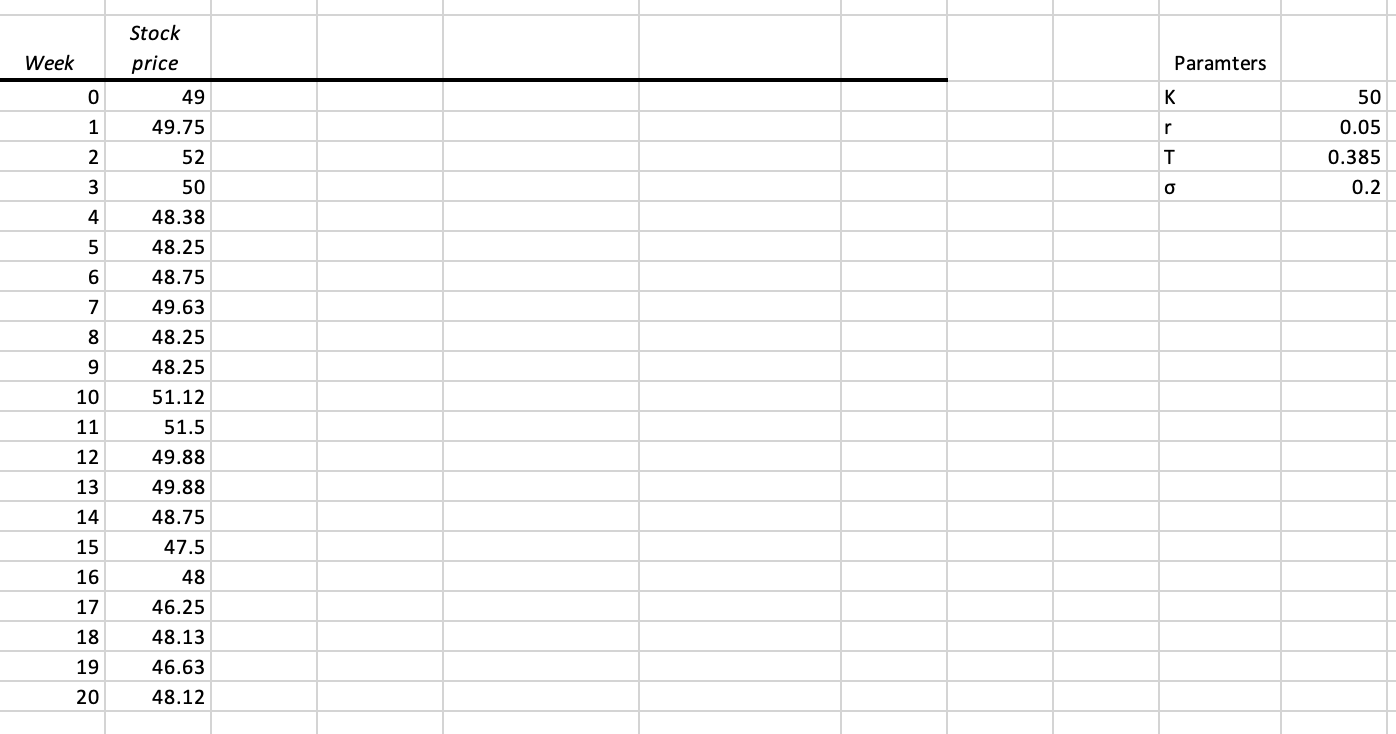

A financial institution has sold a European put option on 100,000 shares of a non-dividend- paying stock. We assume that the stock price is $49, the strike price is $50, the risk-free interest rate is 5% per annum, the stock price volatility is 20% per annum, the time to maturity is 20 weeks (0.3846 years), and the expected return from the stock is 13% per annum. a. Given the simulated weekly prices ( The excel SS) for 20 weeks, produce a table similar to Table 19.3 on p.405 of the textbook.( the table provided above the excel SS) (6/10) b. How much is the total hedging cost? (2/10) c. Compare the hedging cost to the theoretical Black-Scholes-Merton price. (2/10)

Table 19.3 Simulation of delta hedging. Option clnses nut of the manar and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started