Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. Financing with receivables Omicron Inc. provided the following footnote disclosure regarding certain financing arrangements it made with its accounts receivable. During the year,

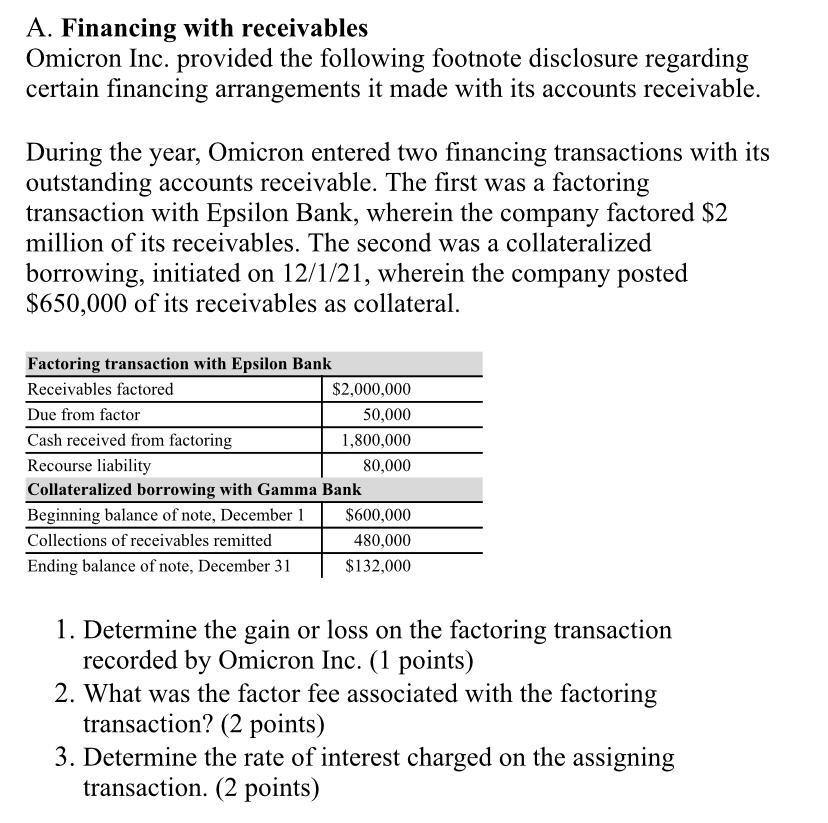

A. Financing with receivables Omicron Inc. provided the following footnote disclosure regarding certain financing arrangements it made with its accounts receivable. During the year, Omicron entered two financing transactions with its outstanding accounts receivable. The first was a factoring transaction with Epsilon Bank, wherein the company factored $2 million of its receivables. The second was a collateralized borrowing, initiated on 12/1/21, wherein the company posted $650,000 of its receivables as collateral. Factoring transaction with Epsilon Bank Receivables factored Due from factor Cash received from factoring Recourse liability $2,000,000 50,000 1,800,000 80,000 Collateralized borrowing with Gamma Bank Beginning balance of note, December 1 Collections of receivables remitted Ending balance of note, December 31 $600,000 480,000 $132,000 1. Determine the gain or loss on the factoring transaction recorded by Omicron Inc. (1 points) 2. What was the factor fee associated with the factoring transaction? (2 points) 3. Determine the rate of interest charged on the assigning transaction. (2 points)

Step by Step Solution

★★★★★

3.47 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

1 The gain on the factoring transaction is 120000 This is calculated as follows Receivables ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started