Answered step by step

Verified Expert Solution

Question

1 Approved Answer

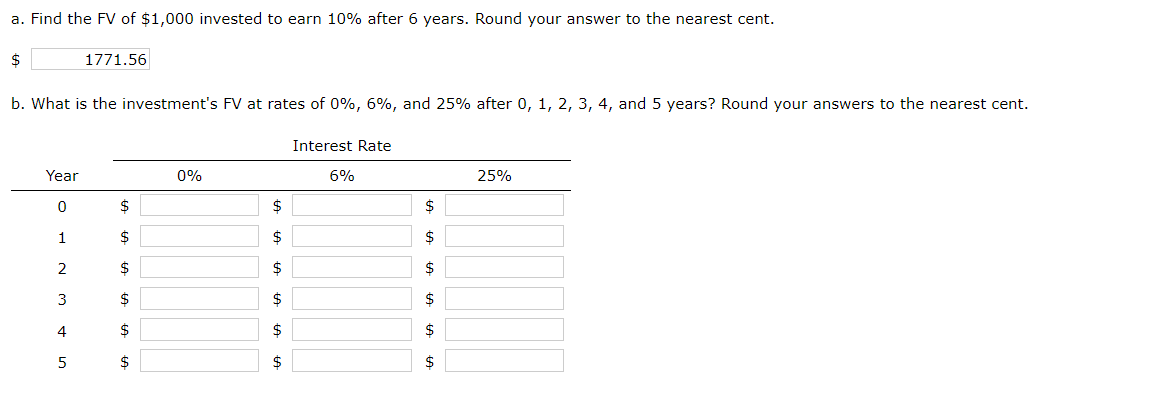

a. Find the FV of $1,000 invested to earn 10% after 6 years. Round your answer to the nearest cent. $ b. What is the

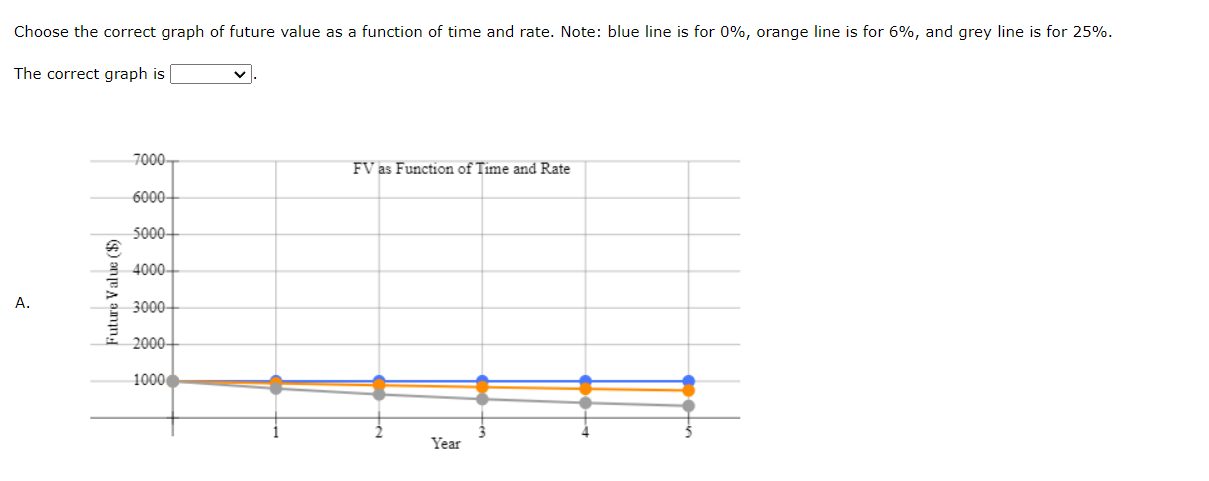

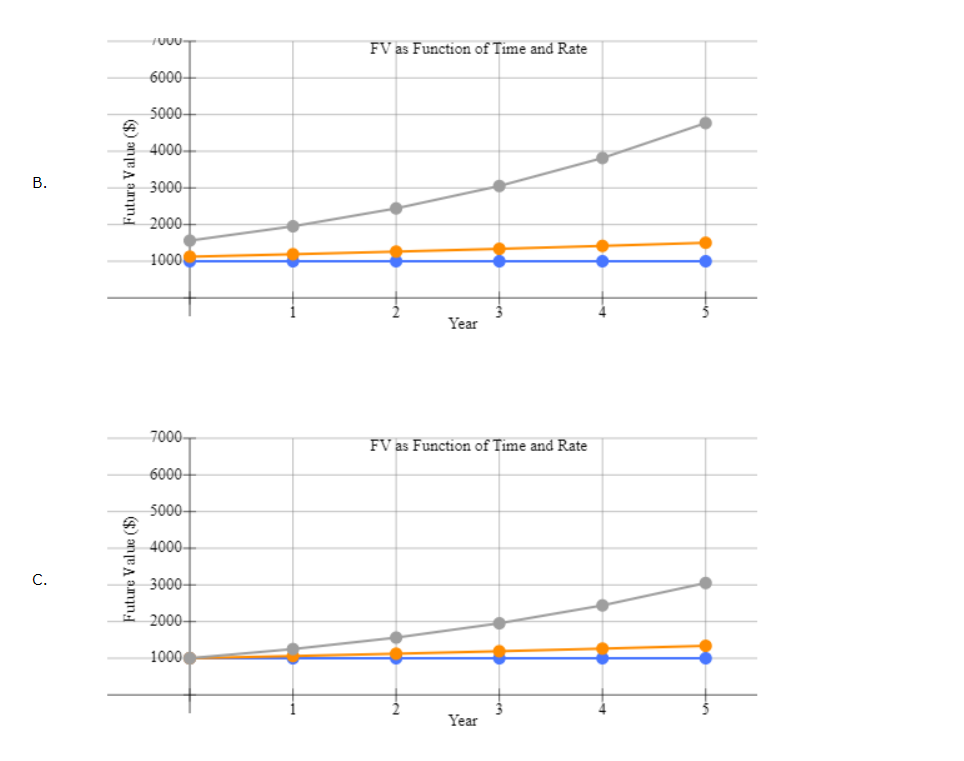

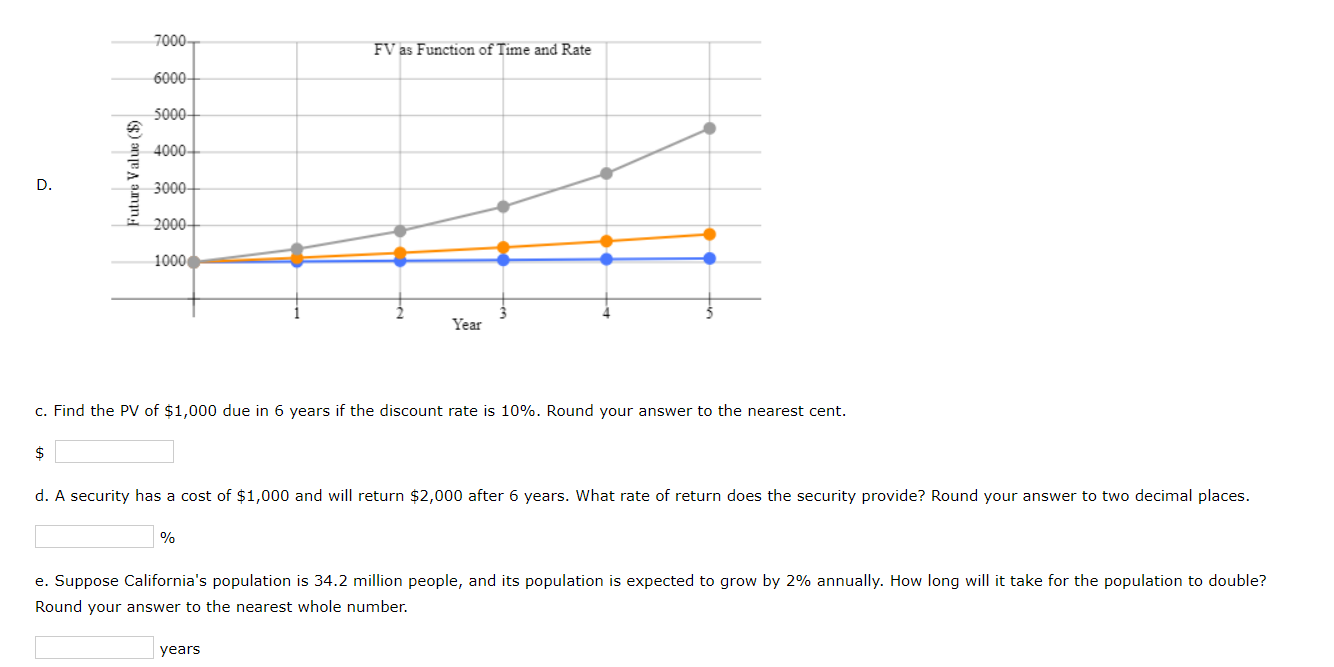

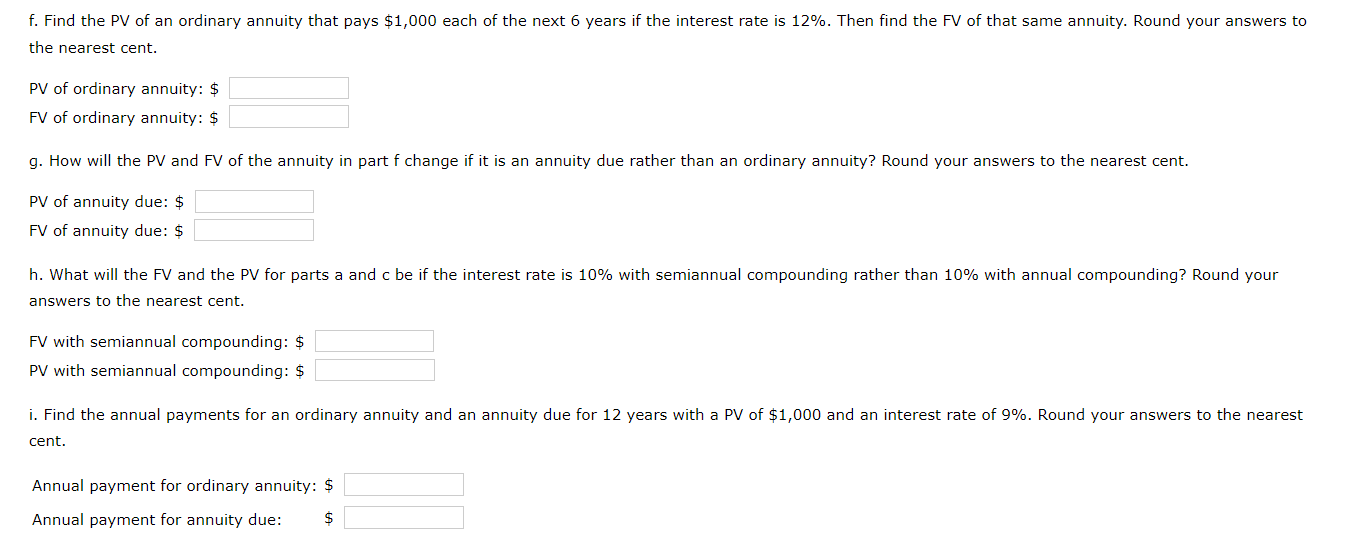

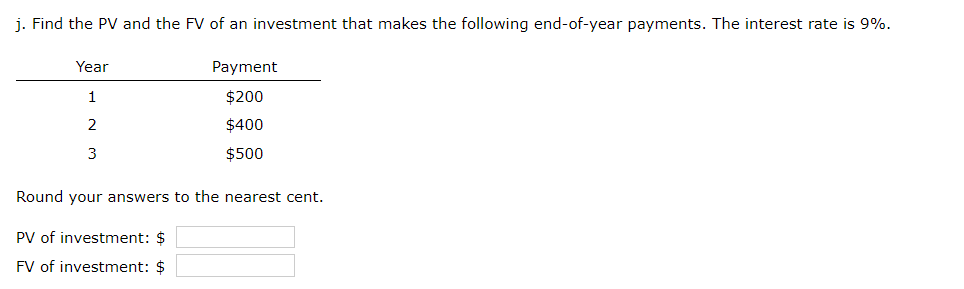

a. Find the FV of $1,000 invested to earn 10% after 6 years. Round your answer to the nearest cent. $ b. What is the investment's FV at rates of 0%,6%, and 25% after 0,1,2,3,4, and 5 years? Round your answers to the nearest cent. Choose the correct graph of future value as a function of time and rate. Note: blue line is for 0%, orange line is for 6%, and grey line is for The correct graph is B. C. c. Find the PV of $1,000 due in 6 years if the discount rate is 10%. Round your answer to the nearest cent. $ d. A security has a cost of $1,000 and will return $2,000 after 6 years. What rate of return does the security provide? Round your answer to two decimal places. % e. Suppose California's population is 34.2 million people, and its population is expected to grow by 2% annually. How long will it take for the population to Round your answer to the nearest whole number. years f. Find the PV of an ordinary annuity that pays $1,000 each of the next 6 years if the interest rate is 12%. Then find the FV of that same annuity. Round your answers to the nearest cent. PV of ordinary annuity: $ FV of ordinary annuity: $ g. How will the PV and FV of the annuity in part f change if it is an annuity due rather than an ordinary annuity? Round your answers to the nearest cent. PV of annuity due: $ FV of annuity due: $ h. What will the FV and the PV for parts a and c be if the interest rate is 10% with semiannual compounding rather than 10% with annual compounding? Round your answers to the nearest cent. FV with semiannual compounding: $ PV with semiannual compounding: $ i. Find the annual payments for an ordinary annuity and an annuity due for 12 years with a PV of $1,000 and an interest rate of 9%. Round your answers to the nearest cent. Annual payment for ordinary annuity: \$ Annual payment for annuity due: $ j. Find the PV and the FV of an investment that makes the following end-of-year payments. The interest rate is 9%. Round your answers to the nearest cent. PV of investment: $ FV of investment: \$ a. Find the FV of $1,000 invested to earn 10% after 6 years. Round your answer to the nearest cent. $ b. What is the investment's FV at rates of 0%,6%, and 25% after 0,1,2,3,4, and 5 years? Round your answers to the nearest cent. Choose the correct graph of future value as a function of time and rate. Note: blue line is for 0%, orange line is for 6%, and grey line is for The correct graph is B. C. c. Find the PV of $1,000 due in 6 years if the discount rate is 10%. Round your answer to the nearest cent. $ d. A security has a cost of $1,000 and will return $2,000 after 6 years. What rate of return does the security provide? Round your answer to two decimal places. % e. Suppose California's population is 34.2 million people, and its population is expected to grow by 2% annually. How long will it take for the population to Round your answer to the nearest whole number. years f. Find the PV of an ordinary annuity that pays $1,000 each of the next 6 years if the interest rate is 12%. Then find the FV of that same annuity. Round your answers to the nearest cent. PV of ordinary annuity: $ FV of ordinary annuity: $ g. How will the PV and FV of the annuity in part f change if it is an annuity due rather than an ordinary annuity? Round your answers to the nearest cent. PV of annuity due: $ FV of annuity due: $ h. What will the FV and the PV for parts a and c be if the interest rate is 10% with semiannual compounding rather than 10% with annual compounding? Round your answers to the nearest cent. FV with semiannual compounding: $ PV with semiannual compounding: $ i. Find the annual payments for an ordinary annuity and an annuity due for 12 years with a PV of $1,000 and an interest rate of 9%. Round your answers to the nearest cent. Annual payment for ordinary annuity: \$ Annual payment for annuity due: $ j. Find the PV and the FV of an investment that makes the following end-of-year payments. The interest rate is 9%. Round your answers to the nearest cent. PV of investment: $ FV of investment: \$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started