Answered step by step

Verified Expert Solution

Question

1 Approved Answer

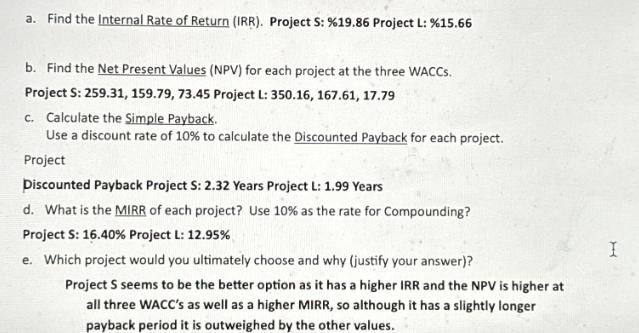

a. Find the Internal Rate of Return (IRR). Project S: % 19.86 Project L: % 15.66 b. Find the Net Present Values (NPV) for

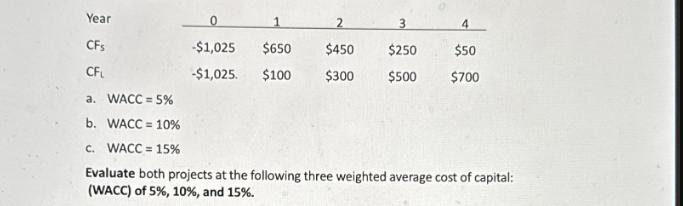

a. Find the Internal Rate of Return (IRR). Project S: % 19.86 Project L: % 15.66 b. Find the Net Present Values (NPV) for each project at the three WACCs. Project S: 259.31, 159.79, 73.45 Project L: 350.16, 167.61, 17.79 c. Calculate the Simple Payback. Use a discount rate of 10% to calculate the Discounted Payback for each project. Project Discounted Payback Project S: 2.32 Years Project L: 1.99 Years d. What is the MIRR of each project? Use 10% as the rate for Compounding? Project S: 16.40% Project L: 12.95% e. Which project would you ultimately choose and why (justify your answer)? Project S seems to be the better option as it has a higher IRR and the NPV is higher at all three WACC's as well as a higher MIRR, so although it has a slightly longer payback period it is outweighed by the other values. I Year CFs CF a. WACC = 5% b. WACC = 10% c. WACC = 15% Evaluate both projects at the following three weighted average cost of capital: (WACC) of 5%, 10 %, and 15%. 0 2 3 -$1,025 $650 $450 $250 -$1,025. $100 $300 $500 4 $50 $700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

c Simple Payback You seem to have already calculated the Discounted Payback not the Simple Payback Simple Payback ignores discounting and focuses on t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started