Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Find the NPV for each project. Are the projects acceptable? b. Find the break-even cash inflow for each project. c. The firm has estimated

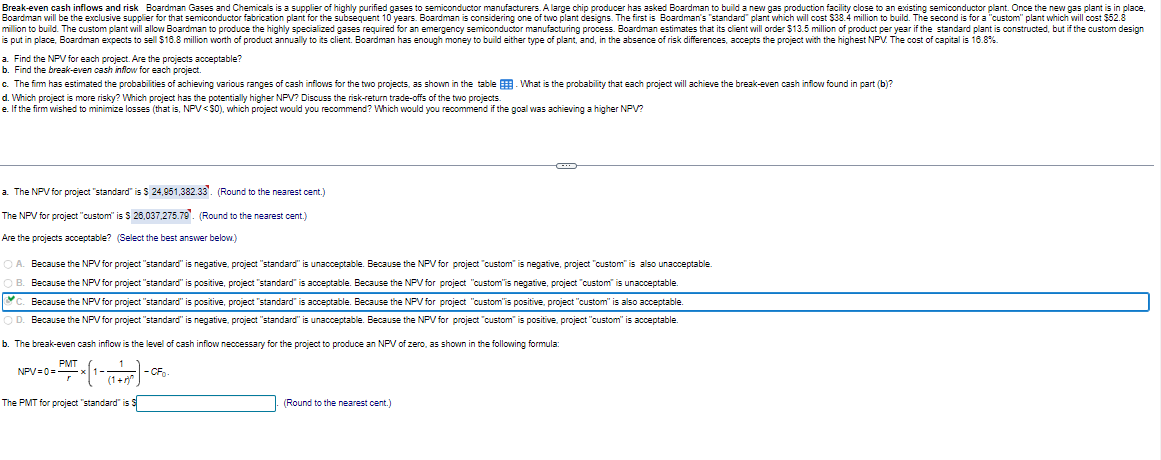

a. Find the NPV for each project. Are the projects acceptable? b. Find the break-even cash inflow for each project. c. The firm has estimated the probabilties of achieving various ranges of cash inflows for the two projects, as shown in the table d. Which project is more risky? Which project has the potentially higher NFV? Discuss the risk-return trade-offs of the two projects. What is the probability that each project will achieve the break-even cash inflow found in part (b)? e. If the firm wished to minimize losses (that is, NPV 24,951,382.33 '. (Round to the nearest cent.) The NFV for project "custom" is \$ 26,037,275.79". (Round to the nearest cent.) Are the projects acceptable? (Select the best answer below.) 4. Because the NFV for project "standard" is negative, project "standard" is unacceptable. Because the NFV for project "custom" is negative, project "custom" is also unacceptable. Because the NPV for project "standard" is positive, project "standard" is acceptable. Because the NPV for project "custom"is negative, project "custom" is unacceptable. C. Because the NPV for project "standard" is positive, project "standard" is acceptable. Because the NPV for project "custom"is positive, project "custom" is also acceptable. D. Because the NPV for project "standard" is negative, project "standard" is unacoeptable. Because the NPV for project "custom" is positive, project "custom" is acceptable. b. The break-even cash inflow is the level of cash inflow neccessary for the project to produce an NFV of zero, as shown in the following formula: NPV=0=rPMT(1(1+r)n1)CF0

a. Find the NPV for each project. Are the projects acceptable? b. Find the break-even cash inflow for each project. c. The firm has estimated the probabilties of achieving various ranges of cash inflows for the two projects, as shown in the table d. Which project is more risky? Which project has the potentially higher NFV? Discuss the risk-return trade-offs of the two projects. What is the probability that each project will achieve the break-even cash inflow found in part (b)? e. If the firm wished to minimize losses (that is, NPV 24,951,382.33 '. (Round to the nearest cent.) The NFV for project "custom" is \$ 26,037,275.79". (Round to the nearest cent.) Are the projects acceptable? (Select the best answer below.) 4. Because the NFV for project "standard" is negative, project "standard" is unacceptable. Because the NFV for project "custom" is negative, project "custom" is also unacceptable. Because the NPV for project "standard" is positive, project "standard" is acceptable. Because the NPV for project "custom"is negative, project "custom" is unacceptable. C. Because the NPV for project "standard" is positive, project "standard" is acceptable. Because the NPV for project "custom"is positive, project "custom" is also acceptable. D. Because the NPV for project "standard" is negative, project "standard" is unacoeptable. Because the NPV for project "custom" is positive, project "custom" is acceptable. b. The break-even cash inflow is the level of cash inflow neccessary for the project to produce an NFV of zero, as shown in the following formula: NPV=0=rPMT(1(1+r)n1)CF0 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started