Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Find the present value of the annual CDS payments, per dollar of payment. (b) Find the CDS rates c (i.e. the rate c so

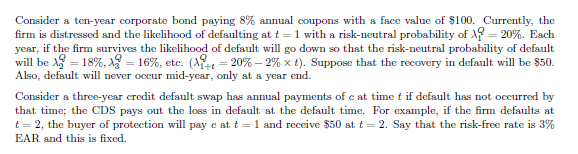

(a) Find the present value of the annual CDS payments, per dollar of payment. (b) Find the CDS rates c (i.e. the rate c so that the initial value of the CDS is 0). (c) Would the CDS rate for a 10-year CDS be higher or lower than the 3-year rate? Intuitively explain your answer. Note: you need not compute the 10-year CDS rate.

Consider a ten-year corporate bond paying 8% annual coupons with a face value of $100. Currently, the firm is distressed and the likelihood of defaulting at t=1 with a risk-neutral probability of y = 20%. Each year, if the firm survives the likelihood of default will go down so that the risk-neutral probability of default will be = 18%, 12 = 16%, etc. (1+2= 20% -2% x t). Suppose that the recovery in default will be $50. Also, default will never occur mid-year, only at a year end. Consider a three-year credit default swap has annual payments of cat time t if default has not occurred by that time; the CDS pays out the loss in default at the default time. For example, if the firm defaults at t=2, the buyer of protection will pay c at t= 1 and receive $50 at t= 2. Say that the risk-free rate is 3% EAR and this is fixed. Consider a ten-year corporate bond paying 8% annual coupons with a face value of $100. Currently, the firm is distressed and the likelihood of defaulting at t=1 with a risk-neutral probability of y = 20%. Each year, if the firm survives the likelihood of default will go down so that the risk-neutral probability of default will be = 18%, 12 = 16%, etc. (1+2= 20% -2% x t). Suppose that the recovery in default will be $50. Also, default will never occur mid-year, only at a year end. Consider a three-year credit default swap has annual payments of cat time t if default has not occurred by that time; the CDS pays out the loss in default at the default time. For example, if the firm defaults at t=2, the buyer of protection will pay c at t= 1 and receive $50 at t= 2. Say that the risk-free rate is 3% EAR and this is fixedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started