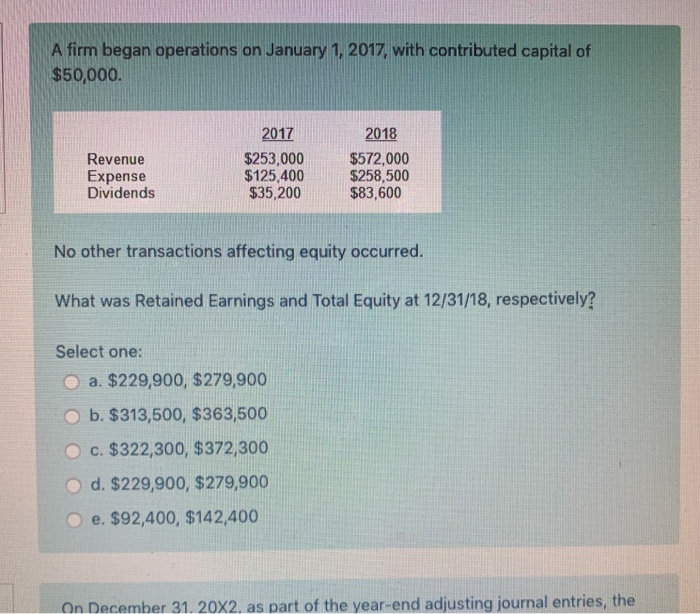

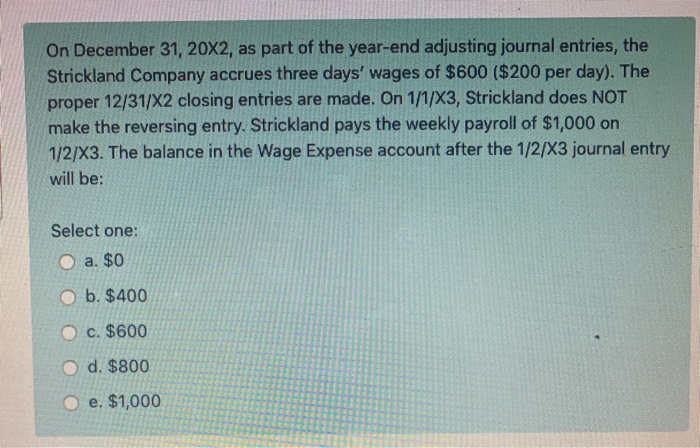

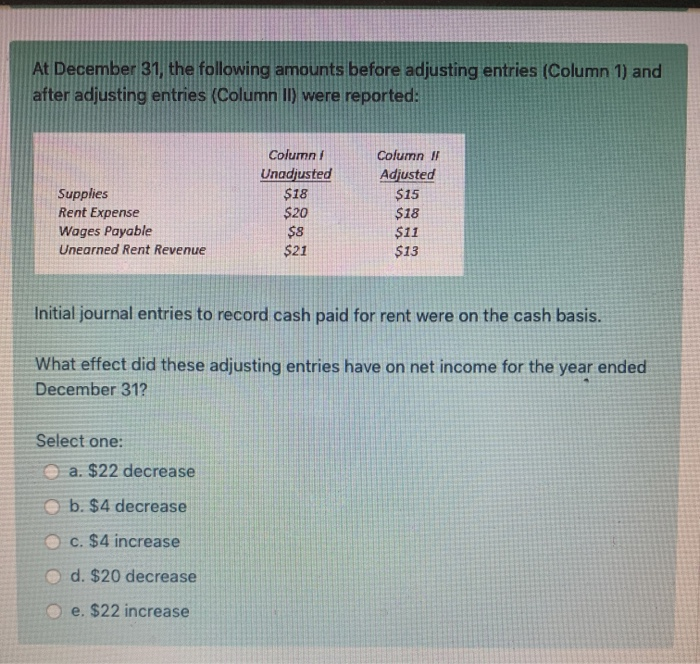

A firm began operations on January 1, 2017, with contributed capital of $50,000. Revenue Expense Dividends 2017 $253,000 $125,400 $35,200 2018 $572,000 $258,500 $83,600 No other transactions affecting equity occurred. What was Retained Earnings and Total Equity at 12/31/18, respectively? Select one: O a. $229,900, $279,900 O b. $313,500, $363,500 O c. $322,300, $372,300 O d. $229,900, $279,900 e. $92,400, $142,400 On December 31, 20X2. as part of the year-end adjusting journal entries, the On December 31, 20X2, as part of the year-end adjusting journal entries, the Strickland Company accrues three days' wages of $600 ($200 per day). The proper 12/31/X2 closing entries are made. On 1/1/X3, Strickland does NOT make the reversing entry. Strickland pays the weekly payroll of $1,000 on 1/2/X3. The balance in the Wage Expense account after the 1/2/3 journal entry will be: Select one: O a. $0 b. $400 O c. $600 O d. $800 O e. $1,000 At December 31, the following amounts before adjusting entries (Column 1) and after adjusting entries (Column II) were reported: Column 1 Adjusted Columni Unadjusted $18 $20 S8 $21 Supplies Rent Expense Wages Payable Unearned Rent Revenue $15 $18 $11 $13 Initial journal entries to record cash paid for rent were on the cash basis. What effect did these adjusting entries have on net income for the year ended December 31? Select one: a. $22 decrease b. $4 decrease c. $4 increase d. $20 decrease e. $22 increase Which of the following describes the accounting principle of "cost contraint"? Select one: a. The financial statements follow principles similar to those of others in the industry O b. The benefit of providing the information is greater than the cost of providing it O c. All relevant information is supplied to the financial statement user O d. An accounting principle is applied uniformly each year after adoption O e. All financial records are made available to shareholders The following information is available from the Juneau Company's accounting records: Purchases Purchase discount Beginning inventory Ending inventory Freight-in $530,000 10,000 160,000 215,000 40,000 Juneau's Cost of Goods Available for Sale is: Select one: O a. $465,000 b. $680,000 c. $505,000 O d. $690,000 O e. $720,000 The accounting records of Seattle Outlet include the following for January: Sales Purchases Sales Discounts Freight - In Purchase Retums and Allowances $326,000 260,000 6,000 2,000 9,000 A physical count determined the cost of inventory on hand at January 31 to be $21,000. If gross profit amounts to 25% of net sales, compute the beginning inventory at January 1. Select one: O a. $10,000 O b. $19,500 c. $8,000 d. $21,000 e. $6,000