Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm considering replacement of its existing machine by a new machine. The new machine will cost Rs 1,60,000 and have a life of five

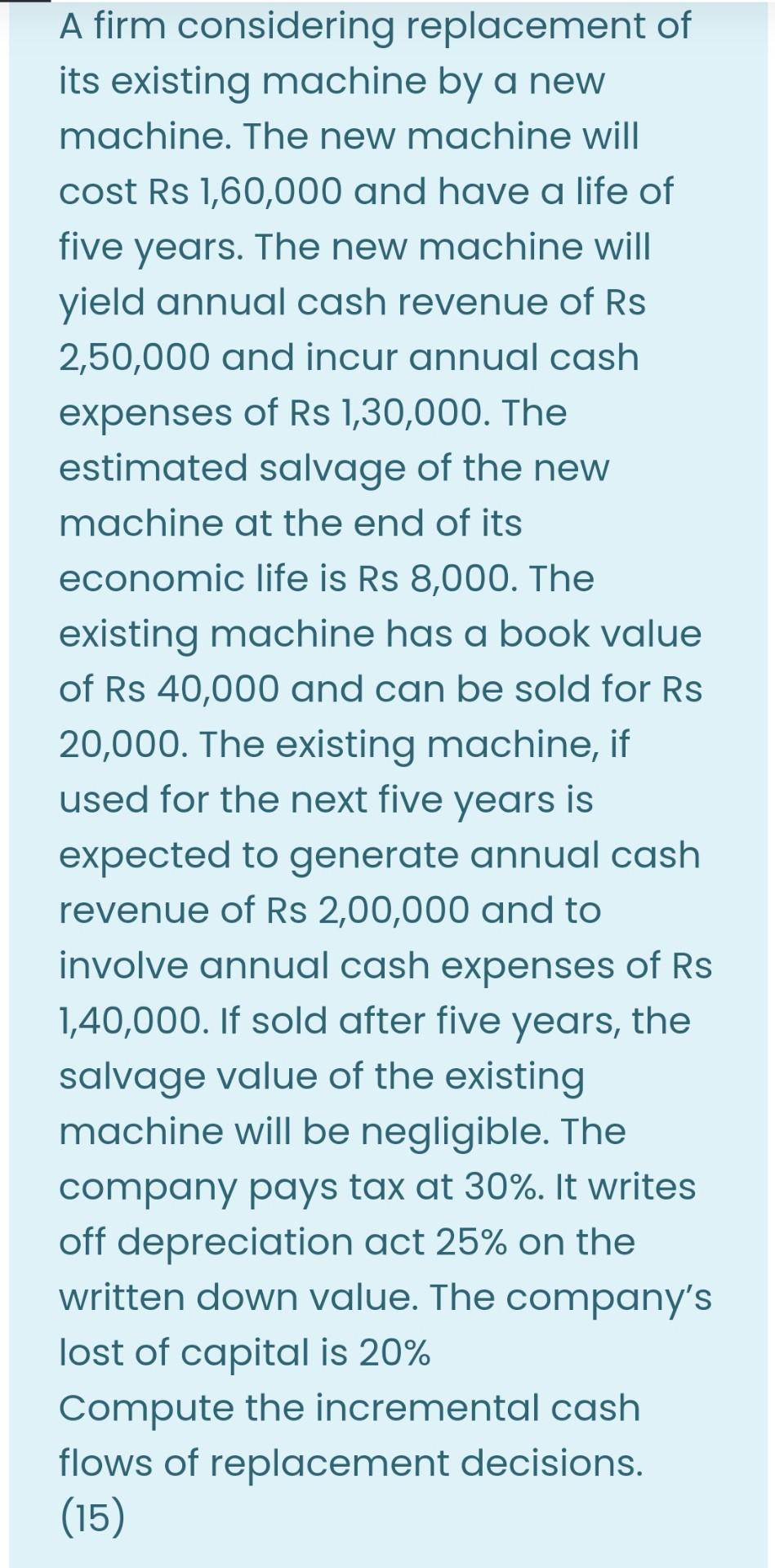

A firm considering replacement of its existing machine by a new machine. The new machine will cost Rs 1,60,000 and have a life of five years. The new machine will yield annual cash revenue of Rs 2,50,000 and incur annual cash expenses of Rs 1,30,000. The estimated salvage of the new machine at the end of its economic life is Rs 8,000. The existing machine has a book value of Rs 40,000 and can be sold for Rs 20,000. The existing machine, if used for the next five years is expected to generate annual cash revenue of Rs 2,00,000 and to involve annual cash expenses of Rs 1,40,000. If sold after five years, the salvage value of the existing machine will be negligible. The company pays tax at 30%. It writes off depreciation act 25% on the written down value. The company's lost of capital is 20% Compute the incremental cash flows of replacement decisions. (15)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started