Question

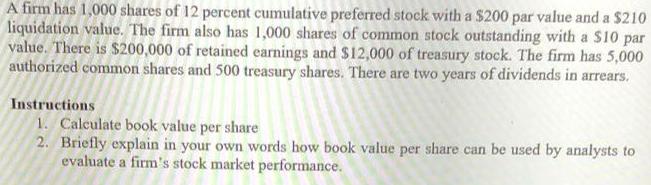

A firm has 1,000 shares of 12 percent cumulative preferred stock with a $200 par value and a $210 liquidation value. The firm also

A firm has 1,000 shares of 12 percent cumulative preferred stock with a $200 par value and a $210 liquidation value. The firm also has 1,000 shares of common stock outstanding with a S10 par value. There is $200,000 of retained earnings and $12,000 of treasury stock. The firm has 5,000 authorized common shares and 500 treasury shares. There are two years of dividends in arrears. Instructions 1. Calculate book value per share 2. Briefly explain in your own words how book value per share can be used by analysts to evaluate a firm's stock market performance.

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1BOOK VALUE PER SHARETOTAL COMMON STOCK HOLDERS EQUITY PREFFERED ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Operations Management Sustainability and Supply Chain Management

Authors: Jay Heizer, Barry Render, Chuck Munson

10th edition

978-0134183954, 134183959, 134181980, 978-0134181981

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App