Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm has a single liability of $5.9 million due on 30 June 2018. Time now is 27 June 2012. The firm builds a

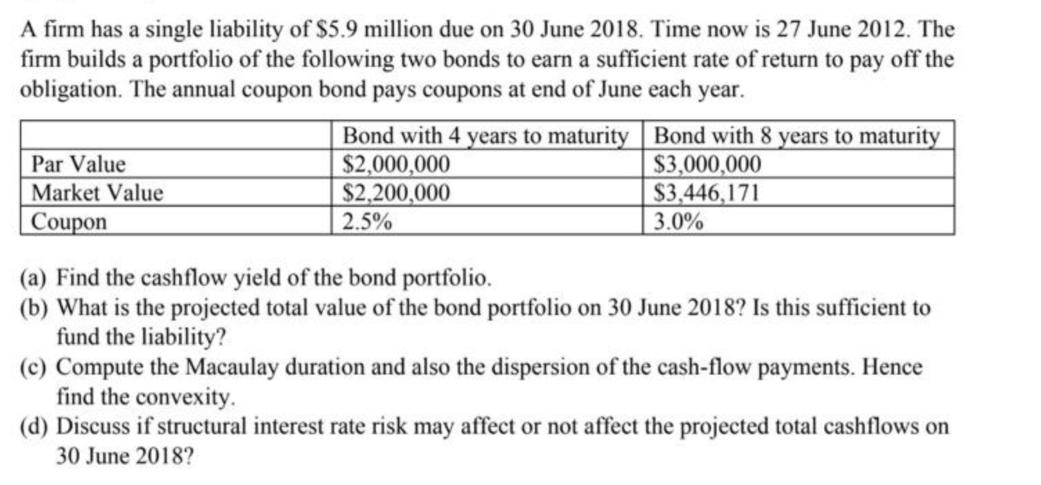

A firm has a single liability of $5.9 million due on 30 June 2018. Time now is 27 June 2012. The firm builds a portfolio of the following two bonds to earn a sufficient rate of return to pay off the obligation. The annual coupon bond pays coupons at end of June each year. Par Value Market Value Coupon Bond with 4 years to maturity $2,000,000 $2,200,000 2.5% Bond with 8 years to maturity $3,000,000 $3,446,171 3.0% (a) Find the cashflow yield of the bond portfolio. (b) What is the projected total value of the bond portfolio on 30 June 2018? Is this sufficient to fund the liability? (c) Compute the Macaulay duration and also the dispersion of the cash-flow payments. Hence find the convexity. (d) Discuss if structural interest rate risk may affect or not affect the projected total cashflows on 30 June 2018?

Step by Step Solution

★★★★★

3.39 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a Cashflow Yield Coupon PaymentsPV x 1YTM For Bond 1 Cashflow Yield 500002200000 x 1YTM 227 For Bond ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started