Answered step by step

Verified Expert Solution

Question

1 Approved Answer

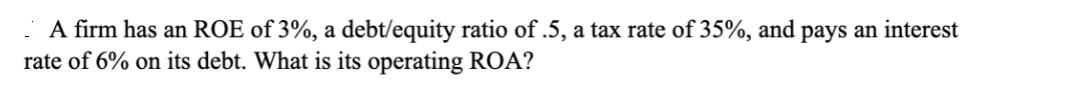

A firm has an ROE of 3%, a debt/equity ratio of .5, a tax rate of 35%, and pays an interest rate of 6%

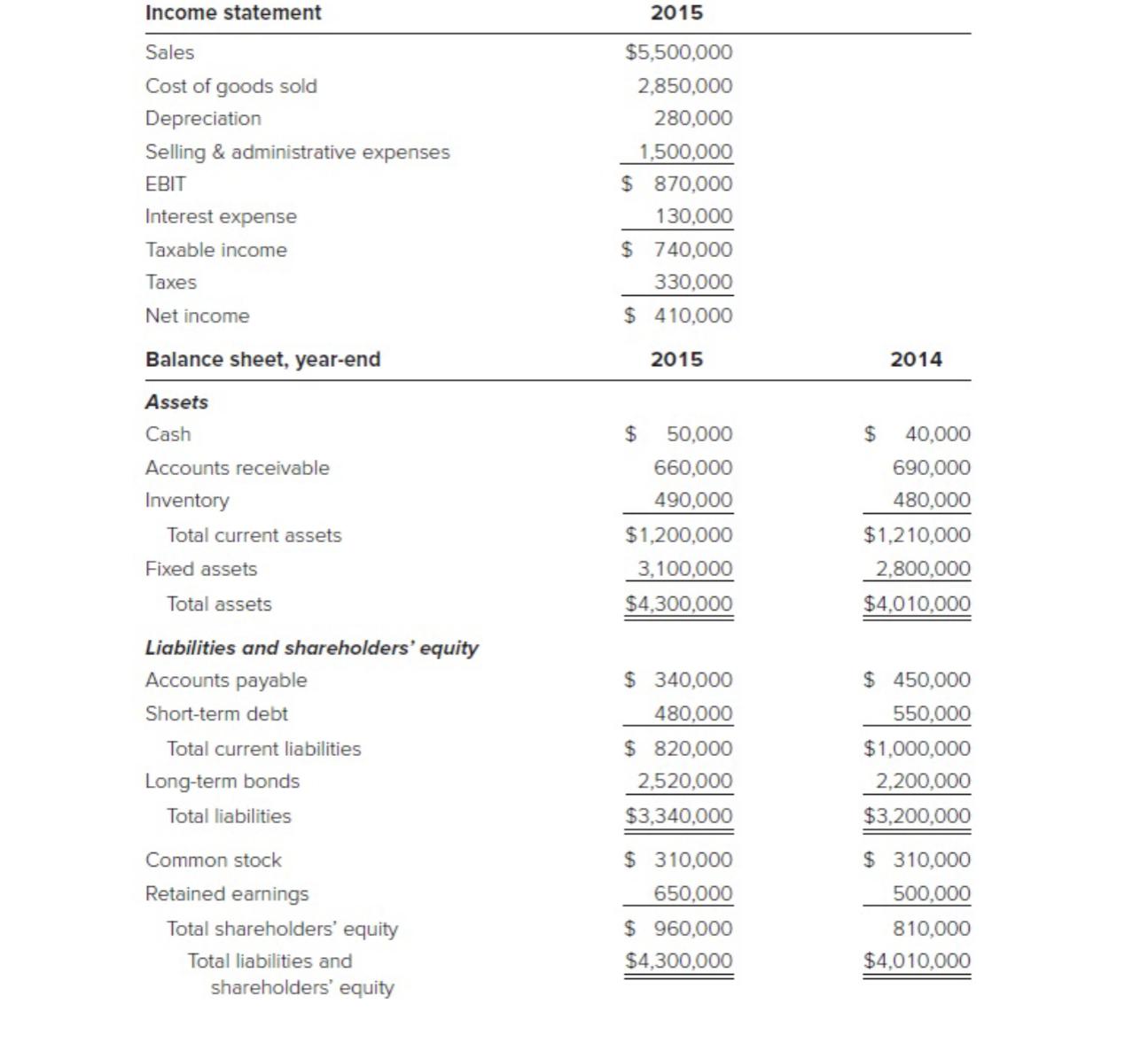

A firm has an ROE of 3%, a debt/equity ratio of .5, a tax rate of 35%, and pays an interest rate of 6% on its debt. What is its operating ROA? Income statement Sales Cost of goods sold Depreciation Selling & administrative expenses EBIT Interest expense Taxable income Taxes Net income Balance sheet, year-end 2015 $5,500,000 2,850,000 280,000 1,500,000 $ 870,000 130,000 $ 740,000 330,000 $ 410,000 2015 Assets Cash Accounts receivable Inventory Total current assets Fixed assets Total assets 2014 $ 50,000 $ 40,000 690,000 480,000 660,000 490,000 $1,200,000 3,100,000 $4,300,000 $1,210,000 2,800,000 $4,010,000 Liabilities and shareholders' equity Accounts payable Short-term debt Total current liabilities Long-term bonds Total liabilities Common stock Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 340,000 480,000 $ 820,000 2,520,000 $3,340,000 $ 310,000 650,000 $ 960,000 $4,300,000 $ 450,000 550,000 $1,000,000 2,200,000 $3,200,000 $ 310,000 500,000 810,000 $4,010,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started