Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm has revenues of $20,000 for each of three years. The firm estimates the warranty expense to be 8.0% of revenues each year.

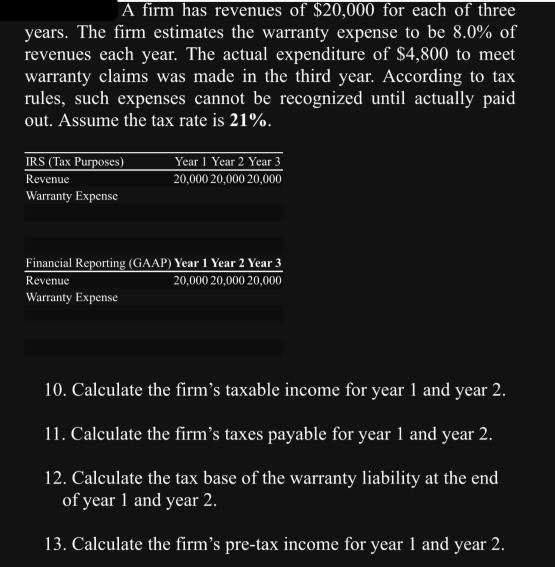

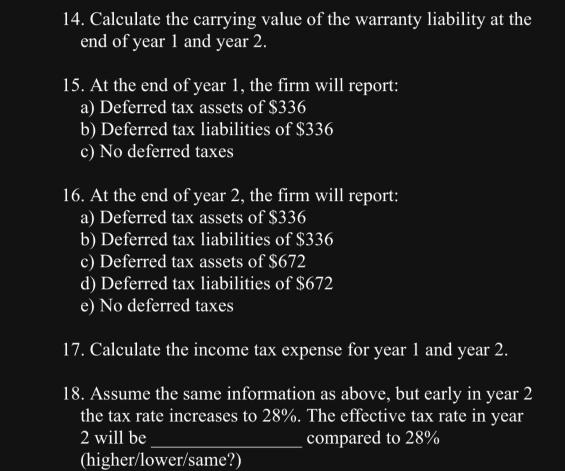

A firm has revenues of $20,000 for each of three years. The firm estimates the warranty expense to be 8.0% of revenues each year. The actual expenditure of $4,800 to meet warranty claims was made in the third year. According to tax rules, such expenses cannot be recognized until actually paid out. Assume the tax rate is 21%. IRS (Tax Purposes) Revenue Warranty Expense Year 1 Year 2 Year 3 20,000 20,000 20,000 Financial Reporting (GAAP) Year 1 Year 2 Year 3 Revenue 20,000 20,000 20,000 Warranty Expense 10. Calculate the firm's taxable income for year 1 and year 2. 11. Calculate the firm's taxes payable for year 1 and year 2. 12. Calculate the tax base of the warranty liability at the end of year 1 and year 2. 13. Calculate the firm's pre-tax income for year 1 and year 2. 14. Calculate the carrying value of the warranty liability at the end of year 1 and year 2. 15. At the end of year 1, the firm will report: a) Deferred tax assets of $336 b) Deferred tax liabilities of $336 c) No deferred taxes 16. At the end of year 2, the firm will report: a) Deferred tax assets of $336 b) Deferred tax liabilities of $336 c) Deferred tax assets of $672 d) Deferred tax liabilities of $672 e) No deferred taxes 17. Calculate the income tax expense for year 1 and year 2. 18. Assume the same information as above, but early in year 2 the tax rate increases to 28%. The effective tax rate in year 2 will be compared to 28% (higher/lower/same?)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Alright lets tackle each of these questions step by step using the information provided Lets first establish the warranty expense calculations for GAAP and tax purposes Under GAAP its 8 of the revenue ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started