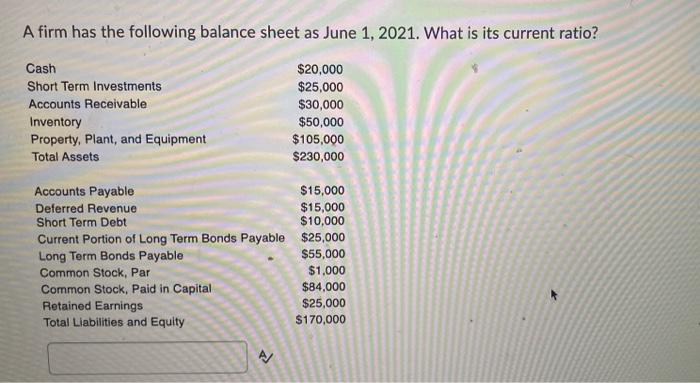

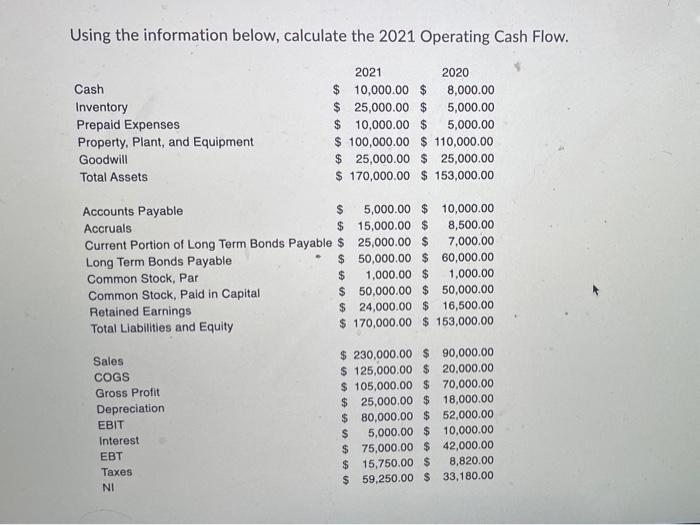

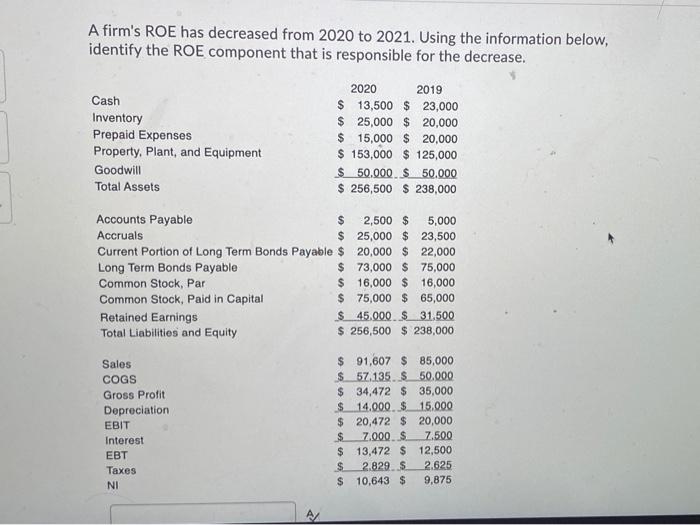

A firm has the following balance sheet as June 1, 2021. What is its current ratio? Cash Short Term Investments Accounts Receivable $20,000 $25,000 $30,000 $50,000 $105,000 $230,000 Inventory Property, Plant, and Equipment Total Assets Accounts Payable $15,000 Deferred Revenue $15,000 Short Term Debt $10,000 Current Portion of Long Term Bonds Payable $25,000 Long Term Bonds Payable $55,000 Common Stock, Par $1.000 Common Stock, Paid in Capital $84.000 Retained Earnings $25,000 Total Liabilities and Equity $170,000 A/ Using the information below, calculate the 2021 Operating Cash Flow. Cash Inventory Prepaid Expenses Property, Plant, and Equipment Goodwill Total Assets 2021 2020 $ 10,000.00 $ 8,000.00 $ 25,000.00 $ 5,000.00 $ 10,000.00 $ 5,000.00 $ 100,000.00 $ 110,000.00 $ 25,000.00 $ 25,000.00 $ 170,000.00 $ 153,000.00 Accounts Payable $ 5,000.00 $ 10,000.00 Accruals $ 15,000.00 $ 8,500.00 Current Portion of Long Term Bonds Payable $ 25,000.00 $ 7,000.00 Long Term Bonds Payable $ 50,000.00 $ 60,000.00 Common Stock, Par $ 1,000.00 $ 1,000.00 Common Stock, Paid in Capital $ 50,000.00 $ 50,000.00 Retained Earnings $ 24,000.00 $ 16,500.00 Total Liabilities and Equity $ 170,000.00 $ 153,000.00 Sales COGS Gross Profit Depreciation EBIT $ 230,000.00 $ 90,000.00 $ 125,000.00 $ 20,000.00 $ 105,000.00 $ 70,000.00 $ 25,000.00 $ 18,000.00 $ 80,000.00 $ 52,000.00 $ 5,000.00 $ 10,000.00 $ 75,000.00 $ 42,000.00 $ 15,750.00 $ 8,820.00 $ 59,250.00 $ 33,180.00 Interest EBT Taxes NI A firm's ROE has decreased from 2020 to 2021. Using the information below, identify the ROE component that is responsible for the decrease. 2020 2019 Cash Inventory Prepaid Expenses Property, Plant, and Equipment Goodwill Total Assets $ 13,500 $ 23,000 $ 25,000 $ 20,000 $ 15,000 $ 20,000 $ 153,000 $ 125,000 $ 50.000 $ 50.000 $ 256,500 $ 238,000 Accounts Payable $ 2,500 $ 5,000 Accruals $ 25,000 $ 23,500 Current Portion of Long Term Bonds Payable $ 20,000 $ 22,000 Long Term Bonds Payable $ 73,000 $ 75,000 Common Stock, Par $ 16,000 $ 16,000 Common Stock, Paid in Capital $ 75,000 $ 65,000 Retained Earnings $_45.000 $31.500 Total Liabilities and Equity $ 256,500 $ 238,000 Sales COGS Gross Profit Depreciation EBIT Interest EBT Taxes $ 91,607 $ 85,000 $57.135 S 50.000 $ 34,472 $ 35,000 $ 14.000.$ 15.000 $ 20,472 $ 20,000 7.000 $ 7.500 $ 13,472 $ 12,500 S 2.829. S 2.625 $ 10,643 $ 9,875 NI