Question: A firm is analyzing their pricing and operations for next year based on the following anticipated cost structure, the given level of production and sales,

A firm is analyzing their pricing and operations for next year based on the following anticipated cost structure, the given level of production and sales, and their target operating income margin of 8%.

Units Produced and Sold 80,000 Sales Commission Rate 10%

Direct Material Cost/Unit $15

Direct Labor Cost/Unit $10

Variable Manufacturing Overhead Cost/Unit $8

Total Fixed Manufacturing Overhead Costs $700,000

Total Fixed Selling & Administrative Costs $400,000

Target Operating Income Margin (Operating Income as a % of Sales) 8%

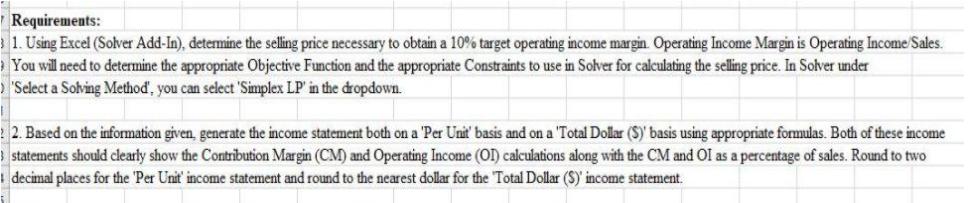

Requirements: 1. Using Excel (Solver Add-In), determine the selling price necessary to obtain a 10% target operating income margin. Operating Income Margin is Operating Income Sales You will need to determine the appropriate Objective Function and the appropriate Constraints to use in Solver for calculating the selling price. In Solver under Select a Solving Method', you can select 'Simplex LP' in the dropdown. 2. Based on the information given, generate the income statement both on a 'Per Unit' basis and on a 'Total Dollar (S)' basis using appropriate formulas. Both of these income statements should clearly show the Contribution Margin (CM) and Operating Income (OI) calculations along with the CM and OI as a percentage of sales. Round to two ! decimal places for the 'Per Unit' income statement and round to the nearest dollar for the Total Dollar (S)' income statement.

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

1 Assume Selling Price per unit to be Y Sales Variable Cost Fixed Expense Pro... View full answer

Get step-by-step solutions from verified subject matter experts