Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm is considering a project manufacturing antennas. The up-front cost of purchasing the equipment needed to manufacture the antennas is $20 million. This

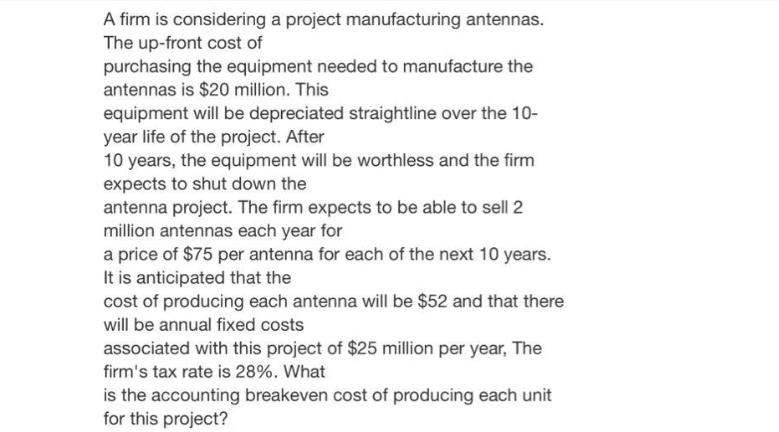

A firm is considering a project manufacturing antennas. The up-front cost of purchasing the equipment needed to manufacture the antennas is $20 million. This equipment will be depreciated straightline over the 10- year life of the project. After 10 years, the equipment will be worthless and the firm expects to shut down the antenna project. The firm expects to be able to sell 2 million antennas each year for a price of $75 per antenna for each of the next 10 years. It is anticipated that the cost of producing each antenna will be $52 and that there will be annual fixed costs associated with this project of $25 million per year, The firm's tax rate is 28%. What is the accounting breakeven cost of producing each unit for this project?

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Heres how to calculate the accounting breakeven cost per unit for this project 1 Calculate annual depreciation Equipment cost 20 million Useful life 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started