Question

A firm is considering an investment of $480,000 in new equipment to replace old equipment with a book value of $95,000 and a market value

A firm is considering an investment of $480,000 in new equipment to replace old equipment with a book value of $95,000 and a market value of $63,000. If the firm replaces the old equipment with new equipment, it expects to save $120,000 in operating costs the first year. The amount of savings will grow at a rate of 8 percent per year for each of the following five years. Both pieces of equipment belong to asset class 8, which has a CCA rate of 20 percent. The salvage values of both the old equipment and the new equipment at the end of six years are $11,000 and $78,000, respectively. There are other assets in the asset class when the project terminates. In addition, replacement of the old equipment with the new equipment requires an immediate increase in net working capital of $50,000. The firms marginal tax rate is 35 percent and cost of capital is 11 percent.

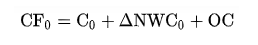

a) What is the initial after-tax cash flow?

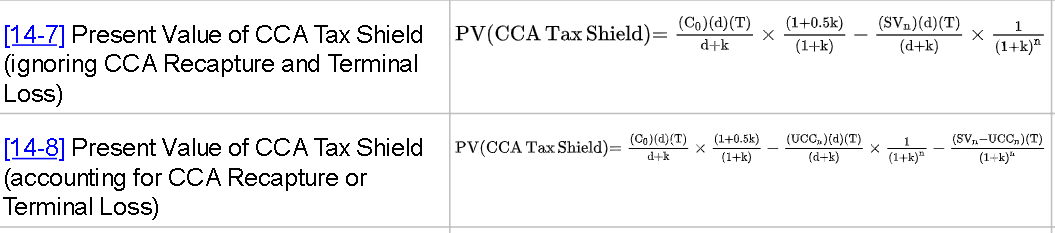

b) What is the present value of the incremental CCA tax savings? (Capital cost allowance) c) What is the present value of the incremental after-tax operating cash flows?

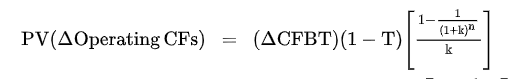

c) What is the present value of the incremental after-tax operating cash flows?

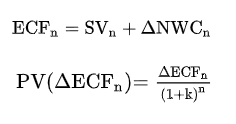

d) What is the present value of the incremental ending after-tax cash flow?

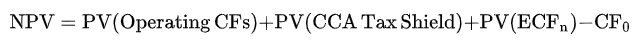

e) What is the NPV of the replacement project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started