Question

A firm is considering an investment.The most likely data values were found during the feasibility study.Analyzing past data of similar projects shows that optimistic values

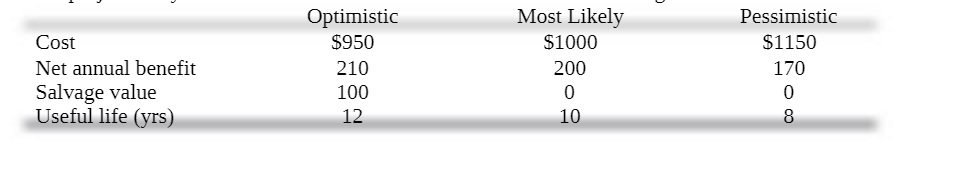

A firm is considering an investment.The most likely data values were found during the feasibility study.Analyzing past data of similar projects shows that optimistic values for the first cost and the annual benefitare 5% better than most likely values.Pessimistic values are 15% worse.The firms most experienced project analyst has estimated the values for the useful life and salvage value (found in the table above)

1. Compute the rate of return for each estimate.

2. If a 10% before-tax MARR is required, is the investment justified under all three scenarios?

Cost Net annual benefit Salvage value Useful life (yrs) Optimistic $950 210 100 12 Most Likely $1000 200 0 10 Pessimistic $1150 170 8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started