A firm is considering the purchase of a new equipment costing $5,052,025 which qualifies for a 26% CCA rate. This equipment has a 4-year

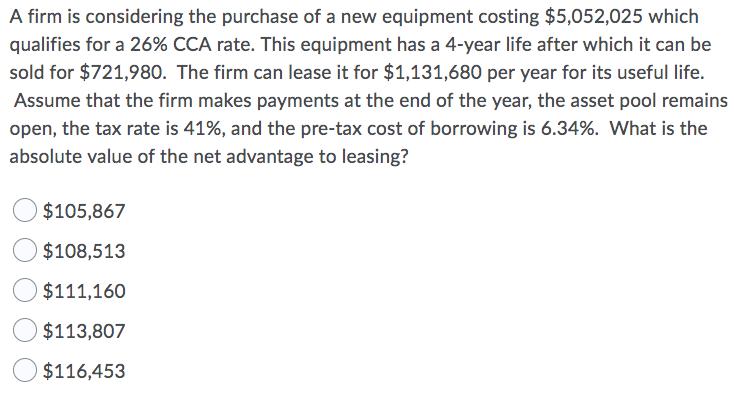

A firm is considering the purchase of a new equipment costing $5,052,025 which qualifies for a 26% CCA rate. This equipment has a 4-year life after which it can be sold for $721,980. The firm can lease it for $1,131,680 per year for its useful life. Assume that the firm makes payments at the end of the year, the asset pool remains open, the tax rate is 41%, and the pre-tax cost of borrowing is 6.34%. What is the absolute value of the net advantage to leasing? $105,867 $108,513 $111,160 $113,807 $116,453

Step by Step Solution

3.30 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

116453 Explanation The advantage of leasing over buying is 116453 The present va...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started