Answered step by step

Verified Expert Solution

Question

1 Approved Answer

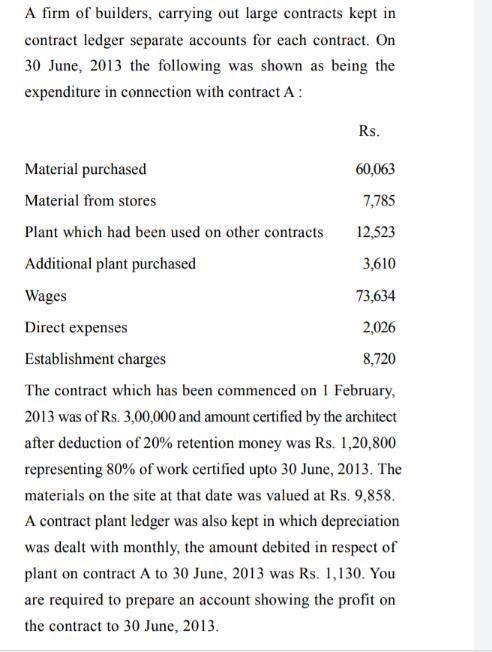

A firm of builders, carrying out large contracts kept in contract ledger separate accounts for each contract. On 30 June, 2013 the following was

A firm of builders, carrying out large contracts kept in contract ledger separate accounts for each contract. On 30 June, 2013 the following was shown as being the expenditure in connection with contract A: Material purchased Material from stores Plant which had been used on other contracts Additional plant purchased Wages Direct expenses Rs. 60,063 7,785 12,523 3,610 73,634 2,026 Establishment charges 8,720 The contract which has been commenced on 1 February, 2013 was of Rs. 3,00,000 and amount certified by the architect after deduction of 20% retention money was Rs. 1,20,800 representing 80% of work certified upto 30 June, 2013. The materials on the site at that date was valued at Rs. 9,858. A contract plant ledger was also kept in which depreciation was dealt with monthly, the amount debited in respect of plant on contract A to 30 June, 2013 was Rs. 1,130. You are required to prepare an account showing the profit on the contract to 30 June, 2013.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Contract A Profit Statement as of June 30 2013 Inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started