Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1. Study the Foodstuffs' annual reports for the year 2019-2021, and develop a case profile by describing the mission, vision, objectives and strategies.

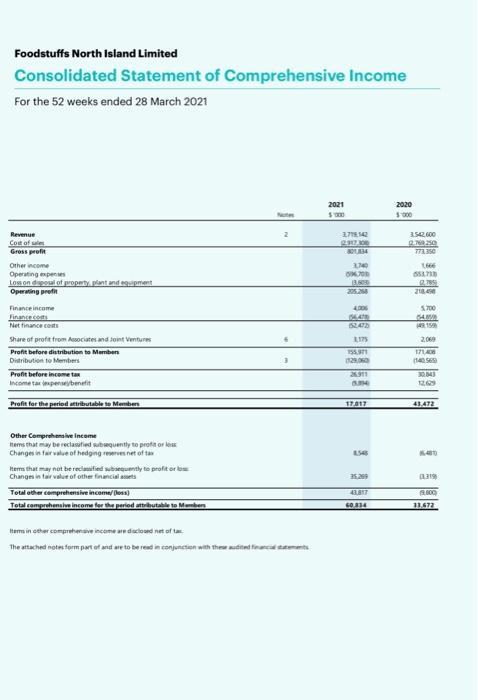

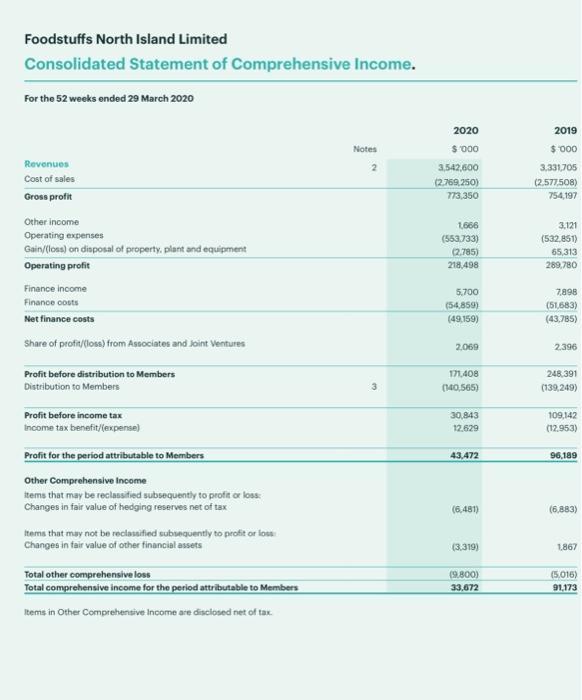

Required: 1. Study the Foodstuffs' annual reports for the year 2019-2021, and develop a case profile by describing the mission, vision, objectives and strategies. Also, briefly comment on the financial performance of the company. Please attach any tables, calculations, and references, if any, as an appendix at the end of the report (500 words; 25 marks). Foodstuffs North Island Limited Consolidated Statement of Comprehensive Income For the 52 weeks ended 28 March 2021 Revenue Cost of Gross profit Other income Operating expenses Loss on disposal of property, plant and equipment Operating profit Finance income Finance costs Net finance costs Share of profit from Associates and Joint Ventures Profit before distribution to Members Distribution to Members Profit before income tax Income tax expense benefit Profit for the period attributable to Members Other Comprehensive Income Items that may be reclassified subsequently to profit or less Changes in fair value of hedging reserves net of tax terms that may not be reclassified subsequently to profit or los Changes in fair value of other financial assets Total other comprehensive income/oss) Total comprehensive income for the period attributable to Mambers Notes Items in other comprehensive income are disclosed net of tax The attached notes form part of and are to be read in conjunction with these audited financial 2 3 2021 $1000 377142 12.917.300 801834 3,740 086700 1,600 275268 4,006 3,175 155,971 (129060 26911 534 17.017 31,399 43.817 60.314 2020 $:000 3.542,600 0.700.250 773.350 1666 653.710 218.4 5,700 SAM 149 159 2.069 171,408 (140 565) 30043 12,69 43.472 1800) 13.672 Foodstuffs North Island Limited Consolidated Statement of Comprehensive Income. For the 52 weeks ended 29 March 2020 Revenues Cost of sales Gross profit Other income Operating expenses Gain/(loss) on disposal of property, plant and equipment Operating profit Finance income Finance costs Net finance costs Share of profit/(loss) from Associates and Joint Ventures Profit before distribution to Members Distribution to Members Profit before income tax Income tax benefit/(expense) Profit for the period attributable to Members Other Comprehensive Income items that may be reclassified subsequently to profit or loss: Changes in fair value of hedging reserves net of tax Items that may not be reclassified subsequently to profit or loss Changes in fair value of other financial assets Total other comprehensive loss Total comprehensive income for the period attributable to Members Items in Other Comprehensive Income are disclosed net of tax Notes 2 2020 $ 000 3,542,600 (2,769,250) 773,350 1,666 (553,733) (2,785) 218,498 5,700 (54,859) (49,159) 2,069 171,408 (140,565) 30,843 12,629 43,472 (6,481) (3,319) (9.800) 33,672 2019 $000 3,331,705 (2.577,508) 754,197 3,121 (532,851) 65,313 289,780 7,898 (51,683) (43,785) 2.396 248,391 (139,249) 109,142 (12,953) 96,189 (6,883) 1,867 (5,016) 91,173

Step by Step Solution

★★★★★

3.30 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER The financial performance identifies how well a company generates revenues and manages its as...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started