Answered step by step

Verified Expert Solution

Question

1 Approved Answer

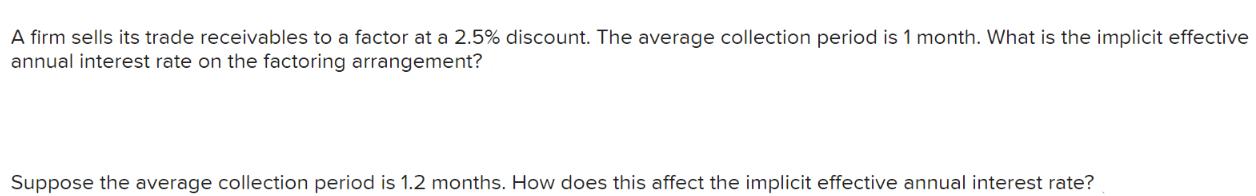

A firm sells its trade receivables to a factor at a 2.5% discount. The average collection period is 1 month. What is the implicit

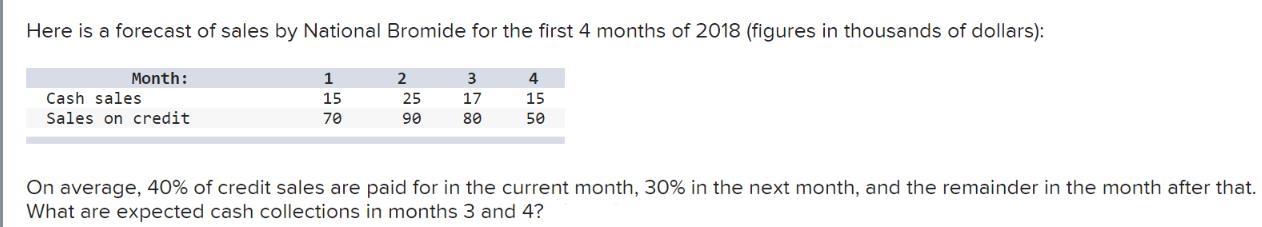

A firm sells its trade receivables to a factor at a 2.5% discount. The average collection period is 1 month. What is the implicit effective annual interest rate on the factoring arrangement? Suppose the average collection period is 1.2 months. How does this affect the implicit effective annual interest rate? Here is a forecast of sales by National Bromide for the first 4 months of 2018 (figures in thousands of dollars): Month: Cash sales Sales on credit 1 2 3 4 15 25 17 15 70 90 80 50 On average, 40% of credit sales are paid for in the current month, 30% in the next month, and the remainder in the month after that. What are expected cash collections in months 3 and 4?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A delightful question Part 1 Implicit effective annual interest rate on the factoring arrangement Wh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started